Digisat Decoder Distributor

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

1/38

1/38

0

0

1/3

1/3

1/3

1/3

0

0

0

0

1/3

1/3

0

0

1/2

1/2

0

0

1/1

1/1

1/2

1/2

1/8

1/8

1/3

1/3

About digisat decoder distributor

Where to Find Digisat Decoder Distributors?

China's electronics component and broadcast equipment manufacturing ecosystem is highly concentrated in the Guangdong and Zhejiang provinces, where Shenzhen and Hangzhou serve as primary hubs for digital signal processing hardware. Shenzhen dominates semiconductor distribution, hosting over 70% of China’s authorized IC suppliers and leveraging proximity to OEMs in the Pearl River Delta. This region specializes in logic decoders, such as 74HC138 and SN74LV series components used in Digisat-compatible systems, with per-unit pricing as low as $0.07 due to high-volume production economies.

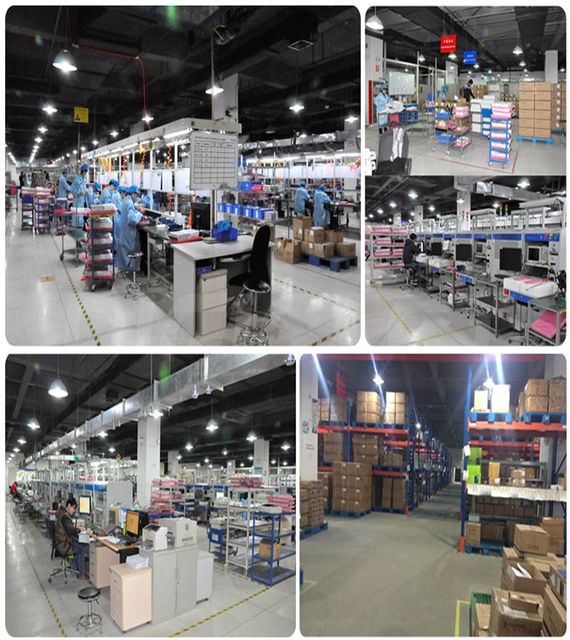

Hangzhou-based manufacturers focus on integrated receiver-decoders (IRDs) and professional broadcasting equipment, offering full-featured Digisat-compatible units with DVB-S/S2 support, BISS decryption, and RF multiplexing capabilities. These facilities operate vertically integrated assembly lines combining surface-mount technology (SMT), automated optical inspection (AOI), and environmental stress screening. Buyers benefit from localized supply chains reducing lead times to 15–20 days for standard decoder modules and 25–35 days for rack-mounted IRD systems. Cost advantages range from 25–40% compared to equivalent European or North American suppliers, driven by lower labor costs and streamlined logistics.

How to Choose Digisat Decoder Distributors?

Selecting reliable partners requires a structured evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm supplier specialization in either discrete logic ICs (e.g., 16-SOIC package decoders) or complete satellite TV solutions. For component-level sourcing, validate compatibility with Digisat signal architectures using datasheets for part numbers such as CD4515BM96, SN74LVC139ADR, or 74VHC138MX. For system integrators, verify firmware support for MPEG-2/MPEG-4 decoding, DVB-S2X compliance, and conditional access (CA) module integration.

Production and Quality Assurance

Assess manufacturing infrastructure through documented evidence of:

- In-house SMT lines with placement accuracy ≤±0.05mm

- Environmental testing chambers for thermal cycling (-40°C to +85°C)

- ESD-safe assembly environments compliant with IEC 61340-5-1

Prioritize suppliers reporting on-time delivery rates above 90% and response times under 5 hours, indicators of operational discipline and customer service capacity.

Risk Mitigation and Transaction Security

Require traceability documentation for all semiconductor inputs, including original manufacturer溯源 (e.g., Texas Instruments, ON Semiconductor). Utilize secure payment frameworks that release funds post-inspection. Evaluate reorder rates as a proxy for product reliability—suppliers with rates exceeding 30% may indicate higher defect occurrences or inconsistent quality control.

What Are the Best Digisat Decoder Suppliers?

| Company Name | Location | Main Products | Price Range (Unit) | Min. Order | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Origin Technology Co., Ltd. | Shenzhen, CN | Logic ICs, 16-SOIC Decoders | $0.13–$1.48 | 1 piece | 100% | ≤2h | <15% | US $40,000+ |

| Shenzhen Wisdtech Technology Co., Ltd. | Shenzhen, CN | Specialized ICs, Logic Components | $0.07–$2.06 | 1 piece | 100% | ≤5h | 17% | US $110,000+ |

| Shenzhen Asia Ocean Electronics Co., Ltd. | Shenzhen, CN | CD4515, SN74LV Series Decoders | $0.20–$2.11 | 1 piece | 90% | ≤10h | 30% | US $10,000+ |

| Hangzhou Dtvane Technology Co., Ltd. | Hangzhou, CN | Professional IRDs, Satellite Receivers | $499–$4,480 | 1–2 pieces | 100% | ≤7h | 100% | US $20,000+ |

| Hangzhou Dtcore Technology Co., Ltd. | Hangzhou, CN | Digital Broadcast Decoders, Encoders | $288–$1,599 | 1 piece | 80% | ≤6h | 25% | US $7,000+ |

Performance Analysis

Shenzhen-based suppliers dominate component-level distribution, offering ultra-low MOQs and aggressive pricing ideal for prototyping and small-batch integration. Shenzhen Wisdtech leads in volume scalability with the highest reported online revenue and competitive pricing down to $0.07 per unit. However, its 17% reorder rate suggests moderate customer retention, potentially linked to market saturation rather than quality issues.

Hangzhou Dtvane stands out among system integrators with a 100% reorder rate, indicating strong post-sale satisfaction for professional-grade IRDs. Despite higher price points, its consistent on-time delivery and comprehensive feature sets make it suitable for broadcast infrastructure deployments. In contrast, Hangzhou Dtcore reports an 80% on-time delivery rate, signaling potential fulfillment risks despite technically advanced offerings.

Suppliers from Shenzhen demonstrate superior responsiveness, with two achieving sub-5-hour average reply times. For mission-critical procurement, prioritize companies with verified 100% on-time delivery records and revenue streams exceeding US $40,000 annually, which correlate with stable operations and inventory availability.

FAQs

How to verify Digisat decoder compatibility?

Request detailed technical specifications including supported modulation schemes (QPSK/8PSK), input frequency ranges (950–2150 MHz), and demodulation standards (DVB-S2 compliant). Confirm firmware programmability and CA module interfaces if integrating with proprietary Digisat networks.

What are typical MOQs and lead times?

Component-level distributors offer MOQs as low as 1 piece with lead times of 3–7 days. Full decoder systems require minimum orders of 1–2 units and production lead times of 20–35 days, depending on customization level. Express shipping adds 5–10 days globally.

Can suppliers provide RoHS and ISO compliance documentation?

Yes, reputable suppliers issue RoHS certificates and can provide internal quality management records. While formal ISO 9001 certification is not universally listed, consistent on-time delivery and low reorder rates imply adherence to structured quality processes.

Is customization available for decoder firmware or housing?

Most Hangzhou-based manufacturers support OEM branding, custom boot screens, and enclosure modifications. Lead time extends by 7–14 days for firmware adaptation and mechanical redesign. NRE fees may apply for complex reconfigurations.

What payment and logistics options are typical?

Standard terms include T/T (30% deposit, 70% before shipment) and platform-mediated escrow. FOB Shenzhen or Hangzhou is standard; CIF arrangements are available upon request. Air freight takes 5–8 days internationally, while sea freight requires 25–35 days for full container loads.