Ducky Mechanical Keyboard Distributor

CN

CN

About ducky mechanical keyboard distributor

Where to Find Ducky Mechanical Keyboard Distributors?

China remains the central hub for mechanical keyboard manufacturing, with key production clusters in Guangdong and Henan provinces driving global supply. The region's mature electronics ecosystem supports specialized producers of high-precision input devices, including distributors and OEMs catering to premium brands like Ducky. Foshan, Shenzhen, and Dongguan host vertically integrated facilities that combine PCB assembly, switch integration, and RGB lighting systems under one supply chain, enabling rapid prototyping and scalable output.

These industrial zones benefit from proximity to component suppliers for switches (e.g., Kailh, Gateron), keycaps (PBT/ABS), and aluminum frames, reducing material lead times by 20–30%. Manufacturers leverage automated SMT lines and manual quality inspection stations to maintain consistency across batches. Average monthly production capacity among verified suppliers ranges from 10,000 to over 100,000 units, supporting both bulk distribution and low-volume custom configurations. Buyers gain access to competitive pricing models, with MOQs as low as 2 pieces for sample validation and scalable orders exceeding 100 units for commercial deployment.

How to Choose Ducky Mechanical Keyboard Suppliers?

Selecting a reliable supplier requires evaluating technical capability, transaction reliability, and customization flexibility:

Quality Assurance & Compliance

Confirm adherence to international standards such as RoHS for hazardous substance control and CE marking for electromagnetic compatibility. While ISO 9001 certification is not universally listed, prioritize suppliers with documented quality control processes, including pre-shipment inspections and functional testing of USB connectivity, switch actuation, and backlight uniformity.

Production & Customization Capabilities

Assess infrastructure and service scope through these benchmarks:

- Minimum factory area supporting dedicated SMT and assembly lines

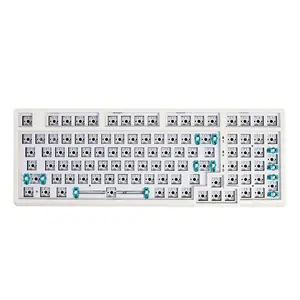

- In-house design teams offering layout (60%, 75%, 98%, 104-key), switch type (linear, tactile, clicky), and RGB customization

- Support for hot-swap PCBs, engraved keycaps, and bilingual labeling

Cross-reference product listings with on-time delivery rates above 90% to verify operational stability.

Transaction Reliability & Risk Mitigation

Utilize secure payment methods such as escrow services to ensure funds are released only upon shipment confirmation. Prioritize suppliers with reorder rates exceeding 15% and response times under 4 hours, indicators of customer satisfaction and operational responsiveness. Request physical or digital samples to validate build quality before full-scale procurement.

What Are the Top Ducky Mechanical Keyboard Distributors?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Foshan Juchao Electronics Co., Ltd. | Foshan, CN | Gaming Keyboards, Keyboard-Mouse Combos, Headphones | US $20,000+ | 80% | ≤3h | 15% | 2–10 pcs | $5.50–$16.68 |

| Shenzhen Yingbao Rubber & Plastic Electronic Technology Co., Ltd. | Shenzhen, CN | Barebones Kits, Replacement Parts, Custom Keyboards | US $340,000+ | 93% | ≤4h | <15% | 5 pcs | $7.07–$19.15 |

| Dongguan Umila Smart Technology Co., Ltd. | Dongguan, CN | Wireless, Ergonomic, RGB Gaming Keyboards | US $60,000+ | 100% | ≤2h | <15% | 40–100 pcs | $9.00–$13.00 |

| Shenzhen Yiqi Network Technology Co., Ltd. | Shenzhen, CN | Hot-Swap PCBs, Keycaps, Full-Size Mechanical Keyboards | US $2,300,000+ | 100% | ≤9h | 100% | 2–100 pcs | $21.37–$46.59 |

| Zhengzhou Damulin Electronic Technology Co., Ltd | Zhengzhou, CN | Wireless Tri-Mode, Magnetic Axis, Gasket-Mount Keyboards | US $2,800,000+ | 99% | ≤3h | 27% | 1–10 pcs | $15.80–$57.32 |

Performance Analysis

Dongguan Umila and Shenzhen Yiqi demonstrate perfect on-time delivery records, indicating robust production planning and logistics execution. Zhengzhou Damulin stands out with a 27% reorder rate—the highest in the dataset—suggesting strong buyer retention through consistent quality and responsive service. Shenzhen-based suppliers dominate customization capabilities, offering engraving, switch options, and layout flexibility, while Foshan Juchao provides the lowest entry MOQs (as low as 2 units), ideal for initial market testing. High-revenue suppliers like Damulin and Yiqi likely operate multi-line production facilities capable of handling complex builds, including tri-mode wireless and magnetic-axis keyboards. For cost-sensitive bulk orders, Dongguan Umila offers prices starting at $9 with 100-piece MOQs. Conversely, buyers seeking premium features should evaluate Damulin’s higher-tier models priced above $50.

FAQs

How to verify a mechanical keyboard supplier’s reliability?

Cross-check declared certifications with official databases. Analyze transaction history, focusing on on-time delivery rates (>95% recommended) and reorder metrics. Request product videos or third-party inspection reports to confirm build quality and functionality.

What is the typical lead time for mechanical keyboard orders?

Standard orders take 15–25 days for production, depending on customization level. Shipping adds 7–14 days via air freight or 25–40 days via sea. Expedited processing may reduce production time by 3–5 days for urgent requests.

Can suppliers provide custom layouts or branding?

Yes, most suppliers support layout modifications (60%, 75%, TKL), custom keycap colors, laser engraving, and logo labeling. Minimum order quantities for branding typically start at 100 units, though smaller runs may be negotiable for repeat buyers.

Do suppliers offer free samples?

Sample policies vary. Some suppliers charge full price for initial units, while others refund sample costs upon placement of a larger order. Expect to pay between $15–$50 per unit for evaluation, depending on configuration.

What are common payment terms for first-time buyers?

New buyers typically face 30–50% upfront payments via T/T or Alibaba Trade Assurance, with balance due before shipment. Established partners may accept L/C or offer net-30 terms based on credit verification.