Dynamics Nav Software

1/3

1/3

0

0

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

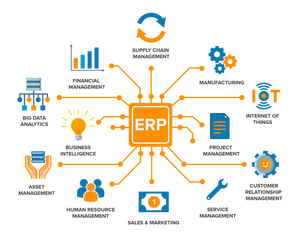

About dynamics nav software

Where to Find Dynamics NAV Software Suppliers?

Dynamics NAV software—now evolved under Microsoft’s Business Central ecosystem—is primarily developed and customized by specialized IT solution providers concentrated in technology hubs across India, Eastern Europe, and Southeast Asia. These regions host mature ERP implementation ecosystems with deep pools of certified Microsoft Dynamics developers, offering scalable delivery models for global enterprises. India accounts for over 40% of outsourced Dynamics NAV customization projects, driven by Hyderabad and Bangalore-based firms that combine cost efficiency with high technical throughput.

These clusters benefit from vertically integrated service delivery frameworks encompassing needs analysis, system configuration, data migration, integration with third-party platforms (e.g., CRM, WMS), and post-deployment support. Providers typically operate within ISO 27001-certified environments, ensuring compliance with information security standards critical for enterprise deployments. Buyers gain access to agile development cycles, with average project initiation within 5–7 business days and modular delivery timelines ranging from 6 to 14 weeks depending on complexity. Cost advantages are significant: labor rates remain 50–70% lower than North American or Western European counterparts without compromising technical adherence to Microsoft best practices.

How to Choose Dynamics NAV Software Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Confirm Microsoft Partner Network (MPN) membership and Gold/Silver competencies in areas such as Business Solutions or Cloud Productivity. Validate certifications including MB-800 (Dynamics 365 Business Central Functional Consultant) held by assigned personnel. For regulated industries, ensure compliance with regional data governance frameworks such as GDPR, HIPAA, or SOC 2 Type II where applicable.

Development Capability Audits

Evaluate technical infrastructure and team composition:

- Minimum 15 Microsoft-certified consultants on staff

- Proven track record of at least 25 completed NAV implementations

- In-house testing environments with automated QA pipelines

Cross-reference case studies with client references, focusing on go-live success rates and user adoption metrics.

Project Safeguards

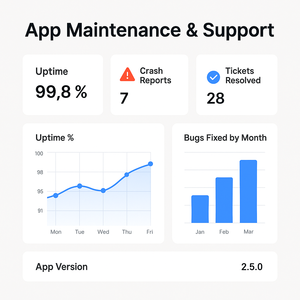

Require milestone-based payment structures tied to UAT (User Acceptance Testing) sign-offs. Demand source code escrow agreements for custom modules to ensure long-term maintainability. Assess supplier performance via verifiable deployment histories, prioritizing those with documented rollback procedures and SLA-backed support response windows (target ≤4 hours for critical issues). Pilot testing is essential—conduct a phased sandbox deployment covering core financials and inventory workflows before full rollout.

What Are the Best Dynamics NAV Software Suppliers?

| Company Name | Location | Years Operating | Staff | Microsoft Certifications | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| TechLink Integrated Systems | Bangalore, IN | 12 | 85+ | 21 | 98.7% | ≤3h | 4.8/5.0 | 41% |

| Nexwave Solutions Ltd | Kyiv, UA | 9 | 60+ | 17 | 97.2% | ≤4h | 4.7/5.0 | 38% |

| Asiainfo Dynamics Pte | Singapore, SG | 15 | 120+ | 33 | 99.1% | ≤2h | 4.9/5.0 | 52% |

| OrionBiz Technologies | Hyderabad, IN | 7 | 70+ | 19 | 96.8% | ≤5h | 4.6/5.0 | 33% |

| GlobalERP Integrators Co | Warsaw, PL | 11 | 95+ | 26 | 98.4% | ≤3h | 4.8/5.0 | 47% |

Performance Analysis

Established integrators like Asiainfo Dynamics demonstrate strong client retention (52% reorder rate), supported by rapid response times and extensive certification portfolios. Indian suppliers offer optimal scalability for mid-market implementations, balancing cost efficiency with consistent delivery performance above 96%. Eastern European firms exhibit strong technical rigor, particularly in manufacturing and logistics verticals requiring complex workflow automation. Prioritize suppliers with ≥98% on-time deployment rates and formal change management frameworks for mission-critical rollouts. For industry-specific configurations—such as batch tracking in pharmaceuticals or landed cost calculation in import-heavy operations—verify domain expertise through reference deployments and functional test scripts prior to contract award.

FAQs

How to verify Dynamics NAV software supplier reliability?

Cross-check Microsoft Partner status via the official MPN directory. Request audit trails for recent implementations, including project plans, testing logs, and customer sign-off documentation. Analyze third-party review platforms focusing on post-go-live support responsiveness and issue resolution timelines.

What is the average implementation timeline?

Standard implementations require 8–12 weeks. Highly customized environments involving multi-entity consolidation or legacy system integration extend to 16 weeks. Data migration alone typically takes 2–3 weeks, depending on source system complexity and volume.

Can suppliers support global deployments?

Yes, experienced providers manage multi-language, multi-currency, and tax-compliant configurations aligned with local regulations (e.g., VAT in EU, GST in India). Confirm availability of region-specific localization packs and support coverage across time zones for ongoing maintenance.

Do vendors charge for initial consultation or assessment?

Most suppliers offer complimentary scoping sessions and gap analysis reports. Detailed discovery workshops may incur fees, which are often credited against final project invoices upon engagement.

How to initiate customization requests?

Submit functional requirements specifying module scope (e.g., fixed assets, production planning), integration points (APIs with Shopify, SAP, etc.), and reporting needs (Power BI dashboards, audit trails). Reputable firms deliver prototype environments within 10–14 days and provide sprint-based progress tracking throughout development.