Electronics Devices

Top sponsor listing

Top sponsor listing

1/3

1/3

1/1

1/1

1/3

1/3

1/33

1/33

1/40

1/40

1/3

1/3

0

0

1/2

1/2

1/3

1/3

1/15

1/15

1/25

1/25

1/3

1/3

1/2

1/2

1/29

1/29

About electronics devices

Where to Find Electronics Devices Suppliers?

China remains the global epicenter for electronics devices manufacturing, with Shenzhen and Xiamen emerging as key production hubs due to their dense ecosystems of component suppliers, design engineers, and rapid prototyping facilities. Shenzhen alone accounts for over 70% of consumer electronics export volume from China, supported by integrated supply chains that reduce assembly and sourcing lead times by up to 40% compared to non-specialized regions. The city’s concentration of PCB fabrication, SMT lines, and firmware development services enables end-to-end product realization within a 50km radius.

These clusters support both high-volume OEM production and low-volume custom builds, offering scalable infrastructure for startups and enterprises alike. Suppliers benefit from localized access to die-casting, injection molding, TPU/rubber coating, and QC testing labs, allowing for faster iteration cycles. Buyers can expect average production lead times of 25–35 days for standard orders, with cost advantages ranging from 20–35% lower than equivalent Western or Southeast Asian manufacturers, primarily due to vertical integration and automation in PCBA and smart device assembly.

How to Choose Electronics Devices Suppliers?

Selecting reliable partners requires rigorous evaluation across technical, operational, and transactional dimensions:

Design and Engineering Capability

Prioritize suppliers with documented expertise in structural design, ID modeling, 3D rendering, and electronic system integration. Verified capabilities in PCB design, firmware programming, and vacuum casting indicate readiness for complex product development. Confirm availability of biodegradable prototyping materials and compliance with RoHS/REACH standards for eco-sensitive markets.

Production Infrastructure Audit

Assess core competencies through verifiable metrics:

- In-house mold design and injection molding capacity for plastic components

- Integrated PCBA lines with SMT and DIP processing

- Customization support including logo printing, packaging design, and material substitution (e.g., PVC, nylon, resin)

- On-site QC protocols covering functional testing, drop tests, and environmental stress screening

Cross-reference claims with on-time delivery performance (target ≥95%) and response time (<5 hours) to validate operational responsiveness.

Transaction and Compliance Verification

Require evidence of quality management systems such as ISO 9001, though not explicitly stated in all cases. For EU and North American markets, ensure products meet CE, FCC, and RoHS compliance—request test reports for EMC, electrical safety, and battery performance where applicable. Utilize secure payment mechanisms with milestone-based disbursement, especially for first-time engagements. Pre-shipment inspection and sample validation are critical to verify functionality, build quality, and labeling accuracy.

What Are the Best Electronics Devices Suppliers?

| Company Name | Location | Main Products | Customization Options | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate | Verification Status |

|---|---|---|---|---|---|---|---|---|

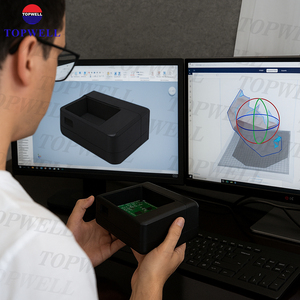

| Shenzhen Topwell Innovations Co., Ltd. | Shenzhen, CN | Moulds, PCBA, Machining Services, Smart Watches, PCB & PCBA | Full design: mechanical, structural, 3D render, mold, injection, firmware, graphic, packaging | 100% | ≤4h | US $710,000+ | 44% | Multispecialty Supplier |

| Shenzhen Fxn Electronics Technology Co., Ltd. | Shenzhen, CN | Power Banks, Consumer Electronics Gadgets, Adapters | Logo, packaging, label, color, material, digital display, instruction book | 93% | ≤4h | US $680,000+ | <15% | Custom Manufacturer |

| Shenzhen Juneng Vehicle Technology Co., Ltd. | Shenzhen, CN | Electronics Mystery Box, TWS Earphones, Smart Watches, Car Alarms | Limited customization (product bundling, mystery box curation) | 98% | ≤2h | US $70,000+ | <15% | - |

| Xiamen Paltier Electronic Technology Co., Ltd. | Xiamen, CN | Consumer Electronics, Car Fridges, Chargers, Smart Home Devices | Basic specification adjustments (voltage, cable length, packaging) | 100% | ≤5h | US $6,000+ | <15% | - |

| INTELLISENSE TECHNOLOGY | Not specified | PCBA, Software Systems, Camera Accessories, Alarm Systems | Engineering-level customization (high-power electronics, wireless modules) | - | ≤3h | - | - | - |

Performance Analysis

Shenzhen Topwell stands out with full-spectrum design and manufacturing capabilities, backed by a 100% on-time delivery rate and the highest reorder rate (44%) among listed suppliers, indicating strong customer retention. Its multispecialty status reflects advanced engineering integration across mold, electronics, and assembly processes. Shenzhen Fxn Electronics demonstrates robust transaction volume (US $680,000+ online revenue) and customization flexibility, despite a lower reorder rate, suggesting a focus on one-off or diversified client projects.

Juneng Vehicle Technology excels in niche product categories like mystery boxes and automotive electronics, with sub-2-hour response times enhancing buyer engagement. Xiamen Paltier maintains perfect delivery performance but operates at a smaller scale, suitable for specialized automotive accessories. INTELLISENSE TECHNOLOGY targets industrial and embedded electronics, though lack of delivery and revenue data increases due diligence requirements. Buyers should prioritize suppliers with transparent service scopes, proven customization workflows, and documented quality control procedures.

FAQs

How to verify electronics devices supplier reliability?

Validate technical claims through facility videos, sample testing, and documentation of design tools (e.g., CAD, Altium). Check for consistent communication patterns, verified transaction histories, and third-party reviews focusing on defect rates and post-delivery support. Request prototypes before scaling to mass production.

What is the typical MOQ and pricing range?

MOQ varies significantly: some suppliers offer single-piece samples (e.g., $4.90/unit), while bulk orders start at 1,000 units with prices as low as $1.90–$18.50 per unit depending on complexity. High-end PCBA or smart devices may require minimum batches of 99–100 pieces at $99–$3,999 per unit.

Can suppliers handle full product development from concept?

Yes, select manufacturers like Shenzhen Topwell provide turnkey solutions including ID design, structural engineering, mold creation, firmware development, and packaging—all under one roof. Confirm availability of 3D rendering and prototype delivery timelines (typically 2–4 weeks).

Do electronics suppliers support private labeling and branding?

Most suppliers offer logo printing, custom packaging, user manual localization, and color matching. Advanced options include laser engraving, rubber coating, and digital interface branding. Ensure artwork files are reviewed and approved pre-production.

What are standard lead times for sampling and mass production?

Prototype development takes 10–20 days depending on design complexity. Mass production lead time averages 25–35 days after sample approval. Logistics via air freight adds 5–10 days internationally; sea freight requires 25–40 days depending on destination.