Electronics Supplier Arduino

1/2

1/2

1/3

1/3

1/3

1/3

1/8

1/8

1/17

1/17

1/2

1/2

1/2

1/2

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/12

1/12

1/15

1/15

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/2

1/2

About electronics supplier arduino

Where to Find Electronics Supplier Arduino?

China remains the central hub for electronics manufacturing, with Shenzhen-based suppliers dominating the production of Arduino-compatible components and development kits. This region benefits from a mature ecosystem of component distributors, PCB fabricators, and logistics providers, enabling rapid prototyping and scalable production. The concentration of technical talent and vertical integration across semiconductor sourcing, surface-mount assembly, and final packaging allows suppliers to maintain competitive pricing while supporting both low-volume educational kits and high-volume industrial module orders.

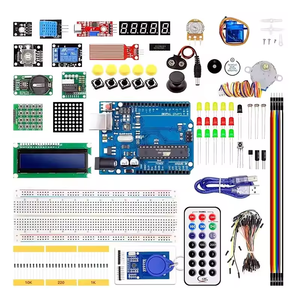

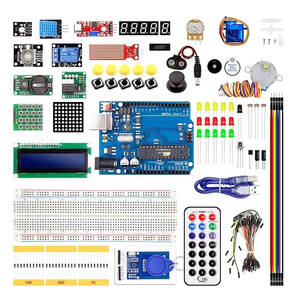

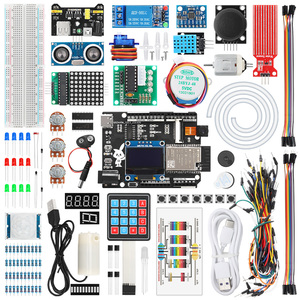

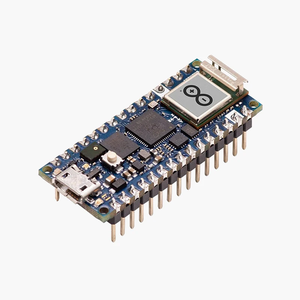

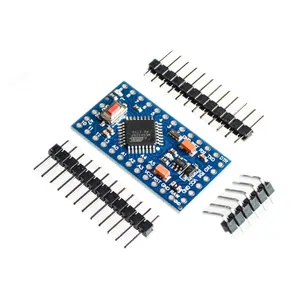

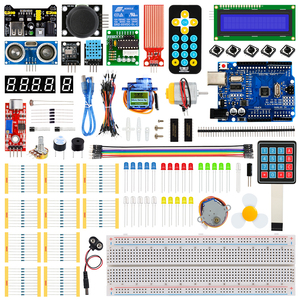

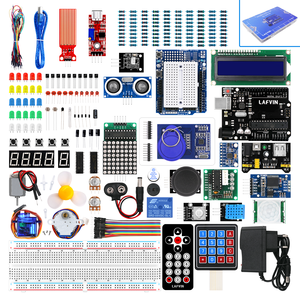

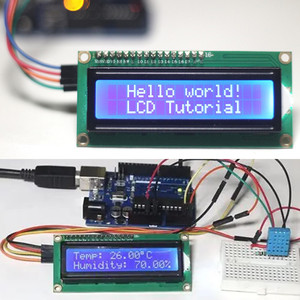

Suppliers in this sector leverage standardized microcontroller platforms such as ATmega328P, ESP32, and STM32 to produce cost-effective alternatives to original Arduino boards. Many offer bundled starter kits integrating sensors, actuators, and display modules—optimized for STEM education, IoT prototyping, and embedded system development. With average unit costs ranging from $0.90 for basic OLED displays to $17.84 for comprehensive ultimate kits (in 100-piece quantities), these suppliers provide scalable solutions tailored to project complexity and volume requirements.

How to Choose Electronics Supplier Arduino?

Effective supplier selection requires structured evaluation across technical, operational, and transactional dimensions:

Product Range and Specialization

Assess the supplier’s core offerings based on listing diversity. Leading suppliers focus on specific niches—such as robotics kits, sensor arrays, or educational bundles—with dedicated R&D aligned to maker and STEM markets. For example, some specialize in multi-sensor kits (e.g., 16-in-1 to 45-in-1 packages), while others prioritize board-level components like UNO R3 or MEGA 2560 variants with CH340 USB-to-TTL chips.

Order Flexibility and Scalability

Evaluate minimum order quantity (MOQ) structures against your procurement strategy:

- Prototyping or retail buyers benefit from MOQs of 1–2 pieces (e.g., $12.07 Super R3 Starter Kit)

- Bulk purchasers achieve economies of scale at 100+ units (e.g., $17.84 Ultimate Kit)

- Hybrid models allow sample testing before scaling, particularly important for quality validation

Pricing transparency and tiered discounts should be clearly defined per volume bracket.

Operational Reliability Metrics

Prioritize suppliers demonstrating consistent performance indicators:

- On-time delivery rates ≥98%

- Average response times ≤4 hours

- Reorder rates exceeding 20%, indicating customer retention and satisfaction

These metrics reflect logistical efficiency, inventory management, and post-sale support capabilities critical for supply chain continuity.

What Are the Best Electronics Supplier Arduino?

| Company Name | Main Products (Listings) | Online Revenue | On-Time Delivery | Response Time | Reorder Rate | Sample MOQ | Key Offerings |

|---|---|---|---|---|---|---|---|

| Shenzhen Tengwei Electronic Technology Co., Ltd. | Electronic Modules (58), Dev Boards (26), Sensors (9) | US $70,000+ | 100% | ≤1h | 24% | 1 piece | UNO R3 Core Board ($1.58), RFID Starter Kit ($9.50), OLED Display ($0.90) |

| Shenzhen RoboWiz Electronic Ltd | Robotics Kits (102), Educational Kits (74), Maker Boards (44) | US $140,000+ | 98% | ≤4h | 25% | 1 piece | Super R3 Starter Kit ($12.07), Complete Robot Kit ($8.65) |

| Shenzhen Robotlinking Technology Co., Ltd. | Dev Boards (45), Electronic Modules (44), Robotics Kits (32) | US $170,000+ | 89% | ≤5h | 21% | 2 pieces | ESP32 Solar Car Kit ($13.99), Bionic Robot Kit ($24.90) |

| Gorsu Elektrik Elektronik Sanayi Ticaret Limited Sirketi | Data not available | US $1,000+ | 100% | ≤5h | - | 100 pieces | Ultimate Arduino Kit ($17.84), RFID Starter Kit ($15.28) |

| Shenzhen Goldeleway Electronics Technology Co., Ltd. | Customizable Components & Kits | US $340,000+ | 99% | ≤4h | 25% | 1 piece | MAX7219 LED Matrix ($0.70), DHT22 Sensor ($6.58), Jubaolai Starter Kit ($15) |

Performance Analysis

Shenzhen Goldeleway leads in transaction volume (US $340,000+ online revenue) and responsiveness (99% on-time delivery), making it suitable for high-frequency procurement. Shenzhen Tengwei stands out for ultra-low MOQs and sub-$1 component pricing, ideal for prototyping and small-scale integration. RoboWiz excels in educational robotics with over 100 listed robotics kits, supporting curriculum-driven buyers. While Gorsu offers competitive per-unit pricing, its 100-piece MOQ limits flexibility for early-stage projects. Robotlinking delivers innovative ESP32-powered solutions but shows lower on-time delivery performance (89%), suggesting potential fulfillment risks under peak demand.

FAQs

What are typical MOQs for Arduino-compatible electronics suppliers?

MOQs vary significantly: prototyping-focused suppliers offer 1–2 piece orders, while bulk-oriented manufacturers require 100+ units. Buyers should align MOQ policies with development phase—low-volume sampling for testing, high-volume orders for production deployment.

Are Arduino-compatible components RoHS compliant?

While not explicitly stated in available data, most Shenzhen-based electronics exporters adhere to RoHS and CE standards to meet EU and North American market requirements. Buyers must request compliance documentation and conduct material testing for regulated applications.

Can suppliers customize Arduino kits?

Yes, several suppliers offer customization options including branding, packaging, component selection, and firmware preloading. Shenzhen Goldeleway explicitly lists original color and size modifications, indicating established OEM/ODM workflows.

What is the average lead time for shipment?

Standard lead times range from 7–15 days after order confirmation, depending on stock availability and shipping method. Air freight typically delivers samples within 7–10 days globally; sea freight takes 25–35 days for containerized bulk shipments.

How reliable are supplier response times?

Top-tier suppliers respond within 1–4 hours, with 60% achieving sub-5-hour response times. Faster communication correlates with higher reorder rates and on-time delivery performance, indicating robust internal coordination and customer service infrastructure.