Emboss Printing

Top sponsor listing

Top sponsor listing

1/25

1/25

1/1

1/1

1/19

1/19

1/16

1/16

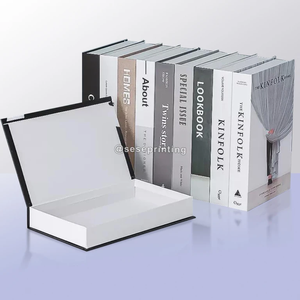

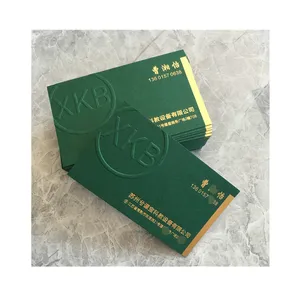

About emboss printing

Where to Find Emboss Printing Suppliers?

China remains the central hub for emboss printing production, with key suppliers concentrated in Guangdong, Zhejiang, and Hunan provinces. Dongguan and Yiwu serve as primary manufacturing clusters, offering integrated supply chains for paper-based packaging, luxury print materials, and customized branding solutions. These regions host vertically aligned facilities capable of handling everything from die-cutting and foil stamping to 3D embossing and blind debossing, supporting both mass production and high-precision customization.

The industrial ecosystem enables rapid prototyping and scalable output, with many manufacturers operating automated printing lines and digital finishing equipment. Proximity to raw material sources—such as coated paper, cotton board, and synthetic films—reduces input costs by 15–25% compared to offshore alternatives. Buyers benefit from consolidated logistics networks, particularly in Guangdong, where export-ready infrastructure supports direct shipment via Hong Kong and Shenzhen ports. Typical lead times range from 7–15 days for sample batches and 15–25 days for bulk orders, depending on complexity and order volume.

How to Choose Emboss Printing Suppliers?

Effective supplier selection requires rigorous evaluation across technical, operational, and transactional dimensions:

Production & Customization Capability

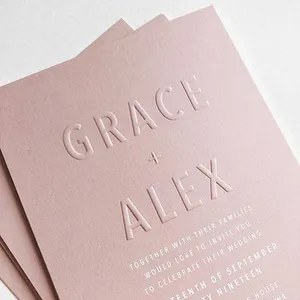

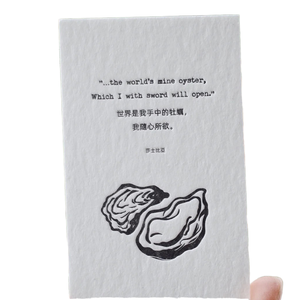

Confirm access to advanced embossing techniques including registered 3D embossing, blind embossing, and combination processes with foil stamping or UV coating. Suppliers should offer multiple substrate options—cotton paper, duplex board, PVC, and adhesive labels—and support custom mold creation for unique textures and shapes. Minimum viable capacity includes offset/digital hybrid printing, hot-stamping units, and precision die-cutting systems.

Quality Assurance Protocols

While formal certifications (e.g., ISO 9001) are not explicitly listed in available data, performance indicators such as on-time delivery rates (>98%) and reorder rates (up to 25%) suggest robust internal quality management. Prioritize suppliers with documented process controls for color accuracy (CMYK/spot color), registration tolerance (<0.2mm), and surface finish consistency. Request physical or digital proofs before production launch.

Transaction Reliability Indicators

Evaluate response time (≤2 hours preferred), online revenue history (indicative of market presence), and reorder rate as proxies for service reliability. Verified custom manufacturers demonstrate stronger design-to-production alignment, especially for complex formats like velvet cards, wax seals, braille embossing, or multi-layer packaging. Cross-reference product listings with actual MOQs and pricing structures to assess transparency.

What Are the Best Emboss Printing Suppliers?

| Company Name | Main Products | On-Time Delivery | Reorder Rate | Response Time | Online Revenue | Customization Support | Sample MOQ | Starting Price (Unit) |

|---|---|---|---|---|---|---|---|---|

| Dongguan Wenfeng New Materials Technology Co., Ltd. | Printing Inks, Coating Machines, Plastic Bags, Glass Bottles, Paper & Paperboards | 100% | 18% | ≤2h | US $20,000+ | Limited (industrial focus) | 100 pcs | $0.01 |

| Vanilla Printing INC | Paper & Paperboard, Greeting Cards, Wedding Decorations, Business Cards | 78% | - | ≤3h | US $20,000+ | High (luxury print specialization) | 100–250 pcs | $0.15 |

| Yiwu Fuyou Packaging Material Co., Ltd. | Labels, Stickers, Packaging, Foil-Stamped Cards | 98% | 24% | ≤2h | US $270,000+ | Extensive (digital layout, die-cut, hot stamping) | 100–500 pcs | $0.01 |

| Hunan Xiangnian Packaging Co., Ltd. | Embossed Labels, Jewelry Packaging, Debossed Design | 98% | 25% | ≤3h | US $170,000+ | Strong (double-sided, textured finishes) | 100 pcs | $0.01 |

| Jiangsu Baoli Lai Printing Co., Ltd. | Catalogs, Brochures, Flyers, Air Dunnage Bags | 100% | - | ≤12h | - | Standard (bulk commercial printing) | 30 pcs | $0.01 |

Performance Analysis

Yiwu Fuyou and Hunan Xiangnian stand out for high reorder rates (24–25%) and consistent on-time delivery (98%), indicating reliable execution and customer satisfaction. Both specialize in premium embossed packaging with extensive customization—ideal for brand-sensitive clients in fashion, cosmetics, and luxury goods. Dongguan Wenfeng and Jiangsu Baoli Lai achieve perfect on-time delivery records but show lower reorder activity, suggesting a transactional rather than relationship-driven model. Vanilla Printing offers niche expertise in wedding and invitation products but lags in delivery performance (78%). Jiangsu Baoli Lai provides the lowest MOQ (30 pieces), making it suitable for startups and small businesses testing designs.

FAQs

How to verify emboss printing supplier reliability?

Assess on-time delivery rate, reorder rate, and response time as key operational metrics. Request samples to evaluate texture depth, registration accuracy, and material durability. For long-term partnerships, conduct virtual factory audits to confirm equipment capabilities and workflow standardization.

What is the typical MOQ for custom embossed products?

Standard MOQs range from 30 to 500 pieces, depending on product type and finishing complexity. Simpler items like flyers start at 30 units, while specialty items such as cotton business cards or foil-stamped labels typically require 100–300 units. Volume discounts usually apply beyond 1,000 units.

Can suppliers combine embossing with other finishing techniques?

Yes, leading suppliers support hybrid processes including embossing with foil stamping, UV spot coating, die-cutting, and debossing. Confirm compatibility during proofing stages to avoid adhesion or registration issues.

Do emboss printing suppliers provide design assistance?

Most verified custom manufacturers offer layout optimization, template guidance, and digital mockups. Advanced providers support CMYK conversion, bleed setting, and emboss mold design based on vector artwork.

How to reduce costs in emboss printing procurement?

Consolidate orders into larger batches to lower per-unit costs. Optimize mold usage across product lines and select standardized paper stocks where possible. Leverage competitive quotes from multiple suppliers in Dongguan, Yiwu, and Hunan to negotiate favorable terms.