Emv Chip Reader Writer Software Distributor

Top sponsor listing

Top sponsor listing

About emv chip reader writer software distributor

Where to Find EMV Chip Reader Writer Software Distributors?

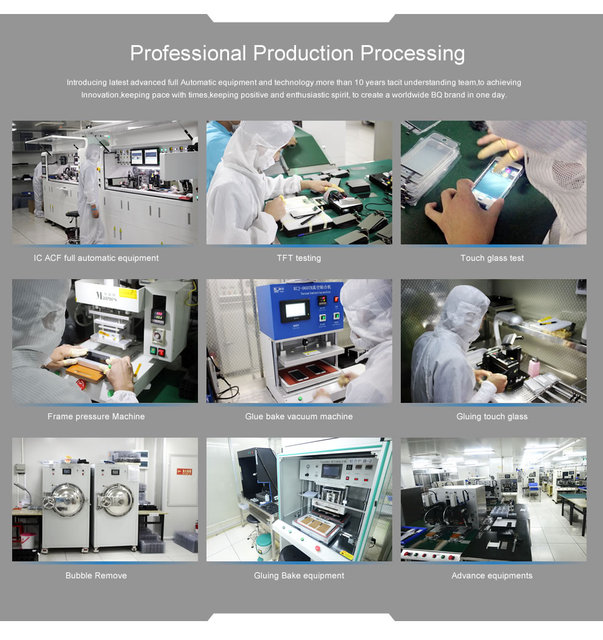

China serves as the central hub for EMV chip reader, writer, and software distribution, with key manufacturing clusters concentrated in Shenzhen, Guangdong Province. This region hosts a dense ecosystem of electronics manufacturers specializing in smart card technology, payment terminals, and embedded software solutions. The proximity to component suppliers, firmware developers, and logistics networks enables rapid prototyping and scalable production, supporting both standard and customized orders.

Shenzhen-based suppliers benefit from vertically integrated operations that include PCB assembly, firmware integration, and device testing within compact supply chains. This localization reduces lead times by 20–30% compared to offshore alternatives and supports agile responses to evolving EMV compliance standards. Buyers gain access to modular product platforms—such as ISO/IEC 7816-compliant readers and USB-based multi-function devices—that can be adapted for banking, retail, or access control applications. Typical advantages include MOQ flexibility (as low as 1 piece), customization of physical attributes (color, cable length, labeling), and compatibility with major operating systems including Windows and Android.

How to Choose EMV Chip Reader Writer Software Suppliers?

Procurement decisions should be guided by structured evaluation criteria focused on technical capability, transaction reliability, and service responsiveness:

Technical Compliance & Product Range

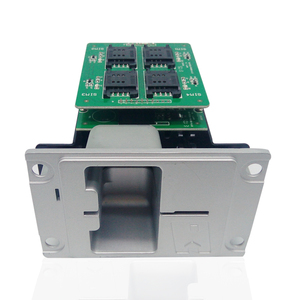

Verify supplier offerings align with EMV Level 1 and Level 2 certification requirements where applicable. Devices should support ISO/IEC 7816 standards for contact IC cards and, if required, ISO 14443 for contactless functionality. Confirm availability of配套 software development kits (SDKs) and driver compatibility across platforms (e.g., Windows 98 to 11, Linux, Android). Prioritize suppliers listing multiple variants—such as USB SIM-style readers, 4-in-1 multifunctional units, or PCI-EMV modules—to ensure scalability.

Production and Customization Capacity

Assess customization depth through available options:

- Physical attributes: color, material, size, logo printing, packaging

- Functional parameters: track data encoding (Track 1/2/3), mag-stripe integration, cable length

- Low-MOQ support for prototyping or niche deployments (down to 1–5 units)

- In-house design teams capable of adapting firmware or housing designs

Cross-reference product listings with delivery performance; suppliers maintaining on-time delivery rates above 95% are more likely to sustain consistent output under volume demand.

Transaction Reliability Indicators

Evaluate operational stability using verifiable metrics:

- On-time delivery rate ≥97%

- Average response time ≤2 hours

- Reorder rate below 15%, indicating broad market reach rather than dependency on repeat clients

- Online revenue exceeding US $230,000 annually, suggesting sustained commercial activity

Request documentation for quality management systems (e.g., ISO 9001) and compliance with RoHS/CE directives, especially for EU and North American market entry.

What Are the Leading EMV Chip Reader Writer Software Suppliers?

| Company Name | Main Products (Listings) | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Customization Options | Min. Order Quantity | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Rocketek Electronics Co., Ltd. | Card Readers (683), USB Hubs (405) | 97% | ≤2h | <15% | $290,000+ | Color, size, logo, cable length, packaging, compatibility | 1 piece | $3.80–4.89 |

| Shenzhen Richer Tianzhao Electronic Co., Ltd. | Access Control Card Readers (28), HDD Enclosure (26) | 100% | ≤15h | - | - | Design, OEM branding | 50 pieces | $3.60–5.50 |

| Shenzhen Hcc Technology Co., Ltd. | ISO7816 Readers, PCI-EMV Modules | 92% | ≤2h | <15% | $240,000+ | Track encoding, mag-stripe, logo, packaging | 1 unit | $13–130 |

| Shenzhen Fuwei Technology Co., Ltd. | Magnetic Stripe Readers, Multi-Function Terminals | 97% | ≤1h | <15% | $230,000+ | Color, size, logo, packaging | 1 pack | $58–108 |

Performance Analysis

Shenzhen Rocketek leads in product breadth and responsiveness, offering extensive customization and low MOQs ideal for startups and integrators. Its high listing volume in card readers indicates mature production infrastructure. Shenzhen Richer Tianzhao achieves perfect on-time delivery but exhibits longer response times, suggesting potential bottlenecks in customer communication. Shenzhen Hcc Technology positions itself in mid-tier pricing with SDK support and broader system compatibility, suitable for developers requiring embedded software integration. Shenzhen Fuwei distinguishes itself with higher-end multifunctional devices, though at significantly elevated price points reflecting advanced magnetic stripe and dual-mode capabilities.

FAQs

How to verify EMV chip reader supplier reliability?

Cross-check technical claims with product specifications and request sample units for functional testing. Validate firmware compatibility with target operating systems and confirm SDK availability for application development. Review transaction history indicators such as on-time delivery rate and response time, preferably backed by platform-verified data.

What is the typical lead time for samples and bulk orders?

Sample delivery generally takes 5–10 days after confirmation. Bulk production lead times range from 15–30 days depending on order size and customization level. Air shipping adds 3–7 days internationally; sea freight requires 25–40 days for full container loads.

Can suppliers provide custom firmware or private labeling?

Yes, many Shenzhen-based manufacturers offer OEM services including logo printing, custom packaging, and firmware modification. Confirm whether SDKs are provided freely and whether API documentation supports integration with existing payment or authentication systems.

Do EMV reader suppliers support global compliance standards?

Select suppliers with CE, FCC, and RoHS certifications to ensure regulatory compliance in European, U.S., and international markets. For payment-grade applications, verify adherence to PCI PTS 6.x standards for secure cryptographic devices, although this may require upgraded models beyond basic readers.

How to negotiate better terms with EMV hardware distributors?

Leverage low-MOQ flexibility to request trial batches before scaling. Use competitive quotes from multiple suppliers to benchmark pricing, particularly for USB-based models priced between $3.50 and $5.50. Negotiate bundled deals that include cables, drivers, and SDKs. Prioritize suppliers with sub-2-hour response times for faster issue resolution during deployment.