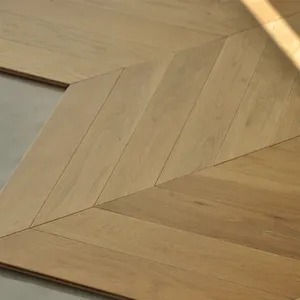

Engineered Products Examples

About engineered products examples

Where to Find Engineered Products Suppliers?

China remains a dominant force in the engineered products manufacturing sector, particularly in wood-based solutions such as engineered flooring and custom architectural components. Key production hubs are concentrated in Zhejiang, Guangdong, and Liaoning provinces, where vertically integrated supply chains and access to raw materials enable competitive pricing and scalable output. These regions host suppliers with advanced processing capabilities, including CNC profiling, multi-layer pressing, and surface finishing technologies, supporting both standard and bespoke product configurations.

The industrial clusters benefit from proximity to hardwood sources in Europe and Southeast Asia, enabling cost-effective import of oak, walnut, and other premium veneers. Integrated facilities combine plywood core production with top-layer lamination, allowing tight control over dimensional stability and moisture resistance—critical performance metrics for engineered wood products. Buyers gain access to mature ecosystems featuring rapid prototyping, batch customization, and consolidated logistics, with average lead times ranging from 25–40 days for containerized orders. Localized manufacturing reduces production costs by 20–35% compared to Western counterparts, while maintaining compliance with international building material standards.

How to Choose Engineered Products Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

Material & Process Verification

Confirm use of stable substrates such as cross-ply birch or poplar core layers, bonded with low-emission adhesives (E0 or CARB P2 compliant). For flooring applications, verify minimum top-layer thickness of 2.5mm for resurfacing capability. Assess processing techniques: suppliers should employ precision milling, UV-cured finishes, and climate-controlled acclimatization chambers to ensure long-term durability.

Production Capacity Assessment

Evaluate infrastructure indicators:

- Monthly output capacity exceeding 50,000 square meters for volume procurement

- In-house design and R&D teams capable of handling pattern, color, and dimension customization

- On-site quality control stations conducting warpage, delamination, and wear resistance tests

Cross-reference facility size with on-time delivery rates (target ≥93%) and reorder frequency to validate scalability and consistency.

Transaction Risk Mitigation

Prioritize suppliers with verifiable export experience and responsive communication (response time ≤4 hours). Utilize secure payment frameworks where possible, and request physical samples before bulk ordering. Insist on pre-shipment inspections to verify packaging integrity, labeling accuracy, and dimensional conformity.

What Are the Best Engineered Products Suppliers?

| Company Name | Location | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | Min. Order Quantity | Price Range (USD) | Customization Options |

|---|---|---|---|---|---|---|---|---|

| Foshan Zesheng Building Materials Co., Ltd. | Guangdong, CN | US $370,000+ | 98% | 36% | ≤1h | 50 sq ft | $3.20–3.58 | Yes |

| Deqing Deke Wood Industry Co., Ltd. | Zhejiang, CN | US $220,000+ | 98% | 16% | ≤2h | 1,000 sq ft | $1.82–24.50 | Yes |

| Guangzhou Qichuan Wooden Products Co., Ltd. | Guangdong, CN | US $90,000+ | 95% | 28% | ≤4h | 100 sq m | $23.80–46.50 | Yes |

| Dalian Oriental International Trading Co., Ltd. | Liaoning, CN | US $70,000+ | 93% | 23% | ≤2h | 200 sq m | $2.10–38.00 | Limited |

| THAI AN PHU THO PLYWOOD WOOD COMPANY LIMITED | Vietnam | Data Unavailable | Not Verified | Not Verified | ≤20h | 2 sq m | $30.00 | No |

Performance Analysis

Foshan Zesheng stands out with the highest reorder rate (36%) and fastest response time (≤1 hour), indicating strong customer satisfaction and operational agility. The company supports extensive customization for overseas projects, including color, finish, and packaging branding. Deqing Deke offers the most competitive pricing for large-volume buyers, with multiple product lines starting at $1.82/sq ft and MOQs structured for wholesale distribution. Guangzhou Qichuan provides premium European oak variants with tighter dimensional tolerances, suitable for high-end residential and commercial installations. Dalian Oriental maintains consistent delivery performance despite lower digital engagement, while THAI AN PHU THO presents higher risk due to unverified metrics and minimal order flexibility despite extremely low MOQs.

FAQs

What certifications should engineered wood suppliers have?

Look for ISO 9001 for quality management and FSC/PEFC chain-of-custody certification if sustainability compliance is required. For EU markets, ensure formaldehyde emissions meet E1 or E0 standards. While not always declared in listings, these credentials can be requested directly from suppliers.

What is the typical sampling timeline for engineered flooring?

Standard samples are typically dispatched within 7–14 days after request. Custom finishes or patterns may require 18–25 days for production. Air shipping adds 5–10 days depending on destination.

Can suppliers accommodate small orders or prototypes?

Yes, select suppliers like Foshan Zesheng accept orders as low as 50 square feet, making them suitable for renovation pilots or boutique developments. However, unit costs are higher compared to bulk purchases. Confirm sample refund policies against future order credits.

How do MOQs vary across engineered product types?

Commodity-grade engineered flooring typically requires 1,000+ square feet. Specialty formats (e.g., chevron, smoked finishes) often have MOQs between 100–500 square meters. Vinyl-core or hybrid engineered boards may carry higher minimums due to production line constraints.

What customization options are commonly available?

Leading suppliers offer adjustments in plank width (up to 260mm), length (up to 2,200mm), surface texture (hand-scraped, wire-brushed), stain color, bevel profile, and packaging labeling. Some support OEM branding and project-specific documentation for commercial bids.