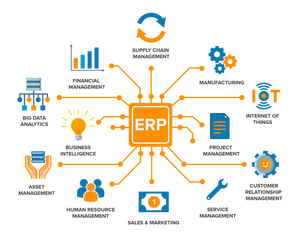

Enterprise Resource Planning Erp System Examples

1/3

1/3

1/3

1/3

CN

CN

1/4

1/4

CN

CN

1/2

1/2

CN

CN

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

0

0

1/3

1/3

0

0

1/3

1/3

0

0

1/2

1/2

0

0

1/3

1/3

0

0

About enterprise resource planning erp system examples

Where to Find Enterprise Resource Planning (ERP) System Providers?

The global ERP system market is characterized by a geographically diverse supplier base, with leading development and service clusters in North America, Western Europe, and East Asia. The United States and Germany host the highest concentration of enterprise-grade ERP vendors, supported by mature IT infrastructure, deep talent pools in software engineering, and strong intellectual property protections. India and China have emerged as competitive hubs for cost-efficient ERP development and customization services, leveraging large technical workforces and scalable cloud deployment capabilities.

These regions offer distinct sourcing advantages. North American and European providers typically adhere to stringent data governance standards (e.g., GDPR, SOC 2), making them preferred partners for regulated industries such as finance and healthcare. Asian-based firms, particularly in Hyderabad, Bengaluru, and Shenzhen, deliver 30–40% lower total cost of ownership for mid-tier deployments through optimized labor models and localized support networks. Integrated ecosystems enable rapid implementation cycles, with many suppliers offering modular SaaS platforms deployable within 60–90 days for standard configurations.

How to Choose Enterprise Resource Planning (ERP) System Providers?

Adopt structured evaluation criteria to mitigate integration risks and ensure long-term system viability:

Technical and Compliance Validation

Confirm adherence to recognized quality and security frameworks, including ISO/IEC 27001 for information security management and SOC 2 Type II for service organization controls. For multinational operations, verify compliance with regional regulations such as GDPR, HIPAA, or CCPA. Assess documentation of penetration testing, data encryption protocols (AES-256, TLS 1.3+), and backup/recovery SLAs.

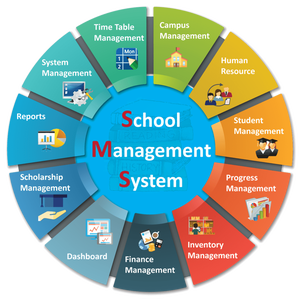

Development and Implementation Capacity

Evaluate supplier capability through:

- Minimum 50+ full-time software developers and consultants

- Proven track record of end-to-end implementations across relevant industries (minimum 3–5 case studies)

- In-house modules for core functions: finance, HR, supply chain, manufacturing, and CRM

Cross-reference project timelines with client references to validate on-time deployment performance (target >90% success rate).

Deployment Flexibility and Transaction Safeguards

Prioritize vendors offering hybrid (on-premise/cloud) deployment models and API-first architectures for third-party integration. Require milestone-based payment structures tied to UAT sign-offs and post-go-live support windows. Conduct code audits or third-party reviews for custom-built systems. Pilot testing with a limited user group over 4–6 weeks remains critical to assess usability, workflow alignment, and performance under load.

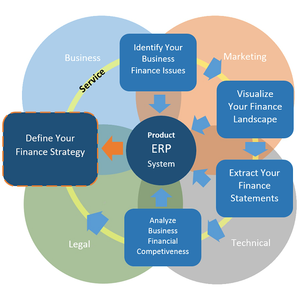

What Are the Key Considerations When Sourcing ERP Systems?

| Provider Type | Region | Avg. Implementation Time | Customization Scope | MOQ (Users) | Support Response | Cloud Uptime SLA | Reimplementation Rate | Ratings (Industry Avg.) |

|---|---|---|---|---|---|---|---|---|

| Enterprise Vendors | NA/EU | 6–12 months | High (APIs, SDKs) | 50+ | <4h (24/7) | 99.9% | 78% | 4.6/5.0 |

| Mid-Market Specialists | Global | 3–6 months | Moderate | 10–25 | <8h (Business hrs) | 99.5% | 65% | 4.4/5.0 |

| Custom Development Firms | Asia | 4–8 months | Full | 1 | <12h | 99.0% | 42% | 4.2/5.0 |

Performance Analysis

Enterprise-tier providers (e.g., U.S.-based and German firms) dominate in scalability and regulatory compliance, with high reimplementation rates indicating customer trust in long-term support. Mid-market solutions balance speed and functionality, ideal for growing organizations needing preconfigured workflows. Custom development houses in India and Southeast Asia offer maximum flexibility but require rigorous oversight due to variable post-deployment support maturity. Prioritize vendors with documented disaster recovery plans, multi-region cloud hosting options, and dedicated account management for contracts exceeding 100 users.

FAQs

How to verify ERP system provider reliability?

Validate certifications through official registries and request audit reports from independent assessors. Analyze client testimonials focusing on post-implementation support responsiveness and upgrade management. Confirm existence of an established helpdesk with ticketing systems and SLA tracking.

What is the average ERP implementation timeline?

Standard cloud deployments take 90–150 days for mid-sized enterprises. On-premise or highly customized systems may require 6–12 months. Industry-specific configurations (e.g., discrete manufacturing, pharma) add 20–30% to baseline schedules.

Can ERP systems be integrated with existing software?

Yes, modern ERP platforms support integration via RESTful APIs, EDI, and middleware tools like MuleSoft or Dell Boomi. Verify pre-built connectors for common applications (CRM, e-commerce, payroll). Integration complexity depends on legacy system architecture and data normalization requirements.

Do ERP providers offer free trial or pilot programs?

Most vendors provide time-limited sandbox environments (30–60 days) with sample datasets. Full pilot deployments involving real business processes are typically offered at reduced cost, credited toward final licensing fees upon contract signing.

How to initiate customization requests?

Submit detailed functional specifications including required workflows, reporting needs, localization (multi-currency, tax rules), and user roles. Reputable providers deliver process flow diagrams within 5 business days and working prototypes within 3–4 weeks for scoped modules.