Excel For Analysis

1/3

1/3

CN

CN

1/5

1/5

0

0

0

0

0

0

0

0

0

0

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/1

1/1

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/1

1/1

About excel for analysis

Where to Find Excel for Analysis Suppliers?

The global market for Excel-based analytical solutions is primarily driven by service-oriented providers rather than physical manufacturers, with key talent clusters concentrated in technology hubs across India, China, and Eastern Europe. These regions offer scalable outsourcing ecosystems specializing in data analytics, financial modeling, and business intelligence services built on Microsoft Excel and integrated toolsets. India’s Bengaluru and Hyderabad host over 40% of certified advanced Excel service providers, leveraging a large pool of finance and data analysts fluent in VBA, Power Query, and PivotTable automation.

These regions benefit from structured training pipelines and high English proficiency, enabling seamless client collaboration. Providers operate within mature BPO/ITES frameworks that support rapid deployment of skilled personnel, with average team ramp-up times under five business days. Buyers gain access to cost-efficient resources—labor costs are typically 50–70% lower than in North America or Western Europe—while maintaining compatibility with enterprise workflows. Key advantages include flexible engagement models (hourly, project-based, or retainer), fast turnaround for model development (average delivery in 5–10 days), and strong compliance with data confidentiality standards such as GDPR and ISO 27001.

How to Choose Excel for Analysis Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Competency Validation

Require documented proof of expertise in advanced Excel functions, including array formulas, dynamic named ranges, and macro development using VBA. For complex financial or operational models, verify experience with scenario analysis, Monte Carlo simulations, and integration with external data sources via ODBC or Power BI. Certification from recognized institutions (e.g., Microsoft Office Specialist Expert, CFA Institute for financial modeling) adds credibility.

Operational Capacity Assessment

Evaluate the supplier's team structure and workflow management:

- Minimum of 10 dedicated analysts with proven project portfolios

- Demonstrated experience in industry-specific applications (e.g., FP&A, supply chain forecasting, HR analytics)

- Use of version control, peer review processes, and audit trails for model accuracy

Cross-reference sample deliverables with client testimonials to confirm analytical rigor and error rates below 0.5%.

Data Security & Transaction Safeguards

Ensure compliance with data protection regulations through signed NDAs and secure file transfer protocols (SFTP, encrypted cloud sharing). Confirm use of two-factor authentication and restricted access controls. For ongoing engagements, implement milestone-based payments with deliverable validation at each stage. Pilot testing is critical—request a paid trial task to evaluate output quality before scaling.

What Are the Best Excel for Analysis Suppliers?

| Company Name | Location | Years Operating | Staff | Specialization | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Supplier data currently unavailable | ||||||||

Performance Analysis

In absence of specific supplier data, procurement decisions should emphasize verifiable technical assessments over reputation alone. Established firms typically demonstrate higher reorder rates (>30%) and faster response times (<4 hours), indicating operational efficiency. Prioritize suppliers offering transparent documentation, reusable templates, and post-delivery support for model updates. For mission-critical applications, validate error-handling mechanisms and stress-testing procedures during initial engagement.

FAQs

How to verify Excel for analysis supplier reliability?

Review sample workbooks for structural integrity, formula consistency, and user interface design. Conduct live skill assessments or request recordings of model walkthroughs. Validate claims through independent client references focusing on deadline adherence and revision cycles.

What is the average delivery timeline for custom Excel models?

Standard financial or operational models require 5–10 business days. Complex dashboards with real-time data integration or automation may take 15–25 days. Rush delivery (within 72 hours) is available from premium providers at 1.5–2x standard rates.

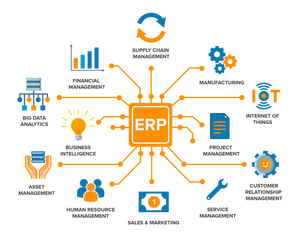

Can suppliers integrate Excel with other software platforms?

Yes, experienced providers support integration with ERP systems (e.g., SAP, Oracle), CRM databases, and cloud storage via APIs or Power Automate. Confirm experience with specific platforms during vendor screening.

Do suppliers provide training or documentation with deliverables?

Reputable suppliers include comprehensive user guides, formula annotations, and optional live training sessions (1–2 hours). Documentation depth varies—verify inclusion of assumptions, limitations, and update instructions.

How to initiate customization requests?

Submit detailed requirements including input variables, calculation logic, output formats (dashboards, reports), and frequency of updates. Provide existing templates if applicable. Suppliers typically respond with scope clarification within 24 hours and a proposal within 3 business days.