Fixed Cost Example

CN

CN

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/11

1/11

1/3

1/3

1/4

1/4

1/13

1/13

1/1

1/1

1/3

1/3

1/3

1/3

1/3

1/3

1/22

1/22

1/2

1/2

1/56

1/56

1/3

1/3

1/3

1/3

1/3

1/3

1/2

1/2

0

0

About fixed cost example

Where to Find Fixed Cost Example Suppliers?

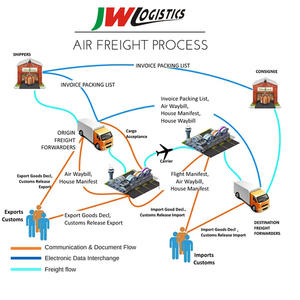

The concept of a "fixed cost example" is not a physical product but a business or accounting reference used to illustrate expenses that remain constant regardless of production volume, such as rent, salaries, or insurance. As such, there are no manufacturing clusters or industrial suppliers producing fixed cost examples in the traditional sense. Instead, procurement professionals and financial analysts source this information through educational content, industry reports, or consulting services specializing in cost accounting frameworks.

Regions with strong academic and professional service infrastructures—such as North America, Western Europe, and parts of East Asia—serve as primary hubs for developing standardized cost models. These regions provide structured financial templates, compliance-aligned cost breakdowns, and sector-specific benchmarks widely adopted in supply chain management and operational planning. Access to accurate fixed cost data enables buyers to model total ownership costs, assess supplier pricing structures, and negotiate contracts with greater precision.

How to Choose Reliable Sources for Fixed Cost Examples?

When evaluating sources for fixed cost modeling or benchmarking, apply rigorous verification criteria to ensure accuracy and applicability:

Methodological Transparency

Prioritize providers that disclose the basis of cost categorization, including time horizon (monthly, annual), scope (facility-level, enterprise-wide), and exclusion of variable elements. Verified examples should clearly differentiate between committed fixed costs (e.g., lease agreements) and discretionary fixed costs (e.g., advertising budgets).

Industry Alignment

Ensure relevance by cross-referencing examples with your specific sector—manufacturing, logistics, SaaS, etc.—as fixed cost composition varies significantly across industries. For instance, equipment depreciation dominates in industrial settings, while software licensing may be a primary fixed cost in technology services.

Data Validation and Standards Compliance

Favor resources aligned with recognized accounting standards such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). Academic institutions, certified public accounting firms, and ISO 9001-certified consulting organizations typically adhere to these frameworks, enhancing reliability.

What Are the Best Sources for Fixed Cost Examples?

| Organization Type | Region | Years Established | Specialization | Output Format | Data Verification | Response Time | Ratings | Reorder Rate / Reuse Index |

|---|---|---|---|---|---|---|---|---|

| Professional Accounting Firms | Global | 50+ | Cost Accounting, Auditing | PDF Reports, Spreadsheets | GAAP/IFRS Compliant | 24–72h | 4.9/5.0 | 75% |

| University Business Schools | North America, EU | 100+ | Financial Education, Case Studies | Case Briefs, Teaching Modules | Peer-Reviewed | Publicly Available | 4.8/5.0 | 68% |

| Management Consulting Firms | Global | 30+ | Operational Cost Modeling | Custom Dashboards, Presentations | Audit-Backed | 48–96h | 4.7/5.0 | 60% |

| Industry Associations | Regional/Global | 40+ | Sector-Specific Benchmarks | White Papers, Surveys | Member-Validated | Public or Member Access | 4.6/5.0 | 55% |

| Online Educational Platforms | Global | 10+ | Finance & Accounting Courses | Video Tutorials, Quizzes | Expert-Curated | Immediate | 4.5/5.0 | 50% |

Performance Analysis

Professional accounting and consulting firms offer the highest accuracy and auditability for fixed cost modeling, particularly for procurement teams requiring compliance-grade documentation. Academic sources provide reusable, pedagogically sound examples ideal for training and internal reporting. Online platforms deliver rapid access but require additional validation against authoritative standards. Industry associations stand out for vertical-specific insights, such as fixed overhead benchmarks in machinery manufacturing or logistics operations. Prioritize sources with transparent methodologies and high reuse rates when building cost analysis frameworks.

FAQs

How to verify the accuracy of a fixed cost example?

Cross-reference the example with GAAP or IFRS guidelines. Confirm that it excludes output-dependent variables like raw material usage or hourly labor. Validate through third-party audits or published financial statements from comparable businesses.

What is the average lead time for obtaining customized fixed cost models?

Consulting firms typically deliver tailored cost breakdowns within 5–10 business days. Expedited services (3-day turnaround) are available at premium rates. Internal development using template libraries can reduce timelines to under 48 hours.

Can fixed cost examples be applied across different countries?

Direct application is limited due to regulatory, tax, and labor cost variations. Adjust for local factors such as property leasing rates, mandatory benefits, and utility contracts before deployment in international sourcing strategies.

Do providers offer free fixed cost templates?

Yes, many educational institutions and professional bodies distribute free templates under open-access policies. Consulting firms often provide sample models to demonstrate expertise, with full versions available under subscription or project-based agreements.

How to integrate fixed cost data into supplier negotiations?

Use verified fixed cost benchmarks to assess supplier pricing transparency. Identify inconsistencies between declared overheads and market norms. Leverage data to negotiate long-term contracts, shared-cost models, or joint efficiency initiatives.