Get A Smart Meter Utilita

Top sponsor listing

Top sponsor listing

About get a smart meter utilita

Where to Find Smart Meter Suppliers?

China remains the global hub for smart meter manufacturing, with key production clusters in Zhejiang, Hunan, and Hebei provinces driving innovation and scale. These regions host vertically integrated supply chains encompassing electronic component sourcing, PCB assembly, and final testing—enabling rapid prototyping and high-volume output. The concentration of IoT-focused manufacturers in cities like Shenzhen and Hangzhou supports advanced functionalities such as LoRaWAN, 4G/GPRS connectivity, and remote prepaid billing systems.

Suppliers benefit from localized access to semiconductor suppliers and injection molding facilities, reducing material lead times by 20–30% compared to offshore alternatives. Industrial ecosystems in these zones support both standardized production and low-volume customization, with average monthly outputs ranging from 10,000 to over 100,000 units per facility. Buyers gain flexibility in procurement strategy, whether targeting cost-efficient bulk orders or feature-specific configurations compliant with international utility standards.

How to Choose Smart Meter Suppliers?

Effective supplier selection requires structured evaluation across technical, operational, and transactional dimensions:

Technical Compliance & Certification

Verify adherence to IEC 62056, ANSI C12, and MID (Measuring Instruments Directive) where applicable. For export markets, confirm CE, RoHS, and STS (Standard Transfer Specification) certification—particularly critical for prepayment meter deployments in Africa, Europe, and South Asia. Request test reports for insulation resistance, impulse voltage, and electromagnetic compatibility (EMC).

Production Capability Assessment

Evaluate core manufacturing competencies through the following indicators:

- Minimum factory area of 3,000m² for stable mass production

- In-house SMT lines and automated calibration systems

- Dedicated R&D teams focused on communication protocols (e.g., DLMS/COSEM, MQTT)

- On-site environmental testing chambers for temperature, humidity, and vibration stress validation

Cross-reference online revenue metrics and order fulfillment rates to assess scalability and financial stability.

Procurement Risk Mitigation

Utilize secure payment mechanisms tied to delivery milestones. Prioritize suppliers with documented quality management systems (ISO 9001 preferred). Conduct sample testing for accuracy class (typically Class 1 or Class 0.5), data logging frequency, and network reliability under weak signal conditions. Confirm firmware update capabilities and cybersecurity measures for OTA (over-the-air) updates.

What Are the Best Smart Meter Suppliers?

| Company Name | Main Products (Listings) | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | Customization Options |

|---|---|---|---|---|---|---|

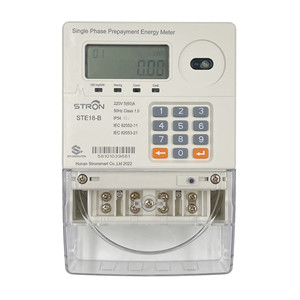

| Hunan Stron Smart Co., Ltd. | Energy Meters (583); Water Meters (279) | US $300,000+ | 100% | 25% | ≤2h | Not specified |

| Shanghai FangQiu Electric Co.,Ltd. | Smart Electric Energy Meters; LoRa-enabled models | US $40,000+ | 100% | 15% | ≤2h | Color, material, size, logo, packaging, label, graphic |

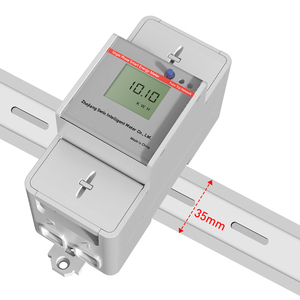

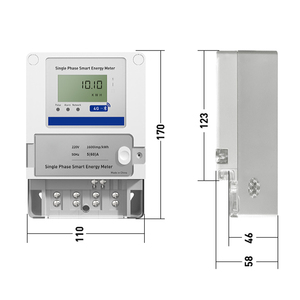

| Zhejiang Swin IoT Technology Co.,Ltd. | Energy Meters (179); Water Meters (64) | US $60+ | - | <15% | ≤2h | Not specified |

| Hebei Yuhan Electronic Technology Co., Ltd. | Water Meters (97); Level Measuring Instruments (274) | US $10,000+ | 93% | 16% | ≤3h | Not specified |

| Shenzhen Londian Wason Holdings Group Co., Ltd. | Three-phase meters; 4G/GPRS/WiFi models | US $7,000+ | 100% | - | ≤3h | Color, material, size, logo, packaging, label, graphic |

Performance Analysis

Hunan Stron leads in transaction volume and customer retention, indicating strong product reliability and market acceptance. Its complete portfolio spans single-phase prepaid meters to three-phase wireless kWh solutions, all backed by a 100% on-time delivery record. Shanghai FangQiu and Shenzhen Londian offer extensive customization—including flame-retardant casings and branded labeling—suitable for utilities requiring OEM branding or region-specific compliance adaptations.

Zhejiang Swin IoT focuses on LoRaWAN-integrated designs ideal for AMI (Advanced Metering Infrastructure) networks, though limited reorder rate transparency suggests lower buyer engagement. Hebei Yuhan demonstrates consistent performance in water and level measurement instruments but has fewer dedicated smart electricity meter listings. Response times are generally efficient, with 80% of suppliers replying within 2 hours—critical for resolving technical queries during integration phases.

FAQs

What is the typical MOQ for smart meters?

Minimum Order Quantities vary by model and supplier. Basic single-phase meters may require only 5 units, while industrial-grade or preconfigured communication models often mandate 100–500 units. High-volume buyers can negotiate MOQ reductions based on long-term contracts.

What are common lead times after order confirmation?

Standard production lead time ranges from 15 to 30 days, depending on complexity and order size. Meters with embedded SIMs, dual tariff programming, or custom enclosures may extend to 45 days. Expedited production is available at select facilities for urgent deployments.

Do suppliers support firmware and communication protocol customization?

Yes, leading manufacturers offer configurable firmware for DLMS/COSEM, Modbus, and private protocols. Some provide API access for integration with utility billing platforms. Confirm SDK availability and version control policies before procurement.

Can smart meters be tested before shipment?

Reputable suppliers conduct full functional tests including accuracy verification, relay operation, display checks, and network registration. Third-party inspection services (e.g., SGS, BV) can be arranged upon request. Pre-shipment samples should undergo independent lab testing for metrological compliance.

Are there export restrictions on smart meter shipments?

While smart meters are generally unrestricted, embedded communication modules (especially those supporting LTE-M or NB-IoT) may require regulatory approvals in destination countries. Suppliers should provide FCC, IC, or NTA certifications as needed. Always validate compliance with local utility tender requirements prior to ordering.