Get Random Number

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/1

1/1

1/1

1/1

1/2

1/2

1/2

1/2

1/14

1/14

1/3

1/3

0

0

1/3

1/3

0

0

1/13

1/13

1/3

1/3

1/2

1/2

1/3

1/3

About get random number

Where to Find Random Number Generation Solutions?

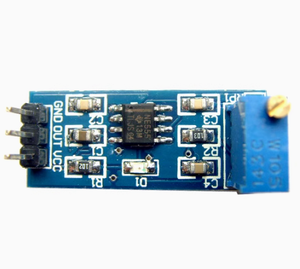

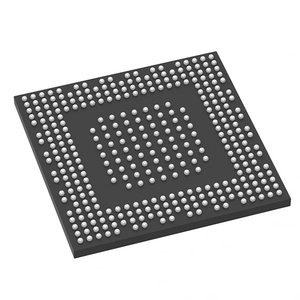

The global market for random number generation (RNG) technologies spans both hardware-based and software-based suppliers, with key manufacturing and development hubs concentrated in technologically advanced regions including China, the United States, Germany, and South Korea. In China, industrial-grade RNG modules are primarily developed within electronics and semiconductor clusters in Guangdong and Jiangsu provinces, where integrated circuit (IC) fabrication facilities support secure cryptographic hardware production. These regions benefit from established supply chains for silicon wafers, microcontrollers, and embedded systems, enabling cost-efficient scaling of true random number generators (TRNGs) and pseudorandom number generators (PRNGs).

Suppliers in these zones leverage automated SMT (Surface Mount Technology) assembly lines and cleanroom environments to ensure high reliability in security-critical applications such as encryption devices, gaming systems, and blockchain infrastructure. Economies of scale, access to Tier-1 component vendors, and proximity to export ports allow lead times averaging 20–35 days for batch orders. Buyers can expect 15–25% lower unit costs compared to equivalent Western-assembled modules, particularly when sourcing certified, volume-produced ICs or OEM-ready firmware solutions.

How to Choose Random Number Generation Suppliers?

Procurement decisions should be guided by rigorous technical and operational evaluation criteria:

Certification & Compliance Verification

Ensure adherence to international standards including ISO/IEC 19790 (security requirements for cryptographic modules), NIST SP 800-90A/B/C (randomness requirements), and Common Criteria EAL4+. For regulated sectors—such as gambling, finance, or government IT—FIPS 140-2/3 validation is essential. Request test reports from accredited labs confirming entropy sources, bias detection, and resistance to environmental tampering.

Technical Production Capabilities

Assess supplier infrastructure based on the following benchmarks:

- Access to semiconductor foundries or licensed IP cores for TRNG design

- In-house firmware development teams with expertise in cryptographic algorithms (e.g., AES-CTR_DRBG, HMAC_DRBG)

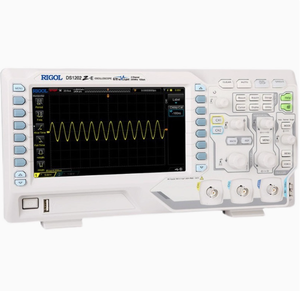

- Automated testing protocols for statistical randomness (e.g., Dieharder, NIST STS, TestU01)

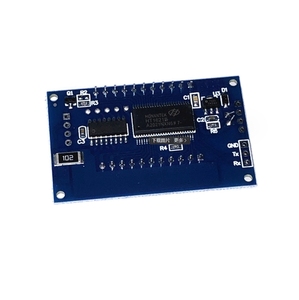

- Integration capabilities with host platforms (PCIe, USB, IoT modules, HSMs)

Confirm scalability through documented yield rates (>95%) and monthly output capacity (minimum 10,000 units for mass deployment).

Quality Assurance & Transaction Security

Require documented quality management systems compliant with ISO 9001 and IATF 16949 (for automotive-grade chips). Conduct remote or on-site audits to verify anti-tamper mechanisms, supply chain traceability, and secure boot implementation. Utilize third-party inspection services before shipment, especially for custom ASICs or firmware-loaded devices. Prioritize suppliers offering sample validation under real-world operating conditions to assess entropy stability across temperature and voltage variations.

What Are the Key Considerations When Sourcing RNG Solutions?

While specific supplier data is currently unavailable, procurement strategies must account for application-specific requirements:

Hardware vs. Software RNGs

Hardware-based solutions (TRNGs) are preferred for high-security environments due to their reliance on physical noise sources (e.g., thermal noise, clock jitter). They typically require higher upfront investment but offer superior unpredictability. Software-based PRNGs are more cost-effective and suitable for non-critical applications, provided they are seeded securely and meet algorithmic robustness standards.

Customization & Integration Support

Evaluate whether suppliers provide SDKs, API documentation, or reference designs for seamless integration into existing systems. Custom requests may include specific output formats (binary, hexadecimal), entropy throughput (Mbps), power consumption profiles, or form factors (DIP, SOIC, module-on-board). Lead time for customized IC tape-outs ranges from 8 to 16 weeks, depending on complexity and fab availability.

Minimum Order Quantities & Pricing Models

MOQs vary significantly: standard off-the-shelf modules may be available from 100 units, while ASIC developments often require minimum runs of 10,000+ units. Unit pricing decreases notably beyond 10k volumes, especially for wafer-level packaging. Some suppliers offer hybrid licensing models where core IP is licensed separately from physical production.

FAQs

How to verify the randomness quality of a supplier’s output?

Request full statistical test suites conducted using NIST STS or Dieharder tools. Verify that p-values fall within acceptable thresholds (typically 0.001–0.999) across all tests, including frequency, runs, longest run, and FFT analysis. Independent lab verification adds credibility.

What is the typical lead time for RNG module delivery?

Standard product deliveries take 20–35 days after order confirmation, including QC and packaging. For custom silicon designs, lead times extend to 10–16 weeks due to design validation, photomask creation, and wafer fabrication cycles.

Can RNG suppliers support global compliance requirements?

Yes, leading manufacturers align with regional regulatory frameworks such as GDPR (data privacy), RoHS (hazardous substances), and ATEX (for industrial environments). Confirm compliance documentation prior to integration, especially for cross-border deployments in finance or healthcare.

Do suppliers offer free samples for testing?

Many suppliers provide paid evaluation kits ($50–$200) to cover material and programming costs. Free samples are typically reserved for qualified buyers placing forecasted orders exceeding 1,000 units annually.

How to assess long-term supplier reliability?

Analyze track record in delivering consistent firmware updates, defect rates (target <0.5%), and responsiveness to security advisories (e.g., CVE disclosures). Review customer case studies in similar industries and confirm ongoing participation in cryptographic standardization bodies.