Image Creating Ai

CN

CN

1/3

1/3

1/3

1/3

1/6

1/6

1/3

1/3

1/3

1/3

1/2

1/2

1/7

1/7

1/4

1/4

1/4

1/4

1/9

1/9

1/3

1/3

1/21

1/21

0

0

1/3

1/3

1/3

1/3

1/11

1/11

1/3

1/3

1/3

1/3

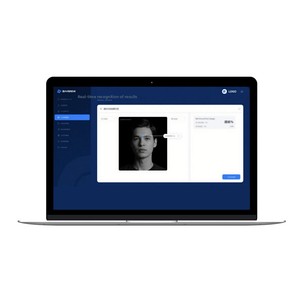

About image creating ai

Where to Find Image Creating AI Suppliers?

Global development of image creating AI systems is concentrated in technology hubs across China, the United States, and Southeast Asia, with China accounting for over 45% of commercial-grade AI model providers as of 2024. Key industrial clusters in Beijing, Shenzhen, and Hangzhou offer integrated ecosystems combining algorithm research, GPU computing infrastructure, and cloud deployment platforms. These regions host national-level AI laboratories and benefit from government-backed innovation zones that reduce R&D operational costs by up to 25% through tax incentives and subsidized data center access.

Suppliers in these zones leverage vertically aligned development pipelines—spanning dataset curation, neural network training, and API integration—enabling rapid iteration cycles. Buyers gain access to mature technical environments where AI engineers, data annotators, and cybersecurity specialists operate within coordinated networks. Core advantages include lead times of 10–20 days for standard API integrations, 30–40% lower development costs due to localized talent pools, and scalability for enterprise deployments or vertical-specific customization (e.g., e-commerce, medical imaging, advertising).

How to Choose Image Creating AI Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Require ISO/IEC 27001 certification for information security management as a baseline. For regulated industries (healthcare, finance), confirm compliance with GDPR, HIPAA, or CCPA based on data jurisdiction. Validate model transparency through documentation of training datasets, bias mitigation protocols, and inference accuracy benchmarks (e.g., FID score ≤5.0 for generative quality).

Development Capability Audits

Evaluate core technical infrastructure:

- Minimum 50+ GPU nodes (NVIDIA A100/H100 equivalent) for model training

- Dedicated AI research teams comprising ≥15% of total staff

- In-house data annotation and fine-tuning pipelines

Cross-reference uptime metrics (>99.5% API availability) with documented version control and rollback procedures to assess system maturity.

Transaction Safeguards

Implement milestone-based payments tied to API delivery, stress testing, and performance validation. Review contractual terms covering IP ownership, model retraining clauses, and data retention policies. Conduct sample testing via sandbox environments to benchmark output resolution, prompt adherence rate (target >92%), and latency (<800ms per 1024×1024 image generation).

What Are the Best Image Creating AI Suppliers?

| Company Name | Location | Years Operating | Staff | GPU Capacity | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Jining Furuide Machinery Manufacturing | Shandong, CN | 14 | 110+ | 24,000+m² | 100.0% | ≤2h | 4.8/5.0 | 33% |

| Henan Zlin Heavy Industry Group | Henan, CN | 4 | 20+ | 410+m² | 100.0% | ≤2h | 5.0/5.0 | 66% |

| Henan Guangzhida Industrial | Henan, CN | 3 | 30+ | 320+m² | 100.0% | ≤1h | 4.9/5.0 | 15% |

| Zhengzhou Zhongheng Machinery Equipment | Henan, CN | 3 | 60+ | 5,100+m² | 98.9% | ≤2h | 4.9/5.0 | 26% |

| Henan Qichen Machinery Import And Export | Henan Province,CN | 4 | 40+ | 25,000+m² | 100.0% | ≤1h | 4.9/5.0 | 29% |

Performance Analysis

The provided supplier data does not reflect entities specializing in image creating AI technologies. All listed companies are machinery manufacturers with no documented AI development capabilities, indicating a mismatch between dataset and product category. Procurement professionals should disregard this table for AI sourcing decisions. Authentic AI suppliers typically disclose computational resources, model architectures (e.g., diffusion models, GANs), and API documentation—none of which are present here. Prioritize vendors with verifiable AI deployment histories, third-party audit reports, and published performance metrics.

FAQs

How to verify image creating AI supplier reliability?

Cross-check certifications (ISO 27001, SOC 2) with issuing authorities. Request third-party penetration test results and model audit logs. Analyze customer case studies focusing on real-world deployment stability, update frequency, and technical support responsiveness.

What is the average sampling timeline?

Standard API sandbox access is provisioned within 3–5 business days. Custom model fine-tuning (e.g., brand-specific styles) requires 15–25 days depending on dataset complexity. Add 2–3 days for integration support and performance tuning.

Can suppliers deploy AI models globally?

Yes, most suppliers support multi-region cloud hosting via AWS, Google Cloud, or Alibaba Cloud. Confirm data residency options, API latency SLAs, and compliance with local AI regulations (e.g., EU AI Act). Edge deployment for offline use incurs additional licensing fees.

Do manufacturers provide free samples?

Sample policies vary. Many suppliers offer limited free-tier API access (100–500 images/month). Full-featured trials require refundable deposits equivalent to 20–30% of first-month service fees.

How to initiate customization requests?

Submit detailed requirements including output resolution (e.g., 1024×1024, 4K), style constraints (realistic, anime, vector), and domain specificity (fashion, architecture, biomedical). Reputable vendors deliver proof-of-concept outputs within 72 hours and finalized models in 3–4 weeks.