Index Tabs

1/1

1/1

1/3

1/3

1/3

1/3

0

0

1/30

1/30

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

0

0

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/30

1/30

0

0

0

0

1/3

1/3

1/1

1/1

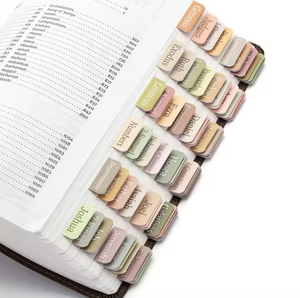

About index tabs

Where to Find Index Tabs Suppliers?

China is the dominant hub for index tabs manufacturing, with key production clusters in Guangdong and Dongguan offering specialized capabilities in precision die-cutting, adhesive lamination, and custom printing. These regions host vertically integrated facilities combining paperboard processing, digital printing, and packaging under one supply chain, enabling cost efficiencies of 20–35% compared to Western producers. Dongguan alone accounts for over 40% of China’s printed stationery exports, supported by advanced flexographic and offset printing infrastructure optimized for short-run customization and bulk orders.

Suppliers in this ecosystem leverage localized access to raw materials such as PET films, kraft paper, and acrylic adhesives, reducing material lead times to under 7 days. Integrated logistics networks allow direct export from Shenzhen and Guangzhou ports, facilitating average shipping times of 18–25 days to North America and Europe via sea freight. The concentration of labeling, packaging, and print specialists within 30km radii supports rapid prototyping, with sample turnaround averaging 5–9 days for customized designs.

How to Choose Index Tabs Suppliers?

Effective supplier selection requires systematic evaluation across three core dimensions:

Production & Customization Capability

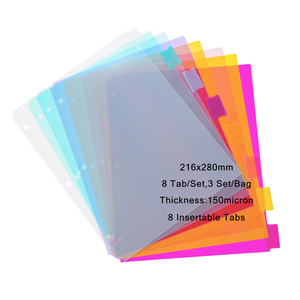

Assess whether suppliers support required materials (e.g., transparent PET, laminated paper, frosted PP) and finishing techniques including hot-stamping, edge gilding, and debossing. Confirm minimum order quantities (MOQs) align with procurement scale—ranging from 100 pieces for standard stock items to 2,000+ units for custom-printed runs. Prioritize manufacturers offering digital proofing and color-matching services (Pantone or CMYK) to ensure design accuracy.

Quality Assurance & Operational Metrics

Evaluate performance indicators such as on-time delivery rate (target ≥96%), response time (≤4 hours preferred), and reorder rate (indicative of customer satisfaction). Suppliers with online transaction revenues exceeding US $100,000 demonstrate consistent output capacity and market validation. Cross-check claims against verifiable metrics like order fulfillment history and defect rates.

Transaction Security & Compliance

Favor suppliers with documented quality control processes and participation in trade assurance programs. While formal certifications like ISO 9001 are not universally listed, operational transparency—evidenced by product traceability, batch testing, and responsive communication—is a reliable proxy for reliability. For branded or religious-themed products (e.g., Bible indexing tabs), confirm intellectual property compliance and design authorization protocols.

What Are the Best Index Tabs Suppliers?

| Company Name | Main Products (Listings) | Online Revenue | On-Time Delivery | Response Time | Reorder Rate | Min. Order Range | Price Range (USD) | Customization |

|---|---|---|---|---|---|---|---|---|

| Dongguan Boyue Packing Co., Ltd. | Packaging Labels (354), Paper Printing (286) | US $10,000+ | 100% | ≤4h | <15% | 50–2000 pcs | $0.01–$1.35 | Limited |

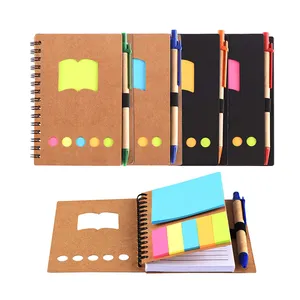

| Shenzhen Mei Yi Tian Group Co., Ltd. | Filing Products (368), Notebooks (237) | US $80,000+ | 100% | ≤3h | 21% | 10–100 packs | $0.24–$1.99 | Standard Options |

| Dongguan Fenghejin Crafts Co., Ltd. | Packaging Labels (2056), Other Packaging (2139) | US $140,000+ | 89% | ≤3h | 21% | 2–1000 sheets | $0.01–$0.99 | Yes |

| Sheng Kang Industrial (HK) Limited | Memo Pads (783), Notebooks (179) | US $40,000+ | 96% | ≤4h | <15% | 10–50 pieces | $0.12–$0.35 | Partial |

| Guangzhou Xinqicai Printing Co., Ltd. | Full-service printing & packaging | US $1,300,000+ | 99% | ≤3h | 35% | 300–1000 pcs | $0.59–$4.99 | Extensive |

Performance Analysis

Guangzhou Xinqicai stands out with the highest transaction volume and robust reorder rate (35%), indicating strong buyer retention, likely driven by comprehensive customization options including logo printing, dual-side lamination, and specialty finishes. Despite a slightly lower on-time delivery rate (89%), Dongguan Fenghejin offers the lowest price points starting at $0.01 per unit, making it ideal for high-volume, budget-sensitive contracts. Shenzhen Mei Yi Tian balances responsiveness (≤3h) and consistent delivery (100%) with competitive pricing for pre-designed office and academic indexing solutions.

Dongguan-based suppliers dominate low-cost production using automated die-cutting and roll-fed adhesive application, while Shenzhen and Hong Kong-linked exporters emphasize faster customer service cycles and broader international shipping experience. Buyers seeking premium laminated or themed Bible tabs should prioritize suppliers with documented lamination and UV-coating capabilities.

FAQs

What are typical MOQs for custom index tabs?

MOQs vary by customization level: full-color printed designs typically require 1,000–2,000 pieces, while basic colored or translucent tabs can be sourced from 100–500 units. Sample orders are available from most suppliers, often at higher per-unit pricing.

How long does production and shipping take?

Standard orders are fulfilled within 7–15 days post-approval. Custom printing adds 3–7 days for plate setup and proofing. Sea freight to major global ports averages 18–25 days; air shipping reduces transit to 5–8 days at increased cost.

Can suppliers provide eco-friendly materials?

Some manufacturers offer recyclable paper substrates and solvent-free adhesives. Confirm availability of FSC-certified stocks or biodegradable PET films directly with the supplier prior to order placement.

Are free samples available?

Most suppliers provide physical samples for $0–$20, refundable upon order confirmation. Digital proofs are typically free and delivered within 24 hours for layout verification.

What file formats are required for custom designs?

Vector files (AI, EPS, PDF with outlined text) at 300 DPI resolution are standard. Include bleed (2–3mm), color mode (CMYK), and Pantone references where applicable. Reputable suppliers will return a signed proof for approval before production.