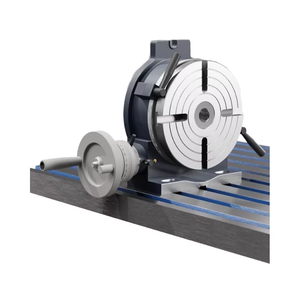

Indexing Tables

1/8

1/8

1/3

1/3

1/3

1/3

1/3

1/3

1/2

1/2

0

0

1/3

1/3

1/27

1/27

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/16

1/16

1/28

1/28

1/3

1/3

1/14

1/14

1/3

1/3

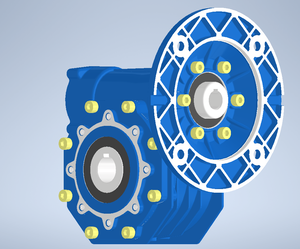

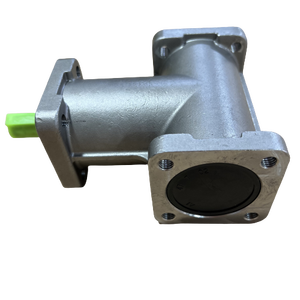

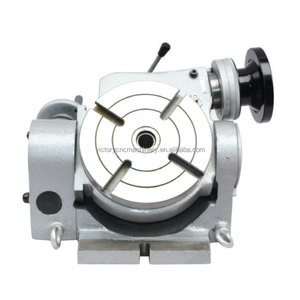

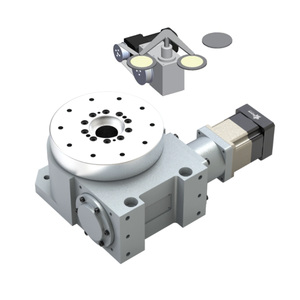

About indexing tables

Where to Find Indexing Tables Suppliers?

China remains the central hub for indexing table manufacturing, with key production clusters in Jiangsu, Shanghai, and Guangdong provinces. These regions host vertically integrated facilities specializing in precision motion control components, leveraging mature supply chains for servo motors, hydraulic systems, and CNC machining centers. Wuxi and Changzhou in Jiangsu province are notable for high-precision 4th and 5-axis rotary tables, supported by localized access to hardened alloy materials and advanced heat treatment processes. Shanghai-based manufacturers emphasize automation integration, offering indexing tables compatible with major CNC controller brands.

The industrial ecosystem enables efficient component sourcing, with casting, grinding, and assembly operations often co-located within 50km radii. This proximity reduces lead times for standard models to 20–35 days and supports rapid prototyping for custom configurations. Buyers benefit from scalable production capacity, with monthly output across verified suppliers ranging from 200 to over 1,000 units depending on complexity. Cost advantages are significant—localized manufacturing reduces unit prices by 25–40% compared to European or North American equivalents, particularly for multi-station and high-torque models.

How to Choose Indexing Tables Suppliers?

Selecting reliable suppliers requires a structured evaluation of technical, operational, and transactional criteria:

Technical Compliance & Precision Standards

Verify adherence to international accuracy benchmarks such as ISO 230-2 for positional repeatability. High-performance indexing tables should achieve ≤±5 arc seconds precision, with backlash controlled below 10 arc seconds. Demand documentation for critical components including servo drivers, bearings, and encoder systems. For automated integration, confirm compatibility with Fanuc, Siemens, or Mitsubishi control platforms.

Production Capability Assessment

Evaluate supplier infrastructure using these benchmarks:

- Minimum factory area of 3,000m² indicating established production lines

- In-house CNC machining and gear grinding capabilities to ensure dimensional consistency

- Dedicated quality inspection stations equipped with laser interferometers or optical encoders

Cross-reference online revenue data (e.g., $110,000+ annual digital sales) with on-time delivery rates above 95% to assess operational reliability.

Customization & Transaction Security

Confirm availability of engineering support for modifications including motor integration, flange dimensions, lubrication systems, and communication protocols. Prioritize suppliers offering customization options in material, color, labeling, and packaging. Utilize secure payment mechanisms such as escrow services, especially when engaging newer suppliers without extensive export histories. Request physical or digital samples before full-scale orders to validate build quality and alignment tolerances.

What Are the Best Indexing Tables Suppliers?

| Company Name | Location | Verified Supplier Type | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Product Range (USD) | Customization Options |

|---|---|---|---|---|---|---|---|---|

| Wuxi Fagor Technology Company Limited | Jiangsu, CN | Multispecialty Supplier | US $110,000+ | 100% | ≤2h | <15% | $2,500–$15,200 | Yes |

| Changzhou Drake International Trade Co., Ltd. | Jiangsu, CN | Custom Manufacturer | US $450,000+ | 97% | ≤3h | 22% | $1,349–$5,000 | Yes |

| Shanghai Think Big Machine Tool Co., Ltd. | Shanghai, CN | Multispecialty Supplier | US $40,000+ | 100% | ≤7h | 33% | $190–$2,530 | Yes |

| Dongguan Thor Machinery Co., Ltd. | Guangdong, CN | Not Specified | US $80,000+ | 92% | ≤3h | <15% | $200–$650 | Limited |

| Shenzhen Dijin Machine Equipment Co., Ltd. | Guangdong, CN | Not Specified | US $220,000+ | 96% | ≤5h | <15% | $101–$272 | Limited |

Performance Analysis

Wuxi Fagor stands out for high-end 5-axis indexing tables, combining 100% on-time delivery with premium pricing and broad customization. Changzhou Drake offers competitive mid-range solutions with strong export volume (US $450,000+), suitable for buyers seeking balance between cost and reliability. Shanghai Think Big targets budget-conscious clients with sub-$2,000 models while maintaining full delivery compliance, though response times lag behind peers. Dongguan Thor and Shenzhen Dijin provide entry-level manual rotary tables at aggressive price points, ideal for light-duty applications but with limited engineering support. Reorder rates suggest niche specialization: Shanghai Think Big’s 33% repeat order rate indicates customer satisfaction in specific automation segments despite lower average transaction values.

FAQs

How to verify indexing table supplier reliability?

Cross-check claimed certifications (e.g., ISO 9001) through official registries. Request evidence of in-process quality checks, including runout tests and load cycle validations. Analyze customer feedback focused on long-term durability and post-sale technical support responsiveness.

What is the typical MOQ and lead time?

Most suppliers list a minimum order quantity of 1 set or piece, enabling low-volume procurement. Standard lead times range from 15 to 30 days for off-the-shelf models. Custom designs may require 45–60 days, depending on complexity and component availability.

Can indexing tables be customized for OEM integration?

Yes, many suppliers offer OEM customization including branding (logo, label), electrical interface specifications, mounting configurations, and material substitutions. High-end manufacturers support full mechanical drawings and 3D model submissions for tailored development.

Do suppliers provide testing reports with shipments?

Reputable suppliers typically include basic performance documentation such as angular accuracy, repeatability, and preload measurements. For mission-critical applications, request certified calibration reports traceable to national standards bodies.

Are there cost differences between vertical and horizontal configurations?

Vertical indexing tables generally command a 10–20% premium due to more complex bearing arrangements and gravity compensation requirements. Multi-position, servo-driven, or hydraulic models further increase costs based on torque and rigidity specifications.