Intel 2nm Processor

About intel 2nm processor

Where to Find Intel 2nm Processor Suppliers?

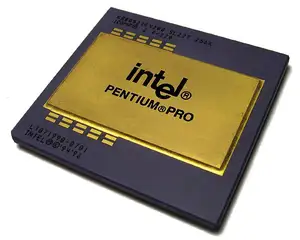

The current supplier landscape for products listed under "Intel 2nm processor" on global B2B platforms reflects a market segment primarily focused on electronic components, used CPUs, and semiconductor scrap materials rather than next-generation 2nm fabrication. While Intel has announced plans for its 2nm-class (Intel 20A and 18A) process technologies, commercial processors based on this node are not yet widely available as of 2024. The suppliers identified in the dataset specialize in legacy Intel processors, refurbished units, or ceramic CPU scraps containing precious metals, indicating that the term "2nm" in product listings may be misused or inaccurately applied.

Suppliers are geographically dispersed, with operations in China and international trade entities based in Uganda and North America. Chinese companies such as Shenzhen Wujihai Technology Co., Ltd. and Shenzhen Chengdaxin Technology Co., Ltd. operate within established electronics supply chains in Shenzhen, leveraging access to secondary markets for CPUs, motherboards, and networking hardware. Other suppliers like EARL CARL ALEXANDRE and AB Trillium Trading LLC focus on bulk commodity-grade CPU scrap, treating processors as recyclable material rather than functional computing units.

How to Choose Intel 2nm Processor Suppliers?

Given the absence of genuine 2nm-node Intel processors in the market, buyer due diligence must prioritize accurate product classification and supplier reliability:

Technical Accuracy Verification

Cross-check product specifications against Intel’s official architecture roadmap. True 2nm-equivalent processors (e.g., powered by Intel 18A) are expected post-2024 and will carry specific branding (e.g., Lunar Lake, Panther Lake). Current listings referencing “2nm” alongside models like Celeron G4920 or Xeon Gold 6226R—manufactured on 14nm or larger nodes—are technically inaccurate. Request die-level documentation or FAB source verification for claims involving advanced process nodes.

Production and Sourcing Capability Assessment

Evaluate whether suppliers engage in active semiconductor manufacturing or function as resellers/scrap aggregators:

- Facilities advertising tonnage-based sales (e.g., 5–10 tons) are engaged in e-waste recycling, not processor fabrication

- Companies listing individual units (Min. order: 1 piece) typically handle used or surplus inventory from decommissioned systems

- No supplier in the dataset references semiconductor foundry partnerships, cleanroom environments, or wafer-scale testing—key indicators of actual chip production

Transaction Risk Mitigation

Prioritize suppliers with verifiable response times and reorder rates. For example, Shenzhen Wujihai Technology reports a 71% on-time delivery rate and ≤1-hour response time, suggesting operational responsiveness. Use secure payment mechanisms and request sample testing for batch quality when procuring used or recycled processors. Confirm export compliance, particularly for shipments involving controlled electronic waste under Basel Convention regulations.

What Are the Leading Intel 2nm Processor Suppliers?

| Company Name | Primary Product Type | MOQ Structure | Price Range (USD) | On-Time Delivery | Avg. Response | Reorder Rate | Revenue Indicator |

|---|---|---|---|---|---|---|---|

| Shenzhen Wujihai Technology Co., Ltd. | Used/Refurbished CPUs | 1 pc | $1.90–$632 | 71% | ≤1h | 19% | US $80,000+ |

| Shenzhen Chengdaxin Technology Co., Ltd. | Used/Refurbished Xeon & Celeron | 1 pc | $20–$300 | 50% | ≤3h | <15% | US $2,000+ |

| JAMNAGAR UGANDA LIMITED | Ceramic CPU Scrap (by weight) | 25 kg | $9–$12/kg | - | ≤8h | - | - |

| EARL CARL ALEXANDRE | CPU Scrap / Recyclable Chips | 5 tons | $120–$150/ton | - | ≤11h | - | - |

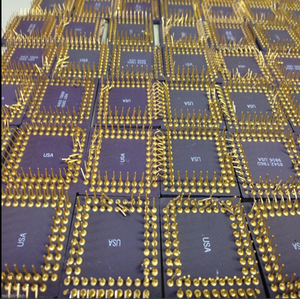

| AB Trillium Trading LLC | Premium CPU Scrap (Gold-bearing) | 1–10 tons | $190–$350/ton | - | ≤6h | - | - |

Performance Analysis

Shenzhen-based suppliers dominate transactional activity with low MOQs and fast response times, catering to buyers seeking functional used processors for replacement or integration into cost-sensitive systems. In contrast, bulk scrap suppliers operate on commodity pricing models, where value is derived from gold and copper content rather than computational performance. No supplier demonstrates capabilities aligned with advanced node semiconductor manufacturing, and all offerings are consistent with secondary market channels. Buyers seeking cutting-edge processing power should instead monitor direct engagements with Intel or authorized OEM partners for upcoming 18A-based platforms.

FAQs

Are there genuine Intel 2nm processors available from these suppliers?

No. The processors listed are manufactured on older process nodes (e.g., 14nm, 22nm, 32nm). The term “2nm” in these listings appears to be incorrectly used or misinterpreted. Genuine Intel 2nm-class processors (Intel 18A) are not expected in mass production until 2025 and will initially target high-performance computing and foundry customers.

What is the typical lead time for ordering?

For in-stock used CPUs, lead times range from 3–15 days depending on destination. Bulk scrap orders may require 10–20 days for logistics coordination, especially for tonnage shipments requiring customs classification under HS codes for electronic waste.

Can I request product certification or testing reports?

Limited technical validation is available. Most suppliers do not provide silicon authenticity certificates, thermal stress tests, or binning data. Independent electrical testing is recommended before deployment in critical applications.

Is customization possible for processor configurations?

Customization is not feasible, as suppliers offer existing stock or scrap material. True custom silicon requires engagement with Intel Foundry Services and multi-million-dollar NRE investments.

What are the risks of sourcing from these suppliers?

Key risks include misrepresentation of process technology, inconsistent batch quality in used CPUs, and regulatory challenges in importing e-waste. Buyers should verify end-use compliance and consider environmental disposal costs when acquiring scrap-grade processors.