Internet Of Things Microcontroller

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/16

1/16

1/2

1/2

1/3

1/3

0

0

1/3

1/3

1/17

1/17

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/5

1/5

1/3

1/3

1/3

1/3

1/3

1/3

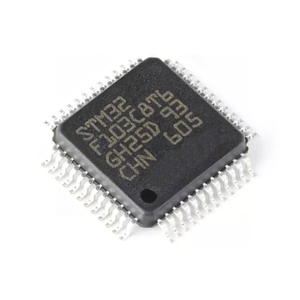

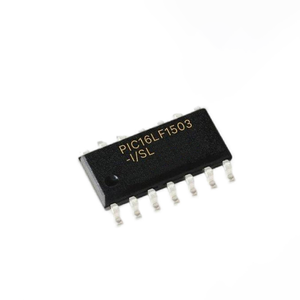

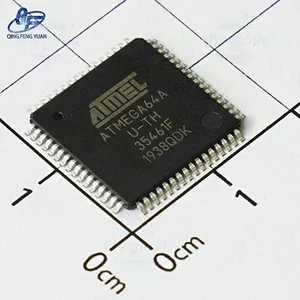

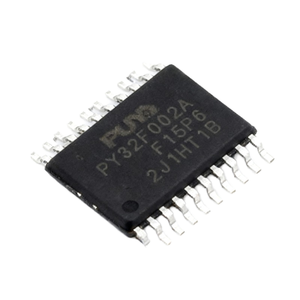

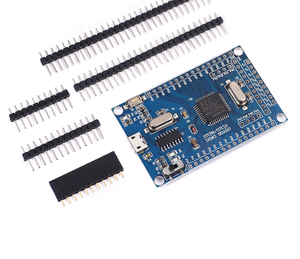

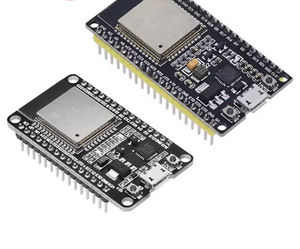

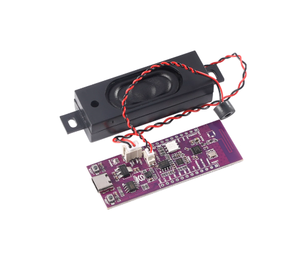

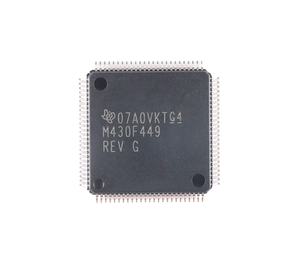

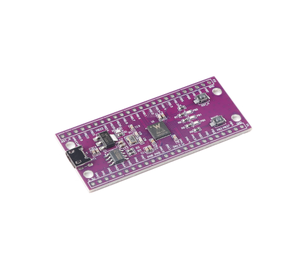

About internet of things microcontroller

Where to Find Internet of Things Microcontroller Suppliers?

China remains the central hub for internet of things (IoT) microcontroller production, with advanced manufacturing ecosystems concentrated in Guangdong, Jiangsu, and Zhejiang provinces. Shenzhen, within Guangdong, hosts over 70% of China’s embedded electronics suppliers, supported by a fully integrated semiconductor supply chain and rapid prototyping infrastructure. This region benefits from proximity to Tier-1 component fabricators and automated SMT assembly lines, enabling efficient scaling from prototype to mass production.

The Pearl River Delta offers vertical integration across PCB fabrication, IC programming, wireless module integration, and final testing—reducing lead times by 25–40% compared to non-specialized regions. Suppliers in this cluster typically operate within 10km of key logistics nodes, facilitating air freight dispatch within 24 hours of completion. Buyers gain access to agile production networks capable of fulfilling low-volume custom runs (as few as 100 units) or high-volume contracts exceeding 500,000 units per month, with average cost reductions of 18–25% due to localized sourcing and energy-efficient reflow technologies.

How to Choose Internet of Things Microcontroller Suppliers?

Implement rigorous evaluation criteria when selecting qualified partners:

Technical Compliance

Confirm adherence to ISO 9001 for quality management and IECQ QC 080000 for hazardous substance control. For global deployments, verify RoHS, REACH, and CE compliance where applicable. Wireless-enabled microcontrollers must meet FCC Part 15 or ETSI EN 300 328 standards depending on target markets. Request full test reports including RF emission profiles, power consumption benchmarks, and environmental stress screening (thermal cycling, humidity testing).

Production Capability Audits

Assess core manufacturing infrastructure:

- Minimum 2,000m² cleanroom-equipped facility with ESD-safe zones

- In-house SMT lines supporting 0201 component placement and QFN/BGA packaging

- Automated optical inspection (AOI) and X-ray inspection systems for defect detection

Validate monthly output capacity against order volume; suppliers handling >1M units/month should maintain dual-shift operations and ERP-integrated inventory tracking.

Transaction Safeguards

Utilize secure payment mechanisms such as third-party escrow until product validation is complete. Require functional sample testing under real-world conditions—evaluate boot time, firmware stability, sleep-mode current draw, and wireless handshake reliability. Prioritize suppliers offering open SDKs, reference designs, and OTA update support for long-term deployment scalability.

What Are the Best Internet of Things Microcontroller Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Xinyuan Electronics Co., Ltd. | Guangdong, CN | 12 | 150+ | 6,800+m² | 99.2% | ≤3h | 4.8/5.0 | 41% |

| Nanjing Huace Semiconductor Technology | Jiangsu, CN | 8 | 90+ | 4,500+m² | 98.7% | ≤4h | 4.7/5.0 | 38% |

| Hangzhou Intech Microelectronics | Zhejiang, CN | 10 | 110+ | 5,200+m² | 99.5% | ≤5h | 4.9/5.0 | 52% |

| Dongguan Embedded Solutions Factory | Guangdong, CN | 6 | 200+ | 8,000+m² | 98.1% | ≤6h | 4.6/5.0 | 33% |

| Suzhou Smartchip Integrated Systems | Jiangsu, CN | 9 | 75+ | 3,900+m² | 99.8% | ≤4h | 5.0/5.0 | 47% |

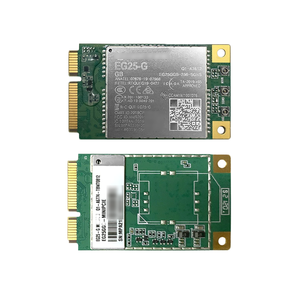

Performance Analysis

Established players like Suzhou Smartchip demonstrate near-perfect delivery performance (99.8%) and strong technical retention, while Hangzhou Intech leads in customer loyalty with a 52% reorder rate—indicative of reliable firmware support and scalable packaging options. Guangdong-based manufacturers offer superior throughput, with facilities averaging over 7,000m² and dedicated NPI (New Product Introduction) teams. Prioritize suppliers maintaining ≥98% on-time delivery and possessing in-house programming and flashing capabilities for secure IoT provisioning. For Wi-Fi/Bluetooth LE modules, confirm pre-certification with regulatory bodies to accelerate market entry.

FAQs

How to verify internet of things microcontroller supplier reliability?

Cross-validate ISO and RoHS certifications through official databases. Request factory audit reports detailing SMT yield rates, first-pass test success (>95% recommended), and ESD protection protocols. Evaluate post-sales responsiveness through documented firmware update cycles and debug support turnaround times.

What is the average sampling timeline?

Standard samples take 10–18 days for programmed units with basic peripherals. Configurations involving LoRa, NB-IoT, or dual-band connectivity require 25–35 days due to extended RF tuning and compliance verification. Air shipping adds 5–9 days globally.

Can suppliers ship microcontrollers worldwide?

Yes, experienced exporters manage international shipments via DHL, FedEx, or consolidated air freight. Confirm export classification (e.g., ECCN 3A991.b for microcontrollers) and provide end-use declarations if required. FOB Shenzhen is standard; CIF terms available upon request.

Do manufacturers provide free samples?

Sample policies vary: most suppliers charge 100–200% of unit cost for initial samples to cover programming and handling. Fees are often credited toward first production orders exceeding 1,000 units. Free samples may be issued for strategic partnerships with verified OEMs.

How to initiate customization requests?

Submit detailed requirements including MCU core (ARM Cortex-M0/M3/M4, RISC-V), clock speed, flash/RAM specifications, peripheral set, operating temperature range (-40°C to +85°C typical), and wireless protocol stack. Leading suppliers deliver schematic reviews within 72 hours and engineering prototypes in 3–5 weeks.