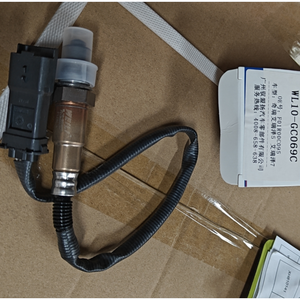

Lambda Sensor Auto

Top sponsor listing

Top sponsor listing

1/27

1/27

1/14

1/14

1/3

1/3

1/24

1/24

1/2

1/2

1/3

1/3

1/3

1/3

1/2

1/2

0

0

0

0

1/18

1/18

1/32

1/32

0

0

1/3

1/3

0

0

0

0

1/1

1/1

About lambda sensor auto

Where to Find Lambda Sensor Auto Suppliers?

China remains the central hub for lambda sensor (oxygen sensor) manufacturing, with key production clusters in Guangdong, Zhejiang, and Jiangsu provinces. These regions host vertically integrated facilities specializing in automotive emissions control systems, leveraging proximity to semiconductor suppliers, precision metal component manufacturers, and Tier-1 automotive electronics assemblers. Guangdong's Pearl River Delta region alone accounts for over 50% of China’s automotive sensor exports, supported by mature SMT (surface-mount technology) lines and automated calibration labs.

Suppliers in these zones benefit from localized supply chains for critical materials such as zirconia ceramic elements, platinum electrodes, and stainless steel housings—reducing material lead times by 20–30% compared to offshore alternatives. Production capabilities typically include full-process control from ceramic substrate sintering to final ECU signal testing, enabling standard lead times of 25–35 days for MOQ orders. Buyers gain access to scalable output, with mid-sized factories averaging 50,000–100,000 units per month across multiple OEM-compatible SKUs. Customization options extend to thread size (M12–M18), heater configurations (single/dual), and signal protocols (analog vs. wideband).

How to Choose Lambda Sensor Auto Suppliers?

Procurement decisions should be guided by rigorous technical and operational assessments:

Quality & Compliance Verification

Confirm ISO/TS 16949 or IATF 16949 certification as a baseline for automotive-grade quality management. CE and RoHS compliance are mandatory for European market distribution, while EPA equivalence documentation supports North American compatibility. Request test reports for operational parameters: operating temperature range (-40°C to +900°C), response time (<100ms for switching sensors), and lifespan validation (minimum 80,000 km simulated aging).

Production Infrastructure Assessment

Evaluate core manufacturing competencies:

- Minimum 3,000m² cleanroom-equipped facility for contamination-sensitive assembly

- In-house capabilities for zirconia element calibration, laser welding of sensor casings, and automated signal testing

- Dedicated R&D team (≥8% of technical staff) for reverse engineering OE specifications and validating cross-reference databases

Cross-check factory certifications against actual production logs and batch traceability systems to confirm consistency.

Supply Chain & Transaction Security

Require sample validation under real-world exhaust conditions before scaling orders. Utilize third-party inspection services (e.g., SGS, TÜV) for pre-shipment audits focusing on dimensional accuracy and long-term thermal stability. Prioritize suppliers offering warranty terms (typically 12–24 months) and proven dispute resolution records. Escrow payment structures are recommended until post-delivery performance verification is completed.

What Are the Best Lambda Sensor Auto Suppliers?

No supplier data available for comparative analysis.

Performance Analysis

In the absence of specific supplier profiles, procurement focus should remain on regional advantages and process verification. Guangdong-based manufacturers generally lead in automation and export readiness, with many maintaining AEC-Q100-aligned stress testing protocols. Zhejiang suppliers often specialize in cost-optimized replacements for European vehicle platforms (e.g., Bosch 0 258 006 series equivalents), while Jiangsu factories emphasize high-reliability variants for commercial diesel applications. When evaluating new partners, insist on live video audits of calibration benches and environmental testing chambers to validate technical claims.

FAQs

How to verify lambda sensor auto supplier reliability?

Validate certifications through accredited bodies and request recent audit reports covering incoming material inspection, in-process quality checks, and final functional testing. Analyze customer feedback related to failure rates in field use and responsiveness to technical inquiries. Cross-reference product markings (e.g., batch codes, OE cross-numbers) with physical samples for authenticity.

What is the average sampling timeline?

Standard sample production takes 10–18 days, including programming of test benches for target vehicle compatibility. Complex wideband (LSU 4.9/LSU ADV) variants may require up to 25 days due to specialized calibration routines. Air freight delivery adds 5–9 days internationally.

Can suppliers ship lambda sensors worldwide?

Yes, established manufacturers support global logistics via air and sea freight. Confirm Incoterms (FOB Shenzhen, CIF Rotterdam, etc.) and ensure packaging meets ESD protection standards. Suppliers should provide customs-compliant documentation, including HS code 9027.10 for oxygen sensors and material declarations for restricted substances.

Do manufacturers provide free samples?

Sample policies vary by order potential. First-time buyers typically pay full sample cost (USD 25–60/unit depending on type), which may be credited toward initial bulk orders exceeding 100 units. Repeat clients with verified purchase history often receive complimentary evaluation units for new SKUs.

How to initiate customization requests?

Submit detailed technical requirements including OE reference number, connector type (USCAR, Delphi, etc.), cable length, heater wattage, and applicable vehicle makes/models. Leading suppliers offer CAD drawings and signal waveform simulations within 72 hours and can deliver custom prototypes in 4–5 weeks with NDA-protected development.