Lcd Screen Display Producer

Top sponsor listing

Top sponsor listing

CN

CN

1/30

1/30

1/36

1/36

1/11

1/11

1/30

1/30

1/36

1/36

1/36

1/36

About lcd screen display producer

Where to Find LCD Screen Display Producers?

China remains the global epicenter for LCD screen and display manufacturing, with Shenzhen emerging as a dominant hub due to its dense ecosystem of electronics suppliers, component manufacturers, and R&D centers. The city hosts numerous vertically integrated producers specializing in custom LCD modules, touch screens, OLED/e-paper displays, and industrial monitors. These companies operate dedicated production lines equipped for surface-mount technology (SMT), automated optical inspection (AOI), and full module assembly, enabling rapid prototyping and scalable output.

Suppliers in this region benefit from proximity to semiconductor, glass, and PCB sourcing networks, reducing material lead times by 20–30% compared to offshore alternatives. Many maintain in-house engineering teams focused on display integration for consumer electronics, medical devices, industrial HMI panels, and digital signage. This clustering effect supports flexible order fulfillment—ranging from low-volume OEM batches to high-volume commercial deployments—with typical lead times of 15–30 days for standard configurations and 30–45 days for customized solutions.

How to Choose LCD Screen Display Producers?

Selecting a reliable supplier requires rigorous evaluation across technical, operational, and transactional dimensions:

Production & Engineering Capability

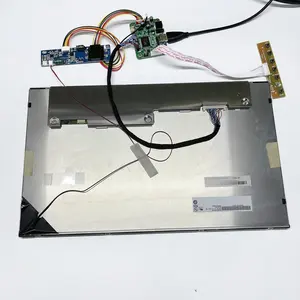

Prioritize manufacturers with confirmed in-house production lines and technical ownership of key processes such as driver IC bonding, touch sensor lamination, and backlight unit assembly. Verify access to cleanroom environments for display module fabrication and confirm compatibility with interface standards (LVDS, MIPI, RGB). For custom designs, assess their ability to support mechanical, electrical, and firmware-level modifications—including brightness optimization, wide temperature operation, and ruggedized (vandal-proof, waterproof) enclosures.

Quality Assurance & Compliance

Ensure adherence to international quality benchmarks. While formal ISO 9001 certification is not explicitly stated in available data, evaluate performance proxies: on-time delivery rates exceeding 97%, response times under 4 hours, and documented compliance with RoHS/REACH environmental directives. Request test reports for luminance uniformity, color accuracy, and ESD protection. Suppliers serving regulated industries should provide evidence of product safety certifications relevant to target markets (CE, FCC, UL).

Customization & Scalability Verification

Confirm scope of customization through direct inquiry, including but not limited to:

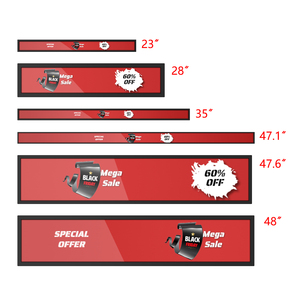

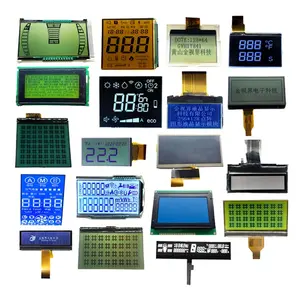

- Screen size (from 1.7-inch OLEDs to 75-inch large-format displays)

- Touch functionality (resistive, capacitive, multi-touch)

- Operating system integration (Android-based UIs)

- Environmental resilience (high-brightness outdoor variants, IP-rated sealing)

- Branding options (custom logos, packaging, labeling)

Cross-reference stated online revenue (e.g., US $570,000+ annual turnover) and reorder rate metrics as indicators of market acceptance and service reliability. High reorder rates may suggest strong post-sale support or competitive pricing structures.

What Are the Top LCD Screen Display Producers?

| Company Name | Main Products | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Customization Options |

|---|---|---|---|---|---|---|

| Shenzhen Startek Electronic Technology Co., Ltd. | LCD Modules, Touch Screens, OLED/E-Paper, Gaming Monitors | 95% | ≤4h | <15% | US $730,000+ | Color, material, size, logo, packaging, graphic |

| Shenzhen Ailiyu International Import And Export Co., Ltd. | LCD Modules, Portable Monitors, PCB & PCBA, Consumer Electronics | 100% | ≤1h | <15% | US $150,000+ | Limited customization noted |

| Shenzhen Landun Professional Monitors Electronic Technology Co., Ltd. | Touch Screen Monitors, Big-Size LCDs, Floor-Standing Displays | 97% | ≤2h | 47% | US $570,000+ | Extensive: OS, size, shape, brightness, waterproofing, mobile app integration |

| Guangzhou Zhexin Technology Co., Ltd. | LCD Modules, LED/LCD TVs | 100% | ≤6h | <15% | US $10,000+ | No explicit customization listed |

| Shenzhen Youritech Technology Co., Limited | LCD Modules, Touch Screens, OLED/E-Paper, Portable Monitors | 97% | ≤4h | 18% | US $70,000+ | OEM/ODM supported across multiple sizes |

Performance Analysis

Shenzhen-based producers dominate both responsiveness and customization depth. Shenzhen Ailiyu leads in operational efficiency with a 100% on-time delivery rate and sub-one-hour average response time, indicating robust internal coordination. Shenzhen Landun distinguishes itself with an extensive customization portfolio and a notably high 47% reorder rate, suggesting strong client retention likely driven by tailored engineering services for industrial and commercial display applications.

Startek and Youritech offer balanced capabilities for mid-range OEM projects, combining solid delivery performance with moderate customization. Guangzhou Zhexin, while achieving perfect on-time fulfillment, reports lower revenue volume and no advertised customization—indicating a focus on standardized products. Buyers seeking complex integrations should prioritize suppliers with proven experience in Android OS embedding, high-brightness panels (>1000 nits), and vandal-resistant construction.

FAQs

How to verify LCD screen producer reliability?

Request factory audit documentation, including equipment lists, SMT line capacity, and QC process flows. Validate claims through video tours of production areas and inspect sample units for solder joint quality, bezel finish, and touch calibration. Cross-check transaction metrics such as on-time delivery and response time against actual communication patterns during initial inquiries.

What is the typical MOQ and pricing structure?

Minimum order quantities start at 1 piece for sample testing, with bulk pricing applying beyond 100–500 units depending on complexity. Unit prices range from $10–$20 for small OLEDs (1.7–5 inch) to $477–$709 for large-format 75-inch displays. Cost drivers include resolution, touch layer type, backlight intensity, and environmental sealing.

Do these producers support OEM/ODM projects?

Yes, multiple suppliers—including Shenzhen Landun and Shenzhen Youritech—explicitly offer OEM/ODM services. Capabilities include custom firmware development, unique mechanical housing design, private labeling, and integrated software interfaces. Prototype delivery typically takes 2–4 weeks after specification finalization.

What are common lead times for samples and mass production?

Sample lead times average 7–15 days for existing models. Custom designs require 20–30 days for first-article builds. Mass production cycles range from 25–45 days, depending on order size and level of customization. Air freight adds 5–7 days globally; sea freight requires 25–35 days plus customs clearance.

Can suppliers handle global logistics and export compliance?

Established exporters manage international shipments under FOB, CIF, or DDP terms. They prepare necessary documentation (commercial invoice, packing list, bill of lading) and ensure packaging meets drop-test and vibration standards. Confirm compliance with destination-country regulations regarding electronic waste (WEEE), electromagnetic compatibility (EMC), and import tariffs before shipment release.