Learning Content Management System Software

1/3

1/3

1/3

1/3

0

0

1/3

1/3

0

0

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

CN

CN

1/3

1/3

1/3

1/3

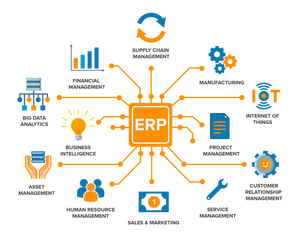

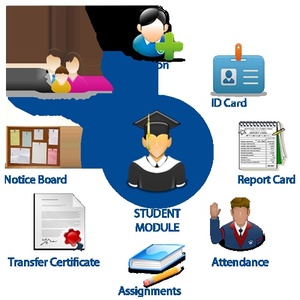

About learning content management system software

Where to Find Learning Content Management System Software Suppliers?

The global market for learning content management system (LCMS) software is highly decentralized, with development hubs concentrated in technology-forward regions including North America, Western Europe, and East Asia. Unlike hardware manufacturing, LCMS software production relies on distributed digital infrastructure and skilled technical workforces rather than physical industrial clusters. The United States and Canada host a significant share of enterprise-grade LCMS developers, particularly those serving higher education and corporate training sectors, supported by mature e-learning ecosystems and strong intellectual property frameworks.

In Europe, Germany, the UK, and the Nordic countries have established specialized software firms focused on compliant, data-secure LCMS platforms aligned with GDPR and ISO/IEC 27001 standards. Meanwhile, India and Vietnam have emerged as competitive outsourcing destinations for cost-efficient custom LCMS development, offering scalable teams at 40–60% lower labor costs compared to Western counterparts. These regions benefit from large pools of certified software engineers and agile development methodologies, enabling rapid deployment of cloud-native solutions. Buyers gain flexibility through hybrid sourcing models—leveraging Western vendors for strategic platform design and Asian partners for development and integration support.

How to Choose Learning Content Management System Software Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Require evidence of adherence to recognized quality and security standards, including ISO 9001 for software development processes and ISO/IEC 27001 for information security management. For public sector or EU-based deployments, confirm compliance with GDPR, WCAG 2.1 accessibility guidelines, and SCORM/xAPI interoperability specifications. Validate documentation for API architecture, data encryption protocols (e.g., TLS 1.3), and third-party penetration testing reports.

Development Capability Audits

Assess core technical infrastructure and team composition:

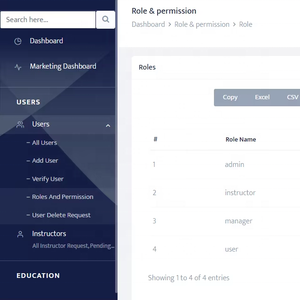

- Minimum of 15 full-time developers with documented expertise in LMS/LCMS platforms (e.g., Moodle, Docebo, or Totara integrations)

- Proven experience in cloud hosting environments (AWS, Azure, or Google Cloud) and containerized deployment (Docker, Kubernetes)

- In-house QA teams conducting automated testing, load simulation, and version control via Git-based workflows

Cross-reference project portfolios with client case studies to confirm delivery consistency and system uptime (>99.5% SLA recommended).

Transaction Safeguards

Implement milestone-based payment structures secured through escrow services until acceptance testing is completed. Review contractual terms covering source code ownership, post-deployment support windows (minimum 12 months), and bug resolution timelines. Pilot deployments with limited user groups are strongly advised—evaluate system performance under real-world conditions before full-scale rollout.

What Are the Best Learning Content Management System Software Suppliers?

| Company Name | Location | Years Operating | Staff | Development Team | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|

Performance Analysis

Due to the absence of specific supplier data, procurement decisions must rely on independent verification of technical credentials and client references. Historically, long-established vendors demonstrate stronger scalability in multi-tenant environments, while newer entrants often achieve higher customer satisfaction through responsive support and modern UX design. Geographic proximity can enhance collaboration efficiency, particularly for iterative customization projects requiring frequent stakeholder feedback. Prioritize suppliers with documented experience in your industry vertical—education, healthcare, and financial services each impose unique regulatory and functional requirements. Always verify claims of AI-driven personalization, analytics dashboards, or SCORM compliance through live demonstrations or sandbox access.

FAQs

How to verify LCMS software supplier reliability?

Request audit trails of past deployments, including client testimonials with verifiable contact details. Confirm participation in recognized software alliances or open-source communities (e.g., IMS Global). Evaluate transparency in incident reporting, update cycles, and vulnerability patching.

What is the average implementation timeline?

Standard LCMS deployment ranges from 8 to 14 weeks, depending on integration complexity. Custom feature development extends timelines by 4–8 weeks. Pilot systems with basic functionality can be provisioned in 2–3 weeks using pre-configured templates.

Can suppliers support global deployments?

Yes, most established vendors offer multi-language interfaces, regional data hosting options, and timezone-compatible support teams. Confirm CDN integration for low-latency content delivery across geographies and compliance with local data sovereignty laws.

Do vendors provide free trial or demo access?

Most suppliers offer time-limited trials (14–30 days) or hosted demo environments. Full sandbox access typically requires a signed NDA. Proof-of-concept engagements may incur setup fees, refundable upon contract execution.

How to initiate customization requests?

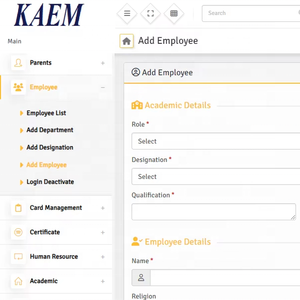

Submit detailed functional specifications including user role hierarchies, assessment engines, branding requirements, and integration endpoints (e.g., SSO via SAML/OAuth). Reputable suppliers deliver wireframes within 5 business days and initial prototypes within 3 weeks.