Learning Lms Software

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/7

1/7

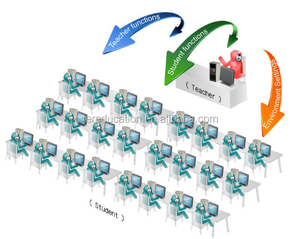

About learning lms software

Where to Find Learning LMS Software Suppliers?

The global market for learning LMS (Learning Management System) software is highly decentralized, with leading development hubs concentrated in North America, Western Europe, and select technology clusters in Asia. Unlike hardware manufacturing, LMS software production relies on skilled IT workforces and agile development ecosystems rather than physical industrial zones. The United States accounts for over 40% of enterprise-grade LMS platforms, driven by Silicon Valley’s innovation pipeline and strong venture capital investment in edtech. India and Eastern Europe have emerged as competitive outsourcing centers, offering cost-efficient development teams with expertise in cloud-native architectures and SCORM/xAPI compliance.

These regions support rapid product iteration through mature DevOps pipelines, scalable cloud infrastructure integration (AWS, Azure), and access to certified instructional designers. Buyers benefit from flexible engagement models—ranging from full-platform licensing to white-label SaaS solutions—with average deployment cycles of 2–6 weeks for standard implementations. Key advantages include reduced development costs (up to 50% lower in offshore hubs compared to U.S.-based vendors), modular customization, and API-first design enabling seamless integration with HRIS, CRM, and video conferencing systems.

How to Choose Learning LMS Software Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Confirm adherence to recognized e-learning standards including SCORM 1.2/2004, xAPI (Tin Can API), AICC, and LTI (Learning Tools Interoperability). For regulated industries (healthcare, finance, government), demand ISO 27001 certification for information security management and GDPR/CCPA compliance for data privacy. Verify SOC 2 Type II reports where applicable to assess system availability, processing integrity, and confidentiality controls.

Development Capability Audits

Evaluate technical infrastructure and team composition:

- Minimum 20+ full-time developers with documented experience in microservices and RESTful APIs

- Dedicated QA teams conducting automated testing across browsers and devices

- In-house instructional design or partnerships with accredited e-learning content providers

Cross-reference uptime SLAs (target ≥99.9%) with third-party monitoring tools and customer references to validate performance claims.

Transaction Safeguards

Require contractual service level agreements covering support response times (ideally ≤4 hours for critical issues), data ownership clauses, and exit provisions for source code handover. Assess vendor stability through financial history reviews and contract renewal rates. Pilot deployments with sandbox environments are essential—test user onboarding, reporting accuracy, and mobile responsiveness before full rollout.

What Are the Best Learning LMS Software Suppliers?

No supplier data available for learning LMS software at this time.

Performance Analysis

In absence of specific supplier profiles, procurement focus should remain on functional capability, compliance depth, and architectural flexibility. Leading vendors typically distinguish themselves through high reorder or renewal rates (>60%), sub-4-hour support response windows, and demonstrated scalability (supporting 10,000+ concurrent users). Prioritize suppliers with transparent roadmaps, regular feature updates (quarterly minimum), and proven export experience in multinational deployments involving multi-language, multi-currency, and regional data residency requirements.

FAQs

How to verify learning LMS software supplier reliability?

Audit compliance documentation including security certifications, penetration test results, and third-party audit trails. Request case studies with verifiable client outcomes focusing on adoption rates, completion metrics, and post-implementation support efficacy. Validate cloud hosting configurations and disaster recovery protocols.

What is the average implementation timeline?

Standard LMS deployment ranges from 14 to 45 days depending on integration complexity. Basic setups with pre-built templates take 2–3 weeks. Full customizations involving single sign-on (SSO), legacy system migration, or bespoke content development extend to 8–10 weeks.

Can LMS software suppliers support global deployments?

Yes, established vendors offer multi-region hosting, localized UI/UX support (20+ languages), and compliance with international data sovereignty laws (e.g., GDPR, PIPL). Confirm CDN usage and latency benchmarks for distributed user bases.

Do suppliers provide free trials or pilot programs?

Most vendors offer time-limited trial environments (typically 14–30 days) with full functionality. Some waive setup fees for pilot programs tied to confirmed enterprise contracts. Expect data migration and training services to be billed separately beyond basic onboarding.

How to initiate customization requests?

Submit detailed functional specifications including user role hierarchies, assessment types (quizzes, simulations, certifications), branding guidelines, and integration endpoints. Reputable suppliers deliver wireframes within 5 business days and MVP builds within 3–5 weeks for scoped modules.