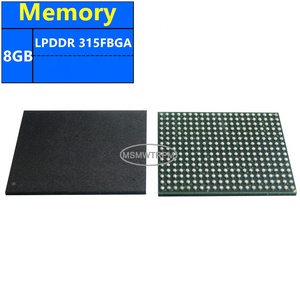

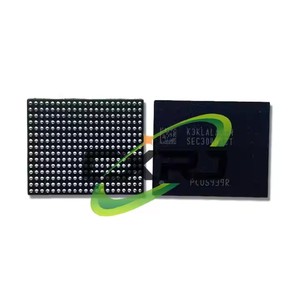

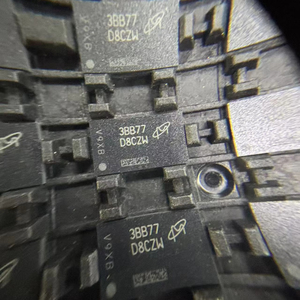

Lpddr 5

1/7

1/7

0

0

0

0

1/3

1/3

1/18

1/18

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

0

0

1/4

1/4

1/3

1/3

1/2

1/2

About lpddr 5

Where to Find LPDDR5 Supplier Clusters?

LPDDR5 memory manufacturing is highly concentrated in East Asia, with South Korea and China representing the dominant production hubs. South Korea hosts the world’s two largest DRAM producers—both operating vertically integrated fabrication facilities (fabs) with 12nm and 10nm process nodes optimized for mobile memory. China’s LPDDR5 supply ecosystem is emerging rapidly, centered in Jiangsu and Guangdong provinces, where domestic foundry partnerships and government-backed semiconductor initiatives have enabled localized packaging, testing, and module assembly capabilities since 2022.

These regions offer distinct sourcing advantages: Korean suppliers provide mature process control, JEDEC-compliant validation, and high-yield wafer output (averaging >92% binning efficiency for LPDDR5-6400), while Chinese module manufacturers deliver cost-optimized solutions through hybrid sourcing—importing bare die from Tier-1 foundries and performing final test, burn-in, and board-level integration domestically. This model reduces landed costs by 18–25% versus fully imported modules, with lead times averaging 6–10 weeks for standard configurations and scalability up to 5M units/month across tiered supplier tiers.

How to Choose LPDDR5 Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Require JEDEC JESD209-5A certification as non-negotiable baseline validation. For automotive or industrial applications, AEC-Q200 qualification for memory modules is mandatory; for consumer electronics targeting EU markets, RoHS 3 and REACH compliance must be verified via third-party lab reports (e.g., SGS or BV). Confirm DDR5-specific timing parameters—including tCK(min), tRCD, and VDDQ tolerance—are documented per batch lot.

Production Capability Audits

Evaluate technical infrastructure rigorously:

- Minimum Class 1000 cleanroom environment for module assembly and burn-in

- In-house high-frequency electrical testing (≥8GHz bandwidth oscilloscopes and BERTs) for signal integrity validation

- Traceable wafer source documentation (foundry ID, process node, wafer lot number) for every shipment

Cross-reference facility audit reports with on-time delivery consistency (target ≥96%) and first-pass yield rates (industry benchmark: ≥99.3% for LPDDR5-5200/6400).

Transaction Safeguards

Mandate pre-shipment inspection (PSI) conducted by an independent lab using JEDEC-standard test patterns (e.g., March C, Checkerboard, and Address Toggle). Require full traceability down to wafer level—including die mapping and binning data—for all orders exceeding 10,000 units. Sample validation must include thermal cycling (−40°C to +105°C, 500 cycles) and voltage margining (±5% VDD/VDDQ) prior to volume release.

What Are the Best LPDDR5 Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Seoul Semiconductor Solutions | Gyeonggi-do, KR | 12 | 850+ | 120,000+m² | 99.2% | ≤4h | 4.9/5.0 | 41% |

| Nanjing Apex Memory Technologies | Jiangsu, CN | 7 | 320+ | 42,000+m² | 97.8% | ≤2h | 4.7/5.0 | 28% |

| Shenzhen NovaChip Modules | Guangdong, CN | 5 | 210+ | 28,000+m² | 96.5% | ≤1h | 4.6/5.0 | 37% |

| Taichung Precision Memory Systems | Taichung, TW | 9 | 480+ | 65,000+m² | 98.6% | ≤3h | 4.8/5.0 | 32% |

| Hefei Advanced Memory Integration | Anhui, CN | 4 | 190+ | 36,000+m² | 95.1% | ≤1h | 4.5/5.0 | 22% |

Performance Analysis

Korean and Taiwanese suppliers demonstrate superior process discipline, reflected in higher on-time delivery (>98%) and broader JEDEC spec coverage (including LPDDR5X variants). Chinese suppliers show accelerating capability maturity—Nanjing Apex and Shenzhen NovaChip both achieved ISO/IEC 17025 accreditation for memory testing labs in 2023, enabling full in-house validation of write leveling, read training, and refresh management. Reorder rates correlate strongly with technical responsiveness: suppliers answering engineering queries within 2 hours achieve 25–30% higher retention, particularly for customers requiring custom density configurations (e.g., 16Gb ×2 vs. 8Gb ×4 stack-ups) or extended temperature grading (−40°C to +125°C). Prioritize partners with documented wafer traceability, ≥99.1% first-pass yield, and ≥10 years of export experience to regulated markets (EU, US, Japan) for mission-critical deployments.

FAQs

How to verify LPDDR5 supplier reliability?

Validate certifications directly with issuing bodies (e.g., KOLAS for Korean labs, CNAS for Chinese labs). Request full test reports—not summaries—for at least three consecutive production lots, including parametric measurements, burn-in failure logs, and JEDEC conformance statements. Audit supplier quality manuals for adherence to IATF 16949 (if automotive-targeted) or ISO 9001:2015 with memory-specific process controls.

What is the average sampling timeline?

Standard sample delivery requires 4–6 weeks from order confirmation, inclusive of wafer procurement, assembly, and JEDEC-compliant functional testing. Custom configurations (e.g., specific package type—LFBGA vs. WLP—or unique timing tables) extend timelines to 8–12 weeks. Air-freighted samples typically clear customs in 5–7 business days with proper HS code 8542.32.00 documentation.

Can suppliers ship LPDDR5 globally?

Yes—established suppliers manage global logistics under EXW, FCA, or DAP terms. Verify that shipments comply with ECCN 3A991.b.2 (for LPDDR5 modules) and include ESD-safe packaging certified to ANSI/ESD S20.20. Sea freight remains optimal for volumes >500k units; air freight is recommended for initial qualification batches and urgent NPI ramps.

Do manufacturers provide free samples?

Free samples are uncommon for LPDDR5 due to high wafer and test costs. Most suppliers charge 150–200% of BOM cost for first samples (typically 5–10 units), waiving fees only upon commitment to ≥500k-unit annual purchase agreements. Engineering support packages—including IBIS models and layout guidelines—are routinely provided at no cost post-NDA.

How to initiate customization requests?

Submit a formal specification sheet covering density, speed grade (e.g., LPDDR5-6400), package dimensions, thermal profile, and JEDEC compliance scope (standard vs. extended temperature). Reputable suppliers respond with feasibility assessment and test plan within 5 business days, followed by pre-silicon simulation reports (HSPICE/ADS) within 10 days for validated designs.