Markdown Editor Online

1/4

1/4

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

1/3

1/3

1/6

1/6

0

0

1/3

1/3

0

0

1/2

1/2

CN

CN

1/3

1/3

0

0

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

About markdown editor online

Where to Find Markdown Editor Online Suppliers?

The global market for online markdown editor software solutions is primarily driven by specialized software development firms based in China and India, with emerging clusters in Sichuan Province (China) and Tamil Nadu (India). These regions host a growing number of tech-focused suppliers offering ready-made, customizable web-based tools targeting SMEs, developers, and digital agencies. Chengdu, in particular, has evolved into a regional technology hub, supporting IT exporters with streamlined logistics and access to engineering talent.

Suppliers in this category typically operate as boutique software houses or digital service providers, delivering lightweight applications with modular functionality. Their competitive advantage lies in low overhead structures and agile development cycles, enabling rapid deployment of code-editing tools integrated with cloud storage, preview rendering, and collaboration features. Buyers benefit from short development lead times—often 7–14 days for customized versions—and flexible licensing models including one-time purchases and subscription-based access.

How to Choose Markdown Editor Online Suppliers?

Selecting reliable partners requires due diligence across technical capability, transaction history, and service scope:

Product Validation

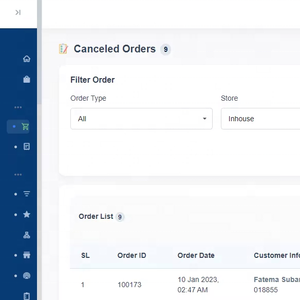

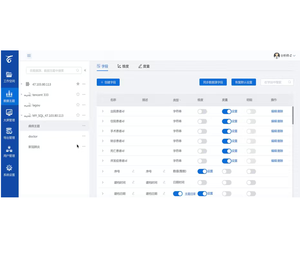

Assess whether listed products are standalone software tools or part of broader digital service offerings. Many suppliers categorize general web development or content management systems under "markdown editor, online," which may not meet specific functional requirements such as real-time preview, syntax highlighting, or export-to-PDF capabilities. Request live demos or trial access to verify feature alignment.

Development Capacity Assessment

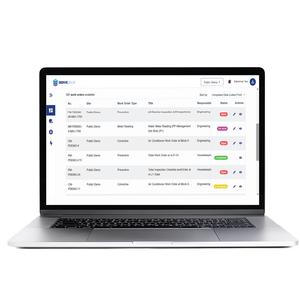

Evaluate supplier infrastructure through available metrics:

- Minimum 50+ software listings indicating active development pipeline

- Dedicated R&D teams confirmed via company profiles or video tours

- Support for customization (e.g., branding, UI adjustments, API integration)

Cross-reference response times (target ≤5 hours) and on-time delivery records where available to gauge operational reliability.

Transaction Safeguards

Prioritize suppliers with verifiable revenue histories and responsive communication channels. Use secure payment mechanisms such as escrow services when procuring high-value licenses. For bulk orders or white-label agreements, insist on source code ownership clauses and post-delivery technical support terms. Independent testing of delivered software remains critical—validate performance across devices and browsers before final acceptance.

What Are the Best Markdown Editor Online Suppliers?

| Company Name | Location | Main Products (Listings) | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Chengdu Chexinwang Electronic Technology Co., Ltd. | Sichuan, CN | Software, ECU Tools, Diagnostics | US $180,000+ | 99% | ≤2h | 17% | 1 piece | $4 – $25.99 |

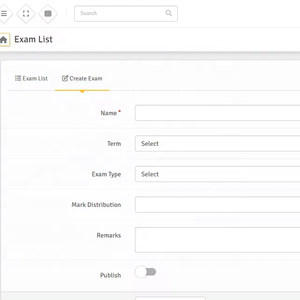

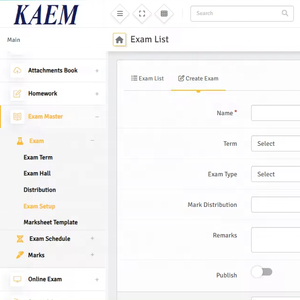

| KAEM SOFTWARES PRIVATE LIMITED | Tamil Nadu, IN | Software (1,284) | US $8,000+ | - | ≤2h | - | 1–2 units | $95 |

| 2DIGIT INNOVATIONS PRIVATE LIMITED | Karnataka, IN | Software (732) | - | - | ≤4h | - | 1 piece | $950 – $2,550 |

| WEB CARE MEDIA | Rajasthan, IN | Software (398), Plastic Printing | - | - | ≤5h | - | 2 pieces | $90 – $2,000 |

| KAEIZO SOLUTION | Gujarat, IN | Software (51), Serving Trays | - | - | ≤20h | - | 2 units | $98.50 |

Performance Analysis

Chengdu Chexinwang stands out with the highest reported online revenue (US $180,000+) and a proven 99% on-time delivery rate, suggesting strong operational discipline. Its product range includes lower-cost utilities priced from $4, suitable for entry-level procurement. KAEM SOFTWARES leads in scale with over 1,200 software listings and sub-2-hour response times, positioning it well for bulk buyers seeking responsiveness. Indian suppliers dominate higher-ticket offerings, with 2DIGIT INNOVATIONS listing enterprise-grade packages exceeding $2,500, indicating specialization in comprehensive web platforms rather than standalone editors. WEB CARE MEDIA offers mid-tier pricing with consistent $90–$100 quotes across multiple listings, reflecting standardized packaging. KAEIZO SOLUTION, while slower in response, maintains uniform pricing at $98.50 across products, suggesting automated fulfillment processes.

FAQs

How to verify markdown editor online supplier reliability?

Cross-check declared revenues and order volumes against platform activity. Analyze customer reviews focusing on software stability, update frequency, and post-purchase support. Verify claims of customization capability through direct inquiries requiring technical documentation or workflow diagrams.

What is the average lead time for custom markdown editors?

Standard configurations are typically delivered within 3–7 days. Custom builds with branded interfaces or extended functionality require 10–15 days, depending on complexity. Add 2–3 days for secure delivery of license keys or installation packages.

Can suppliers provide source code access?

Source code availability varies. Some suppliers offer full source code transfer for premium licenses, while others restrict access to compiled versions. Clarify intellectual property rights and redistribution permissions prior to purchase, especially for reseller or white-label use cases.

Do suppliers support multi-language or collaborative editing?

Limited data suggests that advanced features like real-time collaboration or multi-language UI are not standard. Buyers must explicitly request these capabilities and confirm implementation through pre-purchase testing. Most entries appear to be single-user desktop or web applications without team-sharing functions.

How to negotiate better pricing for bulk orders?

Leverage volume commitments—suppliers like WEB CARE MEDIA and KAEM SOFTWARES quote per-unit prices below $100 for two or more units, indicating willingness to discount. For orders exceeding 10 licenses, propose long-term maintenance contracts to increase bargaining power and secure priority support.