Mashing Machine Producer

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

CN

CN

1/10

1/10

1/3

1/3

1/15

1/15

1/3

1/3

1/3

1/3

1/8

1/8

1/18

1/18

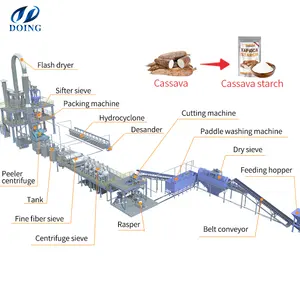

About mashing machine producer

Where to Find Mashing Machine Producers?

China remains a central hub for mashing machine production, with key manufacturing clusters in Shandong and Henan provinces driving industrial output. These regions host vertically integrated facilities specializing in food, feed, and chemical processing equipment, leveraging localized supply chains for stainless steel, motors, and precision components. Shandong’s Laizhou and Qingdao zones focus on commercial-grade mixing systems, while Henan’s Zhengzhou corridor supports high-volume fabrication of agricultural and food processing machinery.

The concentration of engineering talent and component suppliers within 50km radii enables rapid prototyping and scalable production. Facilities typically operate automated CNC lines, welding bays, and polishing stations to produce hygienic, durable mashing units compliant with international material standards. Buyers benefit from lead times averaging 20–35 days for standard configurations, with cost advantages of 25–40% over equivalent Western-manufactured equipment due to lower labor and material overheads.

How to Choose Mashing Machine Producers?

Selecting reliable producers requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Compliance & Material Standards

Verify use of food-grade stainless steel (typically SS304 or SS316) for contact surfaces, especially for food, dairy, or pharmaceutical applications. Demand documentation for surface finish (Ra ≤ 0.8μm recommended), weld integrity, and motor IP ratings (IP55 or higher for washdown environments). While explicit ISO 9001 certification is not visible in all supplier profiles, prioritize vendors demonstrating quality control via on-time delivery records and repeat order performance.

Production Capability Assessment

Evaluate infrastructure indicators such as factory scale, customization capacity, and response efficiency:

- Minimum facility size of 3,000m² to support batch production

- In-house engineering teams capable of adapting impeller design, tank geometry, and drive systems

- Customization options including volume (50L–2000L), speed control, vacuum operation, and CIP integration

Cross-reference product listings with response time metrics—suppliers answering within ≤1 hour demonstrate higher operational responsiveness.

Transaction Risk Mitigation

Utilize secure payment mechanisms such as escrow services to align payment milestones with delivery and inspection. Analyze reorder rates as a proxy for customer satisfaction; rates above 30% indicate consistent performance. Request sample units to validate build quality, sealing efficiency, and homogenization effectiveness before full-scale procurement.

What Are the Leading Mashing Machine Producers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Price Range (Min Order) |

|---|---|---|---|---|---|---|---|

| Laizhou Chenda Chemical Machinery Co., Ltd. | Shandong, CN | Mixing Equipment, Reactors, Grinding Machines | US $1,000+ | 100% | ≤1h | - | $1,500–2,500 (1 set) |

| KESHAV ENGINEERING | Gujarat, IN | Mixing Equipment, Drying Systems, Pressure Vessels | - | - | ≤2h | - | $1,047.52 (1 unit) |

| G S INTERNATIONAL | Haryana, IN | Feed Processing, Wood Pellet Mills, Grinders | - | - | ≤5h | - | $1,280–6,650 (1 set) |

| Zhengzhou Taizy Trading Co., Ltd. | Henan, CN | Potato Crushers, Dairy Processors, Pasta Lines | US $20,000+ | 100% | ≤3h | 33% | $2,500–12,000 (1 set) |

| strong machinery LLC | Hebei, CN | Vegetable Mashers, Garlic Grinders, Feed Processors | - | - | ≤4h | - | $1,400–4,500 (1 set) |

Performance Analysis

Laizhou Chenda and Zhengzhou Taizy exhibit strong operational reliability with 100% on-time delivery and verified online revenue, indicating consistent export experience. Zhengzhou Taizy further distinguishes itself with a 33% reorder rate and broad customization capabilities in color, material, and labeling. Indian-based producers like KESHAV ENGINEERING offer competitive pricing but lack verifiable delivery and reorder metrics, increasing procurement risk. Chinese suppliers dominate responsiveness, with three of five achieving sub-3-hour average reply times. For high-volume contracts, prioritize manufacturers with documented quality assurance processes and stainless steel fabrication expertise.

FAQs

What materials are used in mashing machine construction?

Most industrial mashing machines use SS304 or SS316 stainless steel for tanks and blades to ensure corrosion resistance and food safety. Seals are typically silicone or EPDM-rated for temperature and chemical stability. Frame structures may use carbon steel with powder coating for durability.

What is the typical minimum order quantity (MOQ)?

The standard MOQ is 1 set across listed suppliers, enabling low-risk sampling and pilot testing. Bulk orders often unlock unit price reductions, particularly for customized configurations exceeding 5 sets.

How long does production and shipping take?

Manufacturing lead time ranges from 15–30 days depending on complexity and customization level. Sea freight to North America or Europe adds 25–40 days. Air shipment reduces transit to 5–10 days but increases cost significantly for heavy machinery.

Can mashing machines be customized for specific applications?

Yes, leading producers offer adaptations in capacity, motor power, mixing speed, vacuum functionality, and discharge mechanism. Custom branding, voltage specifications (e.g., 380V/50Hz vs. 220V/60Hz), and control panel interfaces are commonly available.

Do suppliers provide technical support and after-sales service?

Support varies by supplier. Verified vendors with high reorder rates typically offer remote troubleshooting, operational manuals, and spare parts supply. For critical installations, negotiate extended warranties or on-site commissioning assistance where feasible.