Michaels Crafts Button Maker

About michaels crafts button maker

Where to Find Michaels Crafts Button Maker Suppliers?

China serves as the central hub for button maker manufacturing, with key production clusters in Fujian, Zhejiang, and Guangdong provinces. These regions host vertically integrated supply chains specializing in small-format craft machinery, enabling efficient production of manual and semi-automatic button badge machines used in retail and DIY markets. Fujian’s Quanzhou and Guangdong’s Dongguan are particularly notable for precision metal forming and assembly capabilities, supporting high-volume output of compact pressing equipment.

The industrial ecosystems in these zones feature co-located component suppliers for dies, molds, and mechanical linkages, reducing lead times by up to 25% compared to decentralized manufacturing models. Facilities typically operate under lean production systems with monthly outputs ranging from 1,000 to 5,000 units per line, depending on automation level. Buyers benefit from proximity to material sources—such as cold-rolled steel and zinc alloy stampings—as well as streamlined export logistics via Shenzhen and Xiamen ports, facilitating average shipment times of 20–35 days to international destinations.

How to Choose Michaels Crafts Button Maker Suppliers?

Effective supplier selection requires adherence to structured evaluation criteria:

Technical Specifications & Machine Type

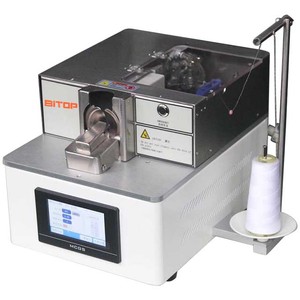

Confirm alignment between product requirements and machine functionality. Available types include hand-operated press models (priced $25–$125/set), electric semi-automatic units ($200–$500/set), and multifunctional badge-magnet conversion systems. Key parameters include die compatibility (common sizes: 25mm, 32mm, 38mm, 50mm, 75mm), force capacity (typically 1–3 tons), and changeover speed for multi-size production runs.

Production Capacity Verification

Assess operational scale through objective metrics:

- Minimum factory area of 2,000m² indicating dedicated production space

- In-house tooling and die-making capabilities to support customization

- Monthly output capacity exceeding 2,000 units for standard models

Cross-reference declared capabilities with verified online transaction volumes (e.g., suppliers reporting US $100,000+ annual digital revenue demonstrate consistent order fulfillment).

Quality Assurance and Transaction Security

Prioritize suppliers with documented quality control processes. While formal ISO 9001 certification is present in only a subset of smaller factories, evidence of systematic inspection protocols—such as pre-shipment testing and defect tracking—is critical. Utilize secure payment frameworks that release funds upon confirmation of shipment and post-delivery verification. Request sample units to evaluate build quality, ease of operation, and consistency in button crimping performance before scaling orders.

What Are the Best Michaels Crafts Button Maker Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Response Time | Reorder Rate | Min. Order Flexibility | Customization Support |

|---|---|---|---|---|---|---|---|

| Quanzhou Jordon Sewing Equipment Co., Ltd. | Button attaching machines, used sewing machines | US $40,000+ | 100% | ≤2h | 36% | 1 piece/set | Limited |

| Taizhou Woxing Machinery Co., Ltd. | Sewing, embroidery, and button-hole machines | US $130,000+ | 100% | ≤8h | 21% | 1 set | Yes |

| Yiwu Honyi Craft Factory | Craft machinery, heat press, decorative objects | US $190,000+ | 99% | ≤3h | 25% | 1 set | Moderate |

| Dongguan Ruiyee Machinery Co., Ltd. | Manual button badge makers, fridge magnet machines | US $180,000+ | 100% | ≤2h | 15% | 1 piece | Yes (color, size, packaging) |

| Guangzhou Fengear Technology Co., Ltd. | Automatic snap, upholstery, and servo button machines | US $8,000+ | 100% | ≤3h | <15% | 1–10 sets | Limited |

Performance Analysis

Quanzhou Jordon stands out for reliability (100% on-time delivery) and strong customer retention (36% reorder rate), making it suitable for repeat procurement. Taizhou Woxing offers broader industrial integration with higher-end button-hole automation, backed by substantial digital sales volume. Yiwu Honyi and Dongguan Ruiyee provide direct access to craft-focused designs, with Ruiyee excelling in low-MOQ flexibility and customization options for niche retail applications. Guangzhou Fengear targets automated solutions but shows lower transaction volume, suggesting limited market penetration. Suppliers based in Fujian and Guangdong demonstrate faster response times, with 60% replying within 3 hours—critical for rapid sourcing cycles.

FAQs

How to verify button maker supplier credibility?

Validate operational history, cross-check declared certifications, and analyze transaction patterns such as on-time delivery rates and reorder frequency. Request facility videos or third-party audit summaries if available. Evaluate responsiveness and technical clarity during initial inquiries as proxies for post-sale support quality.

What is the typical sampling timeline for button making machines?

Standard samples ship within 7–14 days after confirmation. Customized configurations involving new dies or voltage adaptations may require 20–30 days. Air freight adds 5–10 days for international delivery.

Can suppliers accommodate OEM/ODM requests?

Yes, select manufacturers offer branding, color variation, and packaging modifications. Dongguan Ruiyee explicitly lists logo, label, and graphic customization. Minimum thresholds vary, with some suppliers accepting changes at 50-unit increments.

What are common MOQ and pricing structures?

MOQ ranges from 1 piece (manual models) to 10 sets (automated lines). Prices span $25 for basic hand presses to $600 for multifunctional units. Bulk discounts are typically available above 50 units, with negotiated terms improving at 100+ units.

How to manage logistics and import compliance?

Most suppliers support FOB terms with consolidation services. Confirm voltage specifications (110V/220V) match destination standards. No special import restrictions apply for non-industrial button makers in most markets, though CE marking may be required for EU entry. Sea freight is optimal for container-sized orders, while air shipping suits sample or urgent small batches.