Microcontrollers For Iot

1/7

1/7

1/2

1/2

1/2

1/2

1/3

1/3

1/3

1/3

0

0

0

0

1/3

1/3

1/3

1/3

0

0

1/17

1/17

1/3

1/3

1/3

1/3

1/18

1/18

1/2

1/2

1/31

1/31

0

0

0

0

1/3

1/3

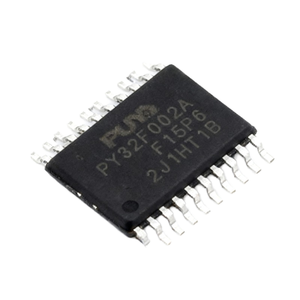

About microcontrollers for iot

Where to Find Microcontrollers for IoT Suppliers?

China leads global production of microcontrollers for IoT applications, with concentrated manufacturing hubs in Guangdong and Jiangsu provinces. Guangdong, particularly the Shenzhen-Dongguan corridor, hosts over 70% of China’s semiconductor packaging and testing facilities, supported by proximity to design centers and rapid prototyping services. Jiangsu’s Suzhou and Wuxi regions specialize in wafer fabrication and advanced IC assembly, leveraging state-subsidized cleanroom infrastructure and integration with domestic foundries like SMIC and Hua Hong.

These clusters enable streamlined supply chains—encompassing silicon sourcing, die bonding, molding, and final testing—within tightly coordinated industrial zones. Proximity to Tier-1 component suppliers reduces material lead times by 25–40% compared to offshore alternatives. Buyers benefit from scalable production ecosystems capable of fulfilling orders ranging from 1,000 units for R&D validation to multi-million-unit volumes for mass deployment. Typical advantages include 18–22% lower unit costs due to localized materials and labor efficiency, lead times of 4–6 weeks for standard configurations, and strong flexibility in firmware integration and pinout customization.

How to Choose Microcontrollers for IoT Suppliers?

Adhere to these verification benchmarks when evaluating potential partners:

Quality & Compliance Verification

Confirm adherence to ISO 9001 for quality management systems and IATF 16949 if targeting automotive-grade IoT devices. For markets in Europe and North America, RoHS, REACH, and CE compliance are mandatory for environmental safety and customs clearance. Request test reports for ESD protection (HBM ≥2kV), operating temperature range (-40°C to +85°C minimum), and power consumption under active/sleep modes.

Production Capacity Assessment

Evaluate core manufacturing capabilities:

- Minimum 3,000m² cleanroom facility with Class 10,000 or better rating

- In-house wire bonding and mold pressing equipment for packaging control

- Automated optical inspection (AOI) and burn-in testing lines

Validate monthly output capacity of at least 500,000 units and traceability systems (lot number tracking) to ensure consistency across batches.

Technical & Transaction Safeguards

Require access to product datasheets, SDKs, and reference designs prior to sampling. Use third-party escrow services for initial transactions until functional validation is completed. Prioritize suppliers with documented export experience to your target region—especially those familiar with UL, FCC, or ETSI regulatory frameworks. Conduct sample testing against IPC-A-610 standards for solder joint integrity and JEDEC J-STD-020 for moisture sensitivity level (MSL) classification.

What Are the Best Microcontrollers for IoT Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Supplier data not currently available. Verify manufacturers through industry registries, trade exhibitions (e.g., Electronica China), or government-certified export directories. | ||||||||

Performance Analysis

While specific supplier metrics are unavailable, leading manufacturers typically demonstrate on-time delivery rates exceeding 97%, supported by dual-source wafer supply agreements and redundant packaging lines. High-performing vendors maintain technical teams comprising 15% or more of total staff, enabling rapid firmware adaptation and co-design support. Reorder rates above 30% often correlate with robust post-sales engineering assistance and long-term availability guarantees (10+ years lifecycle support). Prioritize partners offering AEC-Q100 qualification paths and secure boot/OTA update capabilities for next-generation IoT deployments.

FAQs

How to verify microcontroller supplier reliability?

Cross-validate certifications with accredited bodies such as SGS or TÜV. Request audit trails covering raw material sourcing (e.g., silicon wafers from MEMC or SUMCO), lot traceability records, and failure rate data (PPM levels below 500). Assess customer feedback focusing on yield stability and technical documentation accuracy.

What is the average sampling timeline?

Standard samples take 10–18 days to produce, depending on wafer availability and test cycle duration. Custom variants requiring mask changes or unique package forms may require 35–50 days. Air freight adds 5–8 days for international delivery.

Can suppliers ship microcontrollers worldwide?

Yes, experienced exporters manage global logistics via DHL, FedEx, or sea freight for bulk consignments. Confirm Incoterms (FOB Shenzhen recommended) and ensure compliance with destination regulations regarding static-sensitive electronic components and import tariffs on integrated circuits.

Do manufacturers provide free samples?

Sample policies vary by volume commitment. Many suppliers offer 1–5 free units for qualified engineering evaluations when followed by a pilot order. For non-standard parts, expect partial cost recovery charges covering packaging and testing expenses.

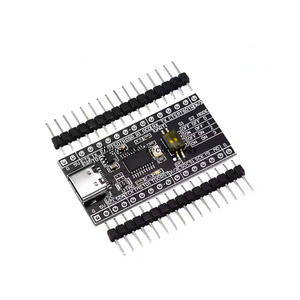

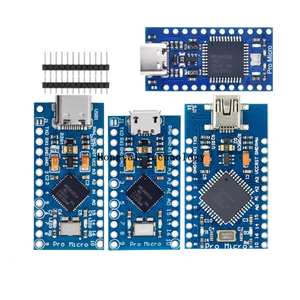

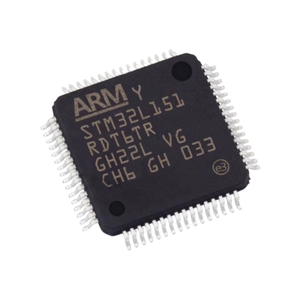

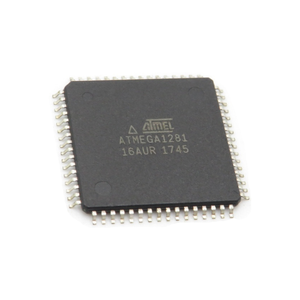

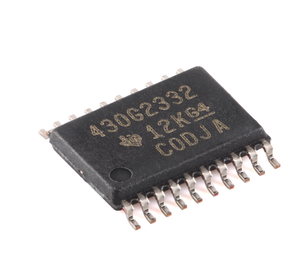

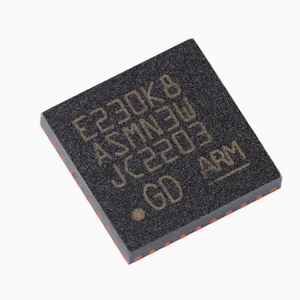

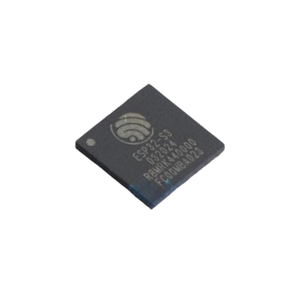

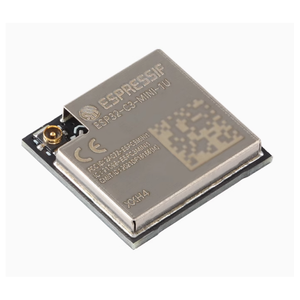

How to initiate customization requests?

Submit detailed requirements including core architecture (ARM Cortex-M0+/M4, RISC-V), flash/RAM specifications, peripheral set (UART, SPI, I2C, BLE, LoRa), package type (QFN, LGA, BGA), and operating voltage. Leading vendors deliver simulation models and layout guidelines within 72 hours and prototypes within 4–5 weeks.