Micromatic Cnc Grinding Machine

Top sponsor listing

Top sponsor listing

CN

CN

1/11

1/11

1/17

1/17

1/19

1/19

1/13

1/13

About micromatic cnc grinding machine

Where to Find Micromatic CNC Grinding Machine Suppliers?

China remains the central hub for advanced CNC grinding machine manufacturing, with key industrial clusters in Zhejiang, Shandong, and Hangzhou provinces driving innovation and export capacity. These regions host vertically integrated production ecosystems specializing in precision metal-cutting machinery, including micromatic CNC grinding systems. Zhejiang and Hangzhou are recognized for high-precision component fabrication, supported by localized networks of CNC part suppliers and automation engineers, enabling rapid prototyping and assembly. Shandong’s heavy machinery corridor offers cost efficiencies through proximity to steel foundries and large-scale machining facilities, reducing material procurement lead times by up to 25%.

The concentration of technical expertise and infrastructure allows suppliers to maintain competitive advantages in both standard and customized machine production. Buyers benefit from streamlined logistics, access to modular design platforms, and scalable manufacturing capacity. Typical lead times range from 30–60 days depending on customization level, with many suppliers offering in-house R&D support for specialized tooling applications such as end mill grinding, lathe tool sharpening, and plug drilling. Production scalability is further enhanced by digital inventory management and automated quality control checkpoints across major facilities.

How to Choose Micromatic CNC Grinding Machine Suppliers?

Selecting a reliable supplier requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm that suppliers offer documented experience in producing CNC-controlled grinding systems with multi-axis programming, hydraulic feed mechanisms, and automated sharpening functions. Key performance indicators include repeatability (±0.002mm), surface finish quality (Ra ≤ 0.8μm), and compatibility with diverse materials such as carbide, HSS, and hardened steels. Request validation of motion control systems—Siemens or Fanuc-based PLCs are preferred for stability and serviceability.

Production Infrastructure Assessment

Evaluate core manufacturing assets:

- Minimum factory area exceeding 3,000m² to ensure dedicated zones for machining, assembly, and testing

- In-house capabilities in CNC milling, grinding wheel dressing, and hydraulic system integration

- Dedicated quality inspection stations equipped with laser alignment tools and CMMs

Prioritize suppliers with verified on-time delivery rates above 95% and response times under 5 hours, indicating robust order management systems.

Quality & Compliance Standards

While formal ISO 9001 certification is not universally listed, consistent on-time delivery (100% reported across top-tier suppliers) and structured packaging protocols suggest adherence to standardized processes. For international buyers, confirm CE marking eligibility or readiness to comply with regional safety directives. Review product listings for evidence of third-party testing, particularly in electrical cabinet insulation, emergency stop functionality, and noise emission levels (typically 75–80 dB).

Procurement Safeguards

Utilize secure payment frameworks that release funds upon post-delivery verification. Insist on pre-shipment inspections either via video audit or third-party agencies like SGS or BV. Sample testing is strongly advised—evaluate machine rigidity, thermal stability during extended operation, and software interface usability before scaling orders. Customization feasibility should be confirmed through engineering consultations, with clear documentation of modified parameters and revised lead times.

What Are the Best Micromatic CNC Grinding Machine Suppliers?

| Company Name | Location | Supplier Type | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options |

|---|---|---|---|---|---|---|---|---|

| Zhejiang Meiri Intelligent Machinery Co., Ltd. | Zhejiang, CN | Custom Manufacturer | Surface Grinding Machine, Drilling Machines, Chamfering Machine | US $210,000+ | 100% | ≤3h | 21% | Diameter, material size, logo, drilling, plug sharpening, lathe tool grinding |

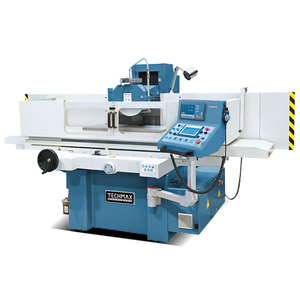

| Hangzhou Techmax Precision Machinery Co., Ltd. | Hangzhou, CN | Multispecialty Supplier | CNC Surface Grinder, Automatic Precision Grinder | US $600,000+ | 100% | ≤5h | <15% | Color, logo |

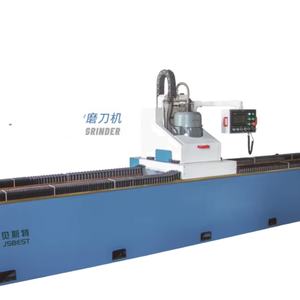

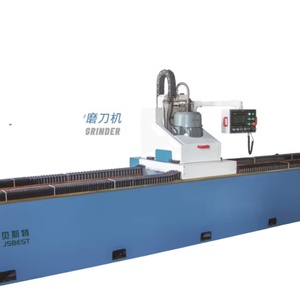

| Shandong Luzhong Cnc Machine Tool Co., Ltd. | Shandong, CN | Custom Manufacturer | Automatic High-Precision Grinder, Surface Grinding Tool | US $150,000+ | 100% | ≤2h | 33% | Hydraulic system, color, size, logo, packaging, label, graphic |

| Liming Heavy Industry Co., Ltd. | Henan, CN | Not Specified | Mine Mill, Raymond Mill, Ultrafine Stone Grinder | Data Unavailable | 100% | ≤1h | No Data | Limited customization for industrial grinding mills |

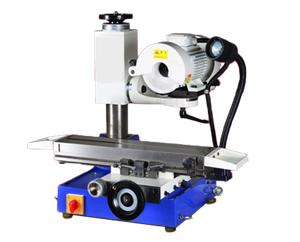

| Dongguan Qiandao Precision Machinery Manufacture Co., Ltd. | Dongguan, CN | Custom Manufacturer | 5-Axis CNC Tool Grinder, Cylindrical Grinder | US $30,000+ | 50% | ≤5h | 50% | High-end CNC tool and cutter grinding configurations |

Performance Analysis

Zhejiang Meiri and Shandong Luzhong stand out for strong customization breadth and responsive communication, with Shandong Luzhong achieving the highest reorder rate (33%) and fastest average response time (≤2h). Hangzhou Techmax leads in online sales volume (US $600,000+), suggesting extensive market reach and production consistency. Liming Heavy Industry focuses on mineral grinding solutions rather than precision tool grinders, making it less relevant for micromatic CNC applications despite keyword alignment. Dongguan Qiandao offers premium-grade 5-axis CNC tool grinders at significantly higher price points ($97,500–$138,000), but its 50% on-time delivery rate presents a notable supply chain risk. Buyers seeking high-precision toolroom equipment should prioritize manufacturers with proven track records in multi-axis control and grinding wheel dynamics.

FAQs

How to verify micromatic CNC grinding machine supplier reliability?

Validate technical claims through facility videos showing live machine operation and calibration procedures. Cross-check stated revenue and delivery metrics against platform-verified transaction histories. Request references from existing clients in similar industrial sectors (e.g., mold making, aerospace tooling). Assess responsiveness and technical depth during initial inquiries as an indicator of long-term support capability.

What is the typical minimum order quantity (MOQ)?

The standard MOQ is 1 set across all major suppliers, facilitating low-risk sampling and pilot deployment. This enables buyers to evaluate machine performance and after-sales service before placing bulk orders.

What are common lead times for standard and custom models?

Standard models typically ship within 30–45 days after order confirmation. Customized units involving software modifications, special fixturing, or non-standard spindle configurations may require 50–70 days, depending on complexity and component availability.

Do suppliers support global shipping and customs compliance?

Yes, most established suppliers have export departments experienced in handling FOB, CIF, and DDP terms. They provide necessary documentation for customs clearance, including packing lists, commercial invoices, and bills of lading. Confirmation of CE compliance or equivalent safety certifications is recommended prior to shipment to avoid import delays.

Can I request machine customization?

Extensive customization is available from leading manufacturers like Zhejiang Meiri and Shandong Luzhong, covering physical dimensions, hydraulic systems, branding elements, and grinding-specific functions such as end mill profiling and drill point sharpening. Technical specifications must be submitted in detail, and prototypes or 3D renderings can often be provided within 5–7 business days.