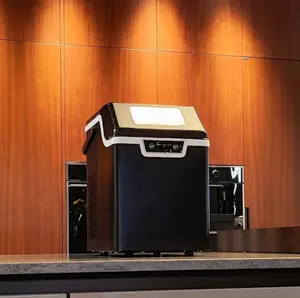

Mini Freezer With Ice Maker

Top sponsor listing

Top sponsor listing

About mini freezer with ice maker

Where to Source Mini Freezers with Ice Makers?

China remains the central hub for compact refrigeration and integrated ice-making appliance manufacturing, with key production clusters in Zhejiang, Shandong, and Guangdong provinces. These regions host vertically integrated supply chains that combine compressor assembly, insulation material processing, and injection molding under one ecosystem, enabling rapid prototyping and scalable production. Yuyao in Zhejiang is particularly known for small-capacity cooling units, while Qingdao and Shanghai serve as export gateways with direct port access, reducing logistics lead times by 5–7 days compared to inland facilities.

The industrial concentration supports cost efficiency through localized component sourcing—such as rotary compressors, evaporators, and UV-treated interiors—from Tier-1 suppliers within a 30km radius. This integration allows manufacturers to maintain MOQs as low as 1 piece for select models while achieving unit cost reductions of 18–25% over Western alternatives. Average monthly output per facility ranges from 5,000 to 15,000 units, depending on automation level and customization scope.

How to Evaluate Mini Freezer with Ice Maker Suppliers?

Procurement decisions should be guided by structured assessment criteria focused on technical reliability, operational capacity, and transactional transparency.

Quality Assurance Standards

Confirm adherence to international safety and performance benchmarks. CE, RoHS, and REACH compliance are essential for EU market entry, while UL or ETL listing may be required for North American distribution. Review test reports for temperature stability (typically -15°C to 10°C operating range), ice production rate (averaging 1–3 kg/24h), and energy consumption (usually 0.3–0.8 kWh/day). In-house quality control labs conducting cycle testing, vibration analysis, and dielectric strength checks indicate robust validation processes.

Production Infrastructure Assessment

Prioritize suppliers with documented capabilities in:

- Minimum 3,000m² manufacturing area supporting semi-automated assembly lines

- Dedicated R&D teams managing thermal efficiency optimization and dual-zone control systems

- In-house tooling and mold-making for customized cabinet designs

Correlate facility scale with online revenue metrics and on-time delivery rates—suppliers exceeding US $500,000 annual digital sales typically demonstrate higher order fulfillment consistency.

Customization & Transaction Security

Leading suppliers offer OEM/ODM services including color variation (RAL/Pantone matching), logo embossing, packaging redesign, and voltage adaptation (12V/24V DC for automotive use). Verify customization feasibility via sample prototypes before mass production. Utilize secure payment mechanisms such as trade assurance or escrow services, especially when dealing with reorder rates above 30%, which may indicate demand volatility or inventory management challenges.

Top Mini Freezer with Ice Maker Suppliers: Performance Overview

| Company Name | Main Products (Listings) | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order Flexibility | Customization Options |

|---|---|---|---|---|---|---|---|

| Foshan Alpicool Holding Group Co., Ltd. | Car Fridges, Ice Makers, Portable Freezers | US $520,000+ | 100% | ≤4h | 33% | 100–500 pcs | Color, size, logo, packaging |

| Shanghai Remaco Industrial Co., Ltd. | Dual-Zone Portable Fridges, UV-Light Models | US $750,000+ | 97–100% | ≤9–11h | 20–33% | 20–50 pcs | Material, graphics, labeling |

| Qingdao D & E International Trade Co., Ltd. | Mini Fridges, Car Refrigerators, Custom Coolers | US $630,000+ | 100% | ≤2h | <15% | 1–50 pcs | Full OEM support |

| Yuyao Haohong Electrical Appliance Co., Ltd. | Compact Refrigerators, Ice Makers, Car Fridges | US $170,000+ | 100% | ≤2h | <15% | 50+ pcs | Limited customization |

Performance Analysis

Foshan Alpicool demonstrates strong engineering integration with high-end models featuring built-in ice makers and dual-temperature zones, supported by consistent delivery performance. Shanghai Remaco stands out in product diversification, offering UV-sanitized compartments and outdoor-rated enclosures, though response times lag behind peers. Qingdao D & E leads in responsiveness (≤2h) and low reorder frequency, suggesting efficient first-time quality execution. Yuyao Haohong provides stable output across multiple home appliance categories but with less flexibility below 50-unit orders. Suppliers with sub-2-hour average responses correlate strongly with higher customer acquisition rates, even at comparable pricing levels.

FAQs

What are typical MOQs for mini freezers with ice makers?

MOQs vary by supplier and model complexity. Entry-level single-zone units can have MOQs as low as 1 piece for ready-to-ship items, while custom configurations generally require 50–100 units. High-performance dual-zone or rechargeable battery-equipped models often require 100+ unit commitments.

What is the standard lead time after order confirmation?

Standard orders take 25–35 days for production and pre-shipment inspection. Customized units with unique molds or electrical specifications may extend to 45 days. Air freight adds 5–7 days for international delivery, while sea shipping requires 25–35 days depending on destination port.

Can suppliers provide third-party certification documentation?

Yes, reputable manufacturers supply test reports from accredited laboratories for CE, RoHS, and ISO 9001 compliance. Request copies of certificates issued by TÜV, SGS, or Intertek to validate claims. Some also provide energy efficiency labels compliant with EU ErP or U.S. DOE standards.

Are samples available before bulk ordering?

Sample availability depends on model type. Stock units are typically available for sampling within 7–10 days at 1.5x unit price, refundable against future orders. Custom samples involving new tooling may take 20–25 days and incur non-recurring engineering fees.

What logistics options do suppliers support?

Most suppliers offer FOB terms from Ningbo, Shanghai, or Qingdao ports. CIF and DDP arrangements are negotiable for large-volume contracts. Consolidated LCL shipments are common for trial orders under 100 units, while full-container loads (20ft/40ft) optimize freight costs above 500 units.