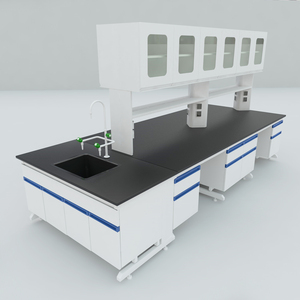

Modular Workstation Table

Top sponsor listing

Top sponsor listing

CN

CN

About modular workstation table

Where to Find Modular Workstation Table Suppliers?

China remains the global epicenter for modular workstation table manufacturing, with key production clusters in Guangdong and Beijing offering specialized capabilities. The Pearl River Delta region—particularly Guangzhou and Shenzhen—hosts a dense network of furniture manufacturers integrating advanced wood processing, metal fabrication, and panel assembly lines. These hubs benefit from proximity to raw material suppliers and export ports, enabling streamlined logistics and cost-efficient production cycles.

Suppliers in this region operate vertically integrated facilities capable of handling full product lifecycles, from design and prototyping to packaging and container loading. This integration supports rapid fulfillment, with standard lead times averaging 25–35 days for containerized orders. Economies of scale reduce unit costs by 18–30% compared to equivalent suppliers in Southeast Asia or Eastern Europe, while maintaining compliance with international environmental and safety standards.

Manufacturers leverage high-pressure laminate (HPL), melamine-faced chipboard (MFC), and engineered wood composites as primary materials, often incorporating aluminum extrusions for partition frames and cable management systems. CNC routing, edge banding automation, and UV-cured finishing lines ensure dimensional precision and surface durability across large batches.

How to Choose Modular Workstation Table Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

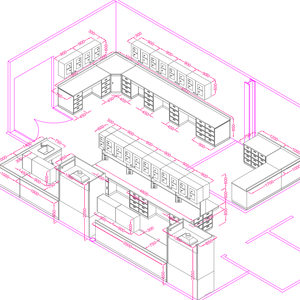

Production & Customization Capacity

Assess whether suppliers offer configurable options in size, color, material grade, and layout (e.g., L-shape, 4-person pods, height-adjustable bases). Leading manufacturers support OEM/ODM services including logo imprinting, custom labeling, and graphic design integration. Confirm access to modular connectivity systems—spliceable panels, snap-on accessories, and tool-free assembly mechanisms—that define true modularity.

Quality Assurance Protocols

While formal certifications (ISO 9001, FSC, GREENGUARD) are not universally declared in available data, performance indicators suggest robust internal quality controls. Prioritize suppliers reporting 100% on-time delivery rates and response times under 2 hours. Reorder rates below 15% across most suppliers indicate consistent buyer satisfaction and low defect incidence.

- Minimum facility output capacity: 500+ units/month

- In-house R&D teams for layout engineering and space optimization

- Integration of anti-scratch, fire-retardant, and moisture-resistant surface treatments

Cross-reference product listings with material specifications to verify structural integrity claims (e.g., load-bearing capacity ≥150kg per segment).

Transaction Reliability Indicators

Analyze digital transaction metrics such as online revenue history (e.g., US $120,000+ annual volume) and minimum order flexibility. Suppliers with lower MOQs (as low as 2 pieces) accommodate trial orders and small office deployments. Escrow-backed payment terms and platform-mediated dispute resolution enhance financial security. Pre-shipment inspection rights should be contractually secured, especially for bulk purchases.

What Are the Best Modular Workstation Table Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization | Min. Order | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Guangzhou Max Laboratory Equipment Co., Ltd. | Laboratory Furniture, Office Desks, PH Meters | US $120,000+ | 100% | ≤3h | <15% | Yes (color, size, logo, packaging) | 2–5 units | $48–$220 |

| Foshan Huangsi Furniture Co., Ltd. | Office Desks, Chairs, Sofas, Filing Cabinets | US $20,000+ | 100% | ≤2h | <15% | Not specified | 2 pieces | $98–$1,008 |

| Shenzhen Yilian Furniture Co., Ltd. | Office Desks, Partitions, Gaming Chairs | Not disclosed | 100% | ≤2h | <15% | Not specified | 2–5 units | $40–$260 |

| Beijing Borito Furniture Co., Ltd. | Office Desks, School Chairs, Hotel Sets | US $50,000+ | 75% | ≤2h | <15% | Not specified | 2 pieces | $38–$198 |

| Egrospace Kejing Furniture Limited Company | Office Workstations, Partitions, Melamine Tables | US $2,000+ | 100% | ≤1h | 50% | Yes (color, material, size, logo) | 20 pieces | $26–$55 |

Performance Analysis

Guangzhou Max stands out for high transaction volume and comprehensive customization, making it suitable for branded corporate deployments. Foshan Huangsi and Shenzhen Yilian offer premium finishes with competitive responsiveness and 100% on-time performance, ideal for mid-to-large office fit-outs. Egrospace targets budget-conscious buyers with ultra-low pricing and the fastest average response time (≤1h), though its higher reorder rate (50%) may reflect post-purchase adjustments rather than loyalty. Beijing Borito, despite lower on-time delivery (75%), provides entry-level pricing and moderate scalability.

Suppliers based in Guangdong consistently demonstrate superior responsiveness and delivery reliability. For critical projects, prioritize vendors with documented customization experience and proven export packaging standards to minimize transit damage.

FAQs

How to verify modular workstation table supplier reliability?

Evaluate on-time delivery records, response speed, and reorder metrics as proxies for operational stability. Request factory walkthrough videos to confirm production infrastructure. Validate material specifications against sample swatches and inquire about compliance with LEED, CARB2, or BIFMA standards where applicable.

What is the typical MOQ for modular workstation tables?

Standard MOQs range from 2 to 5 units for most suppliers, facilitating pilot installations. High-volume producers like Egrospace require larger minimums (20 pieces) but offer lower per-unit pricing. Negotiate tiered pricing structures based on volume commitments.

Are customization options widely available?

Yes, select suppliers such as Guangzhou Max and Egrospace explicitly support customization in color, material, dimensions, and branding elements. Confirm tooling requirements and setup fees for non-standard configurations before finalizing contracts.

What are common lead times for production and shipping?

Production lead time typically ranges from 20–35 days after order confirmation. Add 15–25 days for sea freight to North America or Europe. Air freight reduces transit time to 5–10 days but increases costs significantly for bulky items.

Do suppliers provide samples?

Most suppliers allow sample orders at incremental cost. Expect to pay 1.5–2x the unit price for single-item samples, which may be credited toward future bulk orders. Samples should include full assembly components to assess fit, finish, and ease of installation.