Morse Code

0

0

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/14

1/14

1/13

1/13

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

1/17

1/17

1/2

1/2

1/1

1/1

1/3

1/3

1/2

1/2

1/3

1/3

0

0

0

0

1/3

1/3

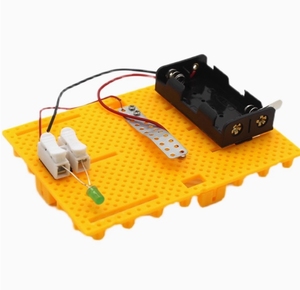

About morse code

Where to Find Morse Code Equipment Suppliers?

China is a central hub for the production of specialized electronic communication tools, including morse code equipment, with key manufacturing clusters concentrated in Shenzhen, Guangdong province. This region hosts a dense network of electronics manufacturers specializing in radio communication devices, training systems, and RF modules. Shenzhen’s ecosystem benefits from vertically integrated supply chains—encompassing PCB fabrication, component sourcing, firmware development, and final assembly—enabling rapid prototyping and scalable production.

Suppliers in this cluster leverage proximity to Tier-1 component distributors and contract manufacturers, reducing material lead times by 20–30% compared to non-specialized regions. The area supports both low-volume custom builds and high-volume OEM orders, with typical monthly output ranging from 1,000 to 5,000 units depending on complexity. Buyers gain access to agile production lines capable of integrating mechanical telegraph keys, digital decoders, audio feedback systems, and LCD-based training interfaces within compact form factors.

How to Choose Morse Code Equipment Suppliers?

Procurement decisions should be guided by structured evaluation criteria focused on technical capability, operational reliability, and transaction security.

Technical & Production Capability

Assess suppliers based on their engineering expertise in wireless communication systems and embedded electronics. Preferred partners demonstrate experience with CW (Continuous Wave) transmission hardware, auto-keyers, paddle mechanisms, and decoder integration. Verify presence of in-house R&D teams through product documentation or video tours of design labs. Suppliers offering customization—such as frequency tuning, sound output options, or interface modifications—typically maintain dedicated firmware developers and circuit designers.

Quality Assurance Metrics

Evaluate performance using quantifiable indicators:

- On-time delivery rate ≥95%

- Average response time ≤2 hours

- Reorder rate below 25% indicates stable customer satisfaction

- Minimum online transaction volume of US $50,000+ signals consistent export activity

Cross-reference these metrics with product listings to confirm consistency across order volumes and configurations.

Transaction Safeguards

Prioritize suppliers participating in verified trade programs that offer escrow protection and dispute resolution. Conduct sample testing before full-scale ordering, focusing on mechanical durability (e.g., key switch lifespan), signal clarity, and decoder accuracy. For integration into larger systems (e.g., amateur radio stations or educational kits), request firmware specifications and API access if applicable.

What Are the Best Morse Code Equipment Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order Quantity | Price Range (USD) |

|---|---|---|---|---|---|---|---|

| Shenzhen Huanqiu Xinrui Electronic Technology Co., Ltd. | Manual telegraph keys, automatic paddles, CW trainers | US $50,000+ | 98% | ≤2h | <15% | 1 piece | $18–$35 |

| Shenzhen Super-D Electronic Technology Co., Ltd. | Escape room props, vintage-style Morse displays, lamps | US $50,000+ | 80% | ≤4h | <15% | 1 set | $85–$165 |

| Shenzhen Shenruixin Technology Co., Ltd. | Shortwave radios, CW decoders, teaching telegraphs | US $130,000+ | 98% | ≤1h | 24% | 1 piece | $10–$50 |

| Shenzhen Muting Industrial Co., Ltd. | LCD CW trainers, automatic paddles, HF shortwave keys | US $10,000+ | 100% | ≤2h | <15% | 5–10 pieces | $40–$169 |

| Shenzhen Lonten Technology Co., Limited | Custom Morse trainers, stainless steel keys, decoder radios | US $140,000+ | 91% | ≤7h | 27% | 1 piece | $18–$106 |

Performance Analysis

Shenzhen Shenruixin and Shenzhen Lonten lead in transaction volume, indicating strong market penetration and diversified client bases. Both support customization and offer mid-range pricing, though Lonten’s higher reorder rate (27%) suggests potential gaps in post-sale consistency despite robust technical offerings. Shenzhen Muting stands out for perfect on-time delivery and MOQ flexibility, making it ideal for bulk procurement of standardized trainer units. In contrast, Shenzhen Super-D focuses on niche applications such as escape room installations, commanding premium prices but exhibiting lower delivery reliability (80%). Buyers seeking cost-effective entry-level equipment can source basic telegraph keys starting at $10 from high-efficiency producers like Shenruixin.

FAQs

How to verify morse code equipment supplier reliability?

Validate operational credibility by reviewing documented delivery performance, response times, and transaction history. Request references or third-party audit reports where available. Test product functionality via physical samples, particularly for decoder accuracy and mechanical switch endurance.

What is the typical minimum order quantity?

MOQ varies by supplier and product type. Standard handheld keys and basic trainers often have an MOQ of 1 piece. Advanced models like LCD-equipped CW trainers or multi-unit sets may require 5–10 pieces. Custom designs typically mandate higher volumes based on tooling investment.

Are customization options available for morse code devices?

Yes, several suppliers offer customization in materials (e.g., stainless steel construction), firmware settings (speed adjustment, language support), and aesthetic design (vintage styling, branding). Confirm engineering capacity and NRE (non-recurring engineering) costs before initiating development.

What are common lead times for production and shipping?

Standard orders are fulfilled within 15–25 days after confirmation. Custom builds may extend lead times to 35–45 days. Air freight delivers samples in 7–10 days internationally; sea freight remains optimal for container-sized shipments, averaging 25–35 days port-to-port.

Do suppliers provide technical documentation and compliance certifications?

Documentation availability varies. Leading suppliers supply user manuals, wiring diagrams, and basic FCC/RoHS declarations for electronic components. For regulated markets, buyers must explicitly request CE or ICES compliance verification and confirm adherence to local radio emission standards.