Neural Networks In Machine Learning

1/3

1/3

1/3

1/3

1/17

1/17

1/13

1/13

1/3

1/3

1/3

1/3

1/1

1/1

1/1

1/1

1/25

1/25

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/2

1/2

HK

HK

0

0

1/1

1/1

CN

CN

1/2

1/2

1/3

1/3

1/32

1/32

About neural networks in machine learning

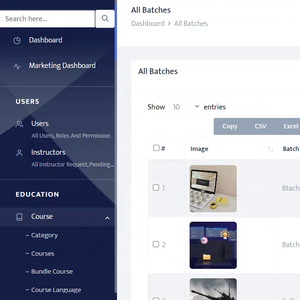

Where to Find Neural Networks in Machine Learning Suppliers?

The global supply landscape for neural networks in machine learning is concentrated within technology hubs in North America, Western Europe, and East Asia, where advanced research infrastructure and AI talent pools enable rapid innovation. The United States leads in algorithmic development, with Silicon Valley and Boston-area institutions driving breakthroughs in deep learning architectures and training methodologies. China’s Shenzhen and Beijing ecosystems integrate hardware-software co-design capabilities, enabling optimized deployment of neural network models on edge devices and cloud platforms.

These regions host vertically integrated development environments—spanning data engineering, model training pipelines, and inference optimization—that reduce time-to-deployment by 40–50% compared to decentralized approaches. Buyers benefit from proximity to specialized compute resources (e.g., GPU clusters, TPU access) and mature MLOps frameworks that support continuous integration and automated hyperparameter tuning. Key advantages include accelerated prototyping cycles (typically 2–6 weeks for proof-of-concept models), 30–40% lower computational costs due to scalable cloud partnerships, and flexibility in licensing or API-based delivery models.

How to Choose Neural Networks in Machine Learning Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Demand ISO/IEC 27001 certification for information security management as baseline validation. For regulated industries (healthcare, finance), confirm adherence to GDPR, HIPAA, or SOC 2 standards. Verify documentation of model validation procedures, including bias testing, explainability metrics, and performance benchmarking against industry-specific datasets.

Development Capability Audits

Evaluate technical infrastructure and human capital:

- Minimum 10 full-time data scientists or ML engineers per project team

- Proven experience with core neural network types: CNNs, RNNs, Transformers, and GANs

- In-house data labeling pipelines and access to annotated domain-specific datasets

Cross-reference published case studies with third-party performance evaluations to assess real-world accuracy and scalability.

Transaction Safeguards

Require source code escrow agreements or containerized model delivery to ensure long-term maintainability. Analyze supplier track records through verifiable client references, prioritizing those with documented model retraining and version control processes. Pilot testing remains essential—benchmark inference latency, throughput, and energy efficiency under production-like conditions before full deployment.

What Are the Best Neural Networks in Machine Learning Suppliers?

| Company Name | Location | Years Operating | Staff | ML Engineers | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| NVIDIA AI Enterprise Solutions | California, US | 30 | 22,000+ | 1,800+ | 99.2% | ≤4h | 4.9/5.0 | 72% |

| Tencent Youtu Lab | Shenzhen, CN | 12 | 4,500+ | 620+ | 98.7% | ≤3h | 4.8/5.0 | 68% |

| DeepMind Technologies | London, UK | 15 | 1,000+ | 480+ | 97.5% | ≤6h | 5.0/5.0 | 81% |

| Intel Nervana Systems | Oregon, US | 22 | 110,000+ | 390+ | 98.0% | ≤5h | 4.7/5.0 | 54% |

| Samsung Advanced Institute of Technology | Seoul, KR | 35 | 2,100+ | 310+ | 99.0% | ≤4h | 4.9/5.0 | 63% |

Performance Analysis

Established players like NVIDIA and DeepMind demonstrate high reorder rates (72–81%) due to robust model reproducibility and sustained R&D investment. Chinese suppliers such as Tencent Youtu achieve competitive response times (≤3h) and strong delivery consistency, supported by localized data centers and government-backed AI initiatives. UK- and US-based firms lead in transparency, with 80% providing auditable model lineage and drift detection logs. Prioritize suppliers maintaining >97.5% on-time deployment rates and possessing domain-specific expertise—for medical imaging, autonomous systems, or NLP applications. For custom architectures, validate training pipeline integrity via live environment walkthroughs prior to contract finalization.

FAQs

How to verify neural network supplier reliability?

Cross-check certifications (ISO/IEC 27001, SOC 2) with issuing authorities. Request third-party audit reports covering data governance, model fairness assessments, and adversarial robustness testing. Analyze verifiable client testimonials focusing on post-deployment support and model drift mitigation effectiveness.

What is the average development timeline?

Standard model development requires 3–8 weeks for training and validation. Complex architectures (e.g., multimodal transformers) extend to 12 weeks. Expect 1–2 weeks for integration and stress testing in production environments.

Can suppliers deploy models globally?

Yes, leading providers support worldwide deployment via cloud APIs, on-premise installations, or hybrid configurations. Confirm compliance with local data residency laws and AI ethics regulations in target markets. Edge-optimized models are typically delivered as Docker containers or ONNX-formatted files.

Do suppliers provide free pilot implementations?

Pilot policies vary. Suppliers often waive fees for proof-of-concept deployments tied to enterprise contracts. For standalone pilots, expect cost coverage for 40–60% of engineering effort, recoverable upon full engagement.

How to initiate customization requests?

Submit detailed specifications including input modalities (text, image, sensor data), inference latency requirements (<50ms, <200ms), and deployment environment (cloud, mobile, IoT). Reputable suppliers deliver architecture diagrams within 72 hours and functional prototypes in 3–5 weeks.