Oracle Supplier Qualification Management Cloud

CN

CN

CN

CN

About oracle supplier qualification management cloud

Where to Find Oracle Supplier Qualification Management Cloud Suppliers?

The global supply base for cloud-based supplier qualification management solutions is concentrated among specialized technology firms in China, particularly in Beijing and Jiangsu provinces. These regions host a growing cluster of IT infrastructure and enterprise software providers that integrate Oracle-compatible systems with cloud deployment capabilities. Beijing’s Zhongguancun tech hub offers access to deep expertise in database integration and enterprise resource planning (ERP) ecosystems, enabling suppliers to deliver compliant, scalable architectures aligned with Oracle standards.

Jiangsu-based providers leverage proximity to Shanghai’s logistics network for rapid service deployment and technical support across Asia-Pacific markets. The region's mature ICT manufacturing ecosystem supports end-to-end development—from system architecture design to secure cloud hosting—allowing vendors to offer fully managed or on-premise hybrid deployments. Key advantages include competitive pricing models (ranging from $4,000–$6,000 per set), modular system configurations, and integration readiness with existing Oracle environments, reducing implementation lead times by up to 30% compared to custom-built alternatives.

How to Choose Oracle Supplier Qualification Management Cloud Suppliers?

Selecting qualified partners requires rigorous evaluation across technical, operational, and transactional dimensions:

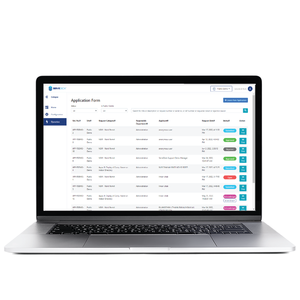

Technical Integration Capability

Verify demonstrated experience in deploying Oracle-centric cloud platforms, including compatibility with Oracle Database, Exadata, and E-Business Suite. Prioritize suppliers offering documented API integrations, data migration protocols, and compliance with enterprise security frameworks such as TLS 1.3 and AES-256 encryption. Confirm support for multi-tenancy, role-based access control, and audit trail retention policies essential for supplier governance workflows.

Development & Deployment Infrastructure

Assess core competencies through the following criteria:

- Proven track record in building distributed enterprise systems using microservices (e.g., Eureka, Spring Cloud)

- Experience with major cloud infrastructures (AWS, Azure) for hybrid or public cloud deployments

- In-house software development teams capable of customization and ongoing maintenance

Cross-reference product listings with response time metrics (target ≤2 hours) and on-time delivery performance (>95%) to validate operational reliability.

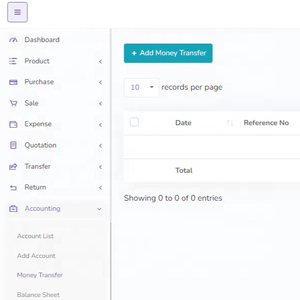

Procurement Risk Mitigation

Utilize structured verification methods before engagement. Request proof of completed implementations, ideally with anonymized case studies or sandbox demonstrations. Where applicable, require third-party verified revenue data and customer reorder rates as indicators of market acceptance. Conduct due diligence on licensing authenticity—particularly for Oracle or VMware-integrated offerings—to avoid intellectual property risks. For high-value contracts, consider phased rollouts starting with pilot modules to assess functionality and vendor responsiveness.

What Are the Best Oracle Supplier Qualification Management Cloud Suppliers?

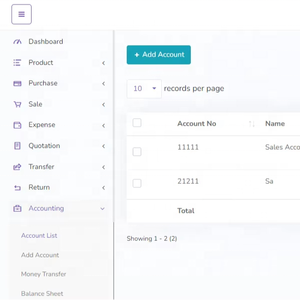

| Company Name | Location | Main Products | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Price Range (Min. Order) |

|---|---|---|---|---|---|---|---|

| Koma Technology (Jiangsu) Co., Ltd. | Jiangsu, CN | Cloud Platform, System Architecture | 100% | ≤1h | - | - | $4,000–$6,000 / set |

| Beijing StarRiver Leading Technology Co., Ltd. | Beijing, CN | Oracle Database, VMware Licensing | 96% | ≤2h | <15% | US $3,000+ | $235–$365 / set |

| Shenzhen Yistar Technology Co., Ltd. | Shenzhen, CN | Cloud Access Control, SDK Server | 98% | ≤3h | 17% | US $180,000+ | $28–$120 / set |

| Brilliant Info Systems Private Limited | India | Warehouse Management Software | - | ≤1h | - | - | $1,000 / unit |

| Beijing Tianheng Jiechuang Technology Co., Ltd. | Beijing, CN | Oracle Servers, Exadata Machines | 100% | ≤14h | - | US $260,000+ | $1,400–$3,000 / piece(s) |

Performance Analysis

Koma Technology stands out with 100% on-time delivery and sub-one-hour response times, indicating strong service commitment despite limited reorder rate visibility. Beijing Tianheng Jiechuang demonstrates significant commercial traction with over US$260,000 in online revenue and full delivery reliability, specializing in Oracle hardware-integrated solutions. Shenzhen Yistar combines affordability with high-volume output and customization options, serving mid-tier enterprises requiring flexible access control integration. For organizations prioritizing rapid support, Jiangsu and Beijing-based suppliers lead in responsiveness. Those seeking cost-effective licensing or secondary market Oracle components should evaluate Beijing StarRiver, though lower reorder rates suggest room for improvement in long-term client retention.

FAQs

How to verify supplier technical alignment with Oracle systems?

Request documentation of past deployments involving Oracle databases or middleware. Validate use of official Oracle APIs and confirm whether systems are tested in Oracle-certified environments. For licensing-related products, verify authorization channels and check serial validity where possible.

What is the typical lead time for cloud system implementation?

Standard deployment timelines range from 4 to 8 weeks, depending on integration complexity. Off-the-shelf platforms with preconfigured modules can be operational within 30 days. Custom development projects may extend to 12 weeks, especially when incorporating legacy ERP interfaces or advanced analytics features.

Do suppliers support international deployment and multilingual operation?

Most established vendors offer English-language interfaces and timezone-aligned support. Confirm availability of localized documentation, GDPR or equivalent compliance measures, and data residency options for cross-border operations. Some providers also support additional languages such as Spanish, Arabic, or Russian upon request.

Can buyers negotiate MOQs or pricing tiers?

Yes, volume-based discounts are common. Suppliers often adjust minimum order quantities for pilot testing (e.g., single-user licenses). Negotiation leverage increases with multi-module procurement or long-term maintenance agreements. Transparent pricing structures typically emerge after initial technical scoping discussions.

Are customization and post-sale support included?

Customization scope varies: some suppliers offer UI branding, workflow adjustments, and field-level configuration at no extra cost, while deeper architectural changes incur additional fees. Post-sale support duration, update frequency, and SLA terms should be contractually defined—ideally including remote diagnostics, patch management, and annual health checks.