Paper File Folder

1/23

1/23

1/46

1/46

1/8

1/8

1/6

1/6

1/23

1/23

1/17

1/17

1/17

1/17

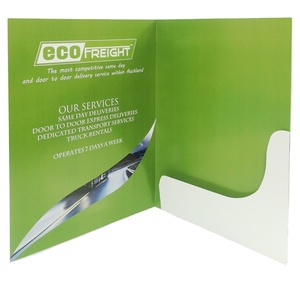

About paper file folder

Where to Find Paper File Folder Suppliers?

China remains the dominant hub for paper file folder manufacturing, with key production clusters in Guangdong, Zhejiang, and Hebei provinces. These regions host vertically integrated printing and packaging facilities that combine raw material sourcing, offset/digital printing, lamination, die-cutting, and folding operations under one roof. Guangdong’s Shenzhen and Guangzhou zones specialize in high-end customized folders with advanced finishing options such as foil stamping and debossing, while Hangzhou-based manufacturers focus on fast-turnaround promotional stationery leveraging automated digital print lines.

The industrial ecosystem supports both mass production and low-volume custom runs, enabled by standardized 350gsm cardstock availability and modular production workflows. Buyers benefit from localized supply chains that reduce lead times to 12–18 days for standard orders and enable cost efficiencies—unit prices as low as $0.05–$0.20 at 500-piece MOQs. Proximity to major ports like Shekou and Ningbo further enhances export scalability, with established logistics routes covering North America, Europe, and Africa.

How to Choose Paper File Folder Suppliers?

Evaluate suppliers using these critical benchmarks:

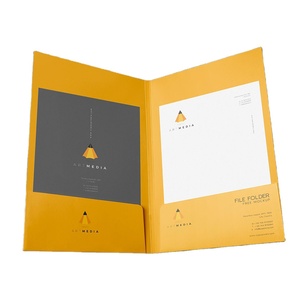

Production & Customization Capability

Confirm access to full-color CMYK printing, matte/glossy lamination, and precision die-cutting equipment. Suppliers offering foil stamping, scratch-proof coatings, or business card slots indicate higher-end processing capabilities. Verify support for A4, FC, and custom dimensions, along with compatibility with recycled or specialty paper stocks (e.g., 350gsm thick card).

Quality Assurance Metrics

Prioritize suppliers with documented on-time delivery rates exceeding 96% and reorder rates above 20%, indicators of consistent quality and customer satisfaction. Response times under 3 hours reflect operational responsiveness. While formal ISO certification is not universally listed, consistent transaction histories and verifiable online revenue (e.g., $100,000+) serve as proxy indicators of reliability.

Order Flexibility & Transaction Security

Assess MOQ adaptability—suppliers offering 100–200 piece minimums provide flexibility for test runs or niche markets. Cross-reference price consistency across volume tiers and confirm whether mockup or sample review processes are available pre-production. For risk mitigation, prefer suppliers with transparent communication channels and structured packaging labeling protocols.

What Are the Best Paper File Folder Suppliers?

| Company Name | Location | Main Products | Customization Options | MOQ Range | Price Range (USD) | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|---|---|

| Zhenyin (Hangzhou) Digital Printing Co., Ltd. | Zhejiang, CN | Paper Filing Products, Promotional Folders | Logo, color, size, packaging, graphic mockup | 200–500 pcs | $0.10–0.87 | 96% | ≤1h | 17% | $660,000+ |

| Shenzhen Bolla Printing Packing Co., Ltd. | Guangdong, CN | Laminated Folders, Business Presentation Kits | Foil stamping, debossing, pockets, pen loops, video samples | 100 pcs | $0.08–1.00 | 100% | ≤5h | 21% | $290,000+ |

| Guangzhou Sentork Packaging Printing Co., Ltd. | Guangdong, CN | Thick Cardstock Folders, Recycled Paper Files | Logo printing, tabbed designs, assorted sizes | 500 pcs | $0.05–0.70 | 100% | ≤3h | 29% | $110,000+ |

| Guangzhou Tianhe Yueyang Stationery Firm | Guangdong, CN | Office & School Filing Solutions | Clip folders, classification systems | 50–1,000 pcs | $0.16–1.00 | 100% | ≤2h | <15% | $20,000+ |

| Hengshui Suyinda Printing Co., Ltd. | Hebei, CN | Wholesale Art Paper Folders, Envelopes | Custom logo, full-color print, design review | 200–500 pcs | $0.01–1.50 | 100% | ≤4h | <15% | $10,000+ |

Performance Analysis

Guangdong-based suppliers dominate customization depth, with Shenzhen Bolla offering the most extensive finishing options including silver foil and scratch-proof layers. Zhejiang’s Zhenyin stands out for rapid response times (≤1h) and high online transaction volume ($660,000+), indicating strong digital integration. Guangzhou Sentork achieves the highest reorder rate (29%) despite a 500-piece MOQ, suggesting reliable quality in thick 350gsm stock production. Hebei’s Hengshui Suyinda offers the lowest entry price point ($0.01) but serves smaller order volumes. Buyers seeking premium presentation folders should prioritize Guangdong suppliers with lamination and foil capabilities, while budget-driven bulk procurement may favor Hebei or Hangzhou-based partners with sub-$0.10 pricing at scale.

FAQs

What materials are commonly used in paper file folders?

Most suppliers use 350gsm art paper or cardstock as standard. Options include recycled paper, kraft board, and matte/glossy laminated finishes for durability and aesthetic appeal.

What is the typical lead time for custom paper file folders?

Standard production lead time ranges from 10–18 days, depending on order complexity and finishing requirements. Expedited production (7–10 days) is available from select suppliers with digital printing capacity.

Can I request a sample before placing a bulk order?

Yes, most suppliers offer sample units with prior design confirmation. Sample costs may apply but are often waived upon full order placement. Some provide video reviews or digital mockups for pre-approval.

Are eco-friendly or recyclable options available?

Several suppliers list recycled paper as a material option. Confirm fiber sourcing and lamination type (water-based vs. synthetic) if sustainability compliance is required.

What customization options are supported?

Common options include full-color CMYK printing, logo embossing/debossing, foil stamping, pocket inserts, business card slots, and custom packaging. Design files are typically accepted in AI, PDF, or PSD formats with bleed and safe zone specifications.