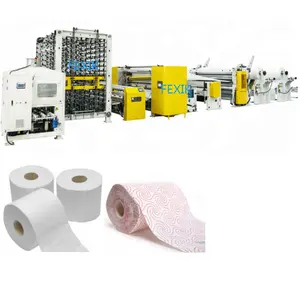

Paper Rolling Machine Producer

1/3

1/3

1/3

1/3

CN

CN

1/24

1/24

1/3

1/3

1/3

1/3

1/16

1/16

1/3

1/3

1/3

1/3

1/25

1/25

CN

CN

1/3

1/3

1/12

1/12

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

About paper rolling machine producer

Where to Find Paper Rolling Machine Suppliers?

China remains the global epicenter for paper rolling machine production, with concentrated manufacturing hubs in Fujian and Guangdong provinces driving innovation and cost efficiency. Fujian-based suppliers, particularly around Quanzhou, specialize in compact, energy-efficient models ideal for small-to-mid-scale tissue and toilet paper producers, leveraging localized access to corrugated paper feedstock and packaging components. Guangdong’s Foshan region hosts integrated machinery manufacturers offering fully automated lines capable of processing jumbo rolls up to 2400mm wide, supported by advanced servo motor controls and CNC fabrication capabilities.

These industrial clusters benefit from vertically aligned supply chains—encompassing raw material sourcing, precision machining, and final assembly—reducing component lead times by 25–40% compared to decentralized production models. Buyers gain access to scalable solutions ranging from semi-automatic units at $7,000 to full production lines exceeding $120,000. Typical delivery windows range from 30 to 45 days post-deposit, with customization options including core diameter, embossing patterns, and multi-lane output configurations. Regional logistics infrastructure enables efficient container loading for global export, particularly via Xiamen and Guangzhou ports.

How to Choose Paper Rolling Machine Suppliers?

Implement structured evaluation criteria to ensure technical compatibility and transaction security:

Technical Specifications & Compliance

Confirm machine compatibility with target paper types (e.g., virgin pulp, recycled tissue) and grammage ranges (typically 15–35 gsm). Verify integration of critical subsystems: automatic rewinding, pneumatic tension control, photoelectric tracking, and servo-driven cutting. While explicit ISO or CE certifications are not listed in available data, prioritize suppliers providing test reports on motor efficiency, roll alignment accuracy, and operational noise levels (≤75 dB).

Production Capacity Verification

Assess manufacturer capability through key indicators:

- Minimum factory footprint of 3,000m² for full-line assembly

- In-house engineering teams supporting design modifications

- CNC machining and welding facilities for structural components

Cross-reference online revenue figures (where disclosed: up to US $1.1M annually) and reorder rates as proxies for market acceptance and after-sales performance.

Customization & Transaction Security

Evaluate flexibility in material specifications, labeling, and graphic interface languages. For risk mitigation, use traceable payment systems with milestone-based disbursements. Request pre-shipment inspection reports and video validation of running machines under load conditions. Sample testing is recommended—run trial batches to assess roll consistency, edge trimming precision, and downtime frequency before scaling procurement.

What Are the Best Paper Rolling Machine Suppliers?

| Company Name | Location | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Price (USD) | Key Product Features |

|---|---|---|---|---|---|---|---|

| Foshan Nanhai Meijing Machinery Manufacture Co., Ltd. | Guangdong, CN | US $1,100,000+ | On-time delivery - | ≤2h | <15% | $19,000 | Fully automatic lines, multi-model compatibility, high-speed winding |

| Quanzhou Hengxin Paper Machinery Manufacturer Co., Ltd. | Fujian, CN | US $80,000+ | 100% | ≤6h | <15% | $8,800 | Compact design, hotel-grade tissue output, low MOQ entry point |

| Qinyang Shengfeng Paper Making Machinery Co., Ltd. | Henan, CN | - | 100% | ≤6h | - | $700 | Wide-width kraft paper handling (up to 2400mm), custom color/logo options |

| Quanzhou Xinda Machinery Co., Ltd. | Fujian, CN | US $520,000+ | 100% | ≤2h | 50% | $7,000 | High reorder rate, extensive customization, napkin and maxi-roll versatility |

| Zhengzhou Guangmao Machinery Manufacturing Co., Ltd. | Henan, CN | US $10,000+ | 100% | ≤4h | - | $7,500 | Slitting & rewinding specialization, A4 and jumbo roll adaptability |

Performance Analysis

Quanzhou Xinda stands out with a 50% reorder rate—indicating strong customer retention—supported by rapid ≤2-hour responses and broad customization capabilities across size, material, and branding parameters. Foshan Meijing offers premium automation suitable for high-throughput environments, though its lower reorder rate suggests potential gaps in post-sale support. Qinyang Shengfeng provides niche value in wide-format kraft paper processing, while Hengxin and Guangmao cater to budget-conscious buyers seeking entry-level systems under $9,000. Suppliers in Fujian demonstrate superior responsiveness, with two achieving sub-4-hour average reply times. Prioritize partners with documented customization experience and verifiable production footage when procuring for specialized applications.

FAQs

What is the typical MOQ for paper rolling machines?

Minimum order quantity is typically 1 set across all major suppliers, allowing feasibility for pilot operations and SMEs. Pricing scales with automation level and output capacity rather than volume discounts.

How long does production and shipping take?

Lead time averages 30–45 days from order confirmation to shipment readiness. Add 15–30 days for international sea freight depending on destination port. Air freight is rarely used due to machine weight and dimensions.

Can suppliers customize machine specifications?

Yes, multiple suppliers explicitly list customization options—including size, material feed width, logo printing, and control panel language. Quanzhou Xinda and Qinyang Shengfeng offer comprehensive tailoring across mechanical and aesthetic elements.

Do manufacturers provide installation and training?

While not specified in public data, industry-standard practice includes remote guidance via video or manuals. On-site technician deployment may be available at additional cost—confirm during negotiation phase.

Are spare parts and after-sales service available?

Buyers should verify availability of critical spares (e.g., rollers, blades, sensors) and technical support channels prior to purchase. Reorder rate and response time serve as indirect indicators of service reliability.