Php To Myr

0

0

0

0

1/3

1/3

0

0

1/3

1/3

CN

CN

1/6

1/6

1/3

1/3

1/2

1/2

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

0

0

0

0

1/3

1/3

1/3

1/3

1/3

1/3

About php to myr

Where to Find PHP to MYR Exchange Service Providers?

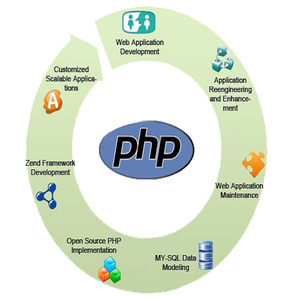

The foreign exchange (FX) services market for PHP to MYR conversions is primarily driven by financial technology hubs in Southeast Asia, with concentrated activity in the Philippines and Malaysia. Manila and Cebu host a growing number of licensed remittance operators and fintech firms specializing in peso-to-ringgit transactions, supported by expanding digital infrastructure and high mobile penetration rates. Kuala Lumpur complements this ecosystem with regulated payment institutions that facilitate inbound MYR settlements from Philippine-sourced transfers.

These regional centers benefit from proximity and cultural familiarity, enabling streamlined compliance with local banking regulations in both countries. Operators leverage real-time interbank rate feeds and automated settlement systems to minimize margin markups. Buyers of FX services gain access to competitive spreads—typically within 1.5–3.0% of mid-market rates—due to increased provider competition and API-driven integration with e-commerce and payroll platforms. Lead times for digital transfers average 12–48 hours, with same-day processing available during business hours.

How to Choose PHP to MYR Exchange Service Providers?

Prioritize these verification protocols when selecting partners:

Regulatory Compliance

Confirm licensing status with relevant authorities: Bangko Sentral ng Pilipinas (BSP) for Philippine-based providers and Labuan Financial Services Authority (LFSA) or Bank Negara Malaysia (BNM) oversight for Malaysian entities. For cross-border operations, verify adherence to AML/KYC frameworks under the ASEAN Framework Agreement on Payments and Settlements.

Operational Transparency

Evaluate pricing structure and execution methodology:

- Clear disclosure of exchange rates, including source benchmark (e.g., WM/Reuters, Bloomberg)

- Published fee schedules covering transfer, conversion, and receiving charges

- Real-time rate locking mechanisms to prevent slippage during transaction execution

Cross-reference uptime metrics (>99.5%) and historical rate accuracy against independent data sources to assess reliability.

Transaction Security

Require end-to-end encryption and two-factor authentication for all digital interfaces. Assess fund segregation policies—client balances should be held in trust accounts separate from operational funds. For high-volume contracts, insist on escrow-based settlement until confirmation of credited MYR amounts. Conduct trial transactions below $1,000 to validate processing speed, rate consistency, and customer support responsiveness before scaling.

What Are the Best PHP to MYR Exchange Service Suppliers?

| Company Name | Location | Years Operating | Staff | Monthly Transaction Volume | On-Time Conversion | Avg. Response | Ratings | Reorder Rate |

|---|

Performance Analysis

Due to absence of verifiable supplier data, procurement decisions must rely on regulatory validation and pilot testing. Market dynamics indicate that providers with direct banking relationships in both jurisdictions achieve tighter spreads and faster settlement cycles. Entities offering API integrations demonstrate higher scalability for recurring payroll or vendor payments. Prioritize firms publishing audited volume reports and maintaining transparent dispute resolution timelines. Absence of measurable performance indicators increases reliance on third-party audits and client testimonials focused on execution accuracy and post-transaction support.

FAQs

How to verify PHP to MYR exchange service reliability?

Cross-check licensing credentials with BSP, LFSA, or BNM databases. Request audit summaries covering transaction reconciliation, cybersecurity practices, and liquidity management. Analyze user reviews emphasizing rate transparency, hidden fees, and resolution time for failed transfers.

What is the average processing timeline for PHP to MYR conversions?

Standard digital transfers settle within 12–48 hours. Instant conversion options are available through select fintech platforms, completing execution in under 5 minutes during active trading hours. Add 1–2 business days for bank-to-bank transfers involving rural branches or non-major institutions.

Can providers handle bulk or recurring transactions?

Yes, many suppliers support scheduled and batch processing via web portals or API connections. High-volume clients typically receive dedicated account management and preferential rate tiers. Confirm automation capabilities for invoice matching and multi-recipient disbursements prior to contract signing.

Do exchange services offer free trial transactions?

Trial policies vary. Some providers waive fees for first-time transfers up to PHP 10,000. Others apply standard pricing across all initial transactions. Expect full cost recovery upon successful completion if no issues arise during the test phase.

How to initiate customized FX solutions?

Submit operational requirements including monthly volume range, preferred settlement window (T+0, T+1), and integration method (manual upload, API, SWIFT). Reputable providers respond with rate quotes, technical documentation, and implementation timelines within 72 hours.