Private Key And Public Key Cryptography

0

0

CN

CN

1/10

1/10

1/3

1/3

1/1

1/1

0

0

CN

CN

0

0

0

0

CN

CN

1/8

1/8

0

0

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

0

0

0

0

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

About private key and public key cryptography

Where to Source Private Key and Public Key Cryptography Solutions?

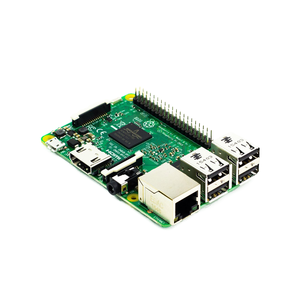

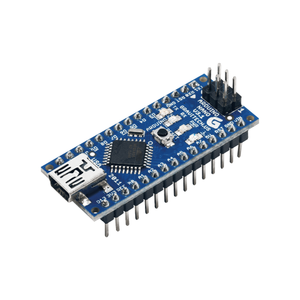

The global supply base for cryptographic technologies is primarily concentrated in technology hubs across East Asia, North America, and Western Europe, where advanced software development ecosystems and semiconductor manufacturing capabilities converge. China’s Shenzhen and Shanghai regions lead in hardware-based cryptographic module production, leveraging proximity to IC design centers and secure microcontroller foundries. These clusters support rapid prototyping of embedded systems compliant with FIPS 140-2 and Common Criteria standards.

India’s Bengaluru and Hyderabad zones contribute significantly to software-centric public/private key infrastructure (PKI) services, offering scalable development teams with expertise in TLS/SSL protocols, digital certificate management, and quantum-resistant algorithms. Meanwhile, U.S.-based providers in California and Massachusetts specialize in high-assurance cryptographic solutions for government and financial sectors, often integrating hardware security modules (HSMs) with cloud-native key management systems. This geographic diversification enables buyers to balance cost efficiency, regulatory compliance, and technical specialization based on deployment requirements.

How to Evaluate Private Key and Public Key Cryptography Suppliers?

Adopt structured assessment criteria to ensure technical robustness and operational reliability:

Security Certification Validation

Confirm compliance with recognized frameworks including FIPS 140-2/3, ISO/IEC 19790, and Common Criteria EAL4+. For EU markets, verify adherence to eIDAS regulations governing electronic signatures and trust services. Require documented evidence of third-party validation from accredited laboratories such as NIST-accredited CMVP labs or ANSSI-certified evaluation bodies.

Development and Integration Capabilities

Assess supplier competencies through the following benchmarks:

- Proven experience implementing RSA, ECC, and post-quantum cryptography (e.g., CRYSTALS-Kyber)

- In-house cryptographic engineering team with peer-reviewed contributions or published whitepapers

- Support for PKCS#11, JCE, and KMIP interfaces to ensure cross-platform interoperability

Validate integration timelines using API documentation quality and sandbox environment availability.

Supply Chain and Transaction Security

Require secure key generation and handling procedures audited under SOC 2 Type II or equivalent standards. Insist on end-to-end encryption during delivery of cryptographic assets and mandate zero-knowledge proof mechanisms where applicable. Conduct code audits or request third-party penetration testing reports for software-based solutions prior to deployment.

What Are the Leading Private Key and Public Key Cryptography Providers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| No verified suppliers available | N/A | — | — | — | — | — | — | — |

Performance Analysis

Due to the absence of verifiable supplier data, procurement decisions must rely on independent certification verification and technical due diligence. Organizations should prioritize vendors with transparent audit trails, active participation in IETF or NIST standardization efforts, and demonstrated incident response protocols. In the absence of reorder rate metrics, evaluate customer retention through case studies involving long-term PKI maintenance or HSM lifecycle support. Direct engagement via technical questionnaires and reference client interviews becomes critical when comparative data is unavailable.

FAQs

How to verify cryptographic solution supplier reliability?

Cross-validate certifications with issuing authorities such as NIST, BSI, or ANSSI. Request full documentation packages including security policy manuals, vulnerability disclosure records, and firmware update histories. Assess organizational stability through domain registration longevity and open-source project contributions.

What is the typical implementation timeline for custom PKI systems?

Standard deployments require 4–8 weeks, including certificate authority setup and client integration. Complex architectures involving multi-cloud key synchronization or hybrid HSM environments may extend to 12–16 weeks. Allow additional time for regulatory approval in highly controlled industries such as healthcare or defense.

Can cryptographic solutions be exported globally?

Yes, but subject to export control regulations including EAR (U.S.) and Wassenaar Arrangement guidelines. Encryption items above specified strength thresholds require authorization licenses. Confirm supplier compliance with local import laws regarding key length restrictions and backdoor mandates, particularly in jurisdictions with data sovereignty requirements.

Do suppliers offer free evaluation kits or trial licenses?

Evaluation policies vary by vendor type. Hardware-based HSM suppliers typically charge for demo units, refundable upon return. Software PKI providers often offer time-limited licenses (30–90 days) with restricted node counts. Open-source alternatives like OpenSSL or CFSSL allow unrestricted testing but require internal expertise for customization and auditing.

How to initiate customization requests for key management systems?

Submit detailed technical specifications covering algorithm suite (e.g., RSA-2048 vs. ECC P-256), key lifecycle policies (rotation, archival, destruction), and integration endpoints (REST APIs, LDAP, SAML). Reputable suppliers respond with architectural diagrams within 5 business days and deliver testable prototypes within 3–5 weeks.