Processing Controls

Top sponsor listing

Top sponsor listing

1/1

1/1

1/3

1/3

1/5

1/5

0

0

0

0

0

0

0

0

0

0

1/3

1/3

CN

CN

1/3

1/3

0

0

1/1

1/1

1/10

1/10

1/3

1/3

0

0

1/3

1/3

0

0

CN

CN

1/3

1/3

1/3

1/3

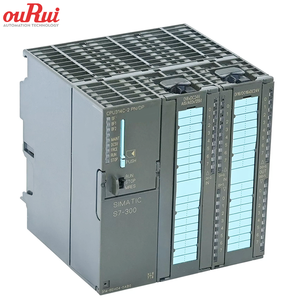

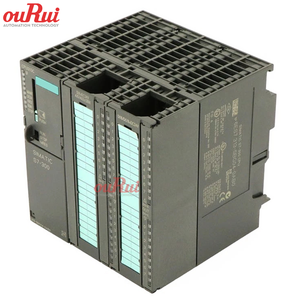

About processing controls

Where to Find Processing Controls Suppliers?

The global supply base for processing controls is concentrated in advanced manufacturing hubs across East Asia, particularly in China’s Yangtze River Delta and Pearl River Delta regions. These industrial clusters integrate precision electronics manufacturing with automation engineering expertise, enabling high-volume production of programmable logic controllers (PLCs), human-machine interfaces (HMIs), and distributed control systems (DCS). Shanghai, Suzhou, and Shenzhen host over 70% of China’s industrial automation suppliers, supported by mature semiconductor packaging lines, SMT assembly facilities, and embedded software development centers.

Regional advantages include proximity to raw material sources for PCB substrates and electronic components, reducing component procurement lead times by up to 40%. Vertically integrated suppliers operate full production cycles—from circuit design and firmware programming to final system integration—within centralized campuses. This ecosystem enables rapid prototyping (typically 7–14 days) and scalable batch production, with standard order fulfillment averaging 25–35 days. Buyers benefit from cost efficiencies due to localized sourcing, achieving 25–35% lower unit costs compared to European or North American manufacturers, while maintaining compatibility with international industrial standards.

How to Choose Processing Controls Suppliers?

Implement structured evaluation criteria when assessing potential partners:

Quality & Compliance Verification

Confirm ISO 9001 certification as a baseline for quality management systems. For regulated industries (e.g., pharmaceuticals, food processing), IEC 61508 or SIL compliance may be required for functional safety. CE marking is mandatory for EU market access, while UL listing ensures conformity with North American electrical safety standards. Request test reports for electromagnetic compatibility (EMC), operating temperature tolerance (-20°C to 70°C typical), and mean time between failures (MTBF >100,000 hours).

Technical Production Assessment

Evaluate supplier capabilities through the following benchmarks:

- Minimum 3,000m² cleanroom-equipped facility for SMT and assembly operations

- In-house engineering team comprising ≥15% of total staff, with PLC programming and SCADA integration experience

- Automated production lines featuring pick-and-place machines, reflow ovens, and AOI (automated optical inspection)

Validate output capacity: leading suppliers achieve monthly production volumes exceeding 10,000 units for standard models.

Procurement Risk Mitigation

Utilize secure payment structures such as irrevocable letters of credit or third-party escrow until product acceptance. Prioritize suppliers with documented export experience to your target market, including customs classification (HS Code 8537.10) and successful shipment histories. Pre-shipment inspections should verify firmware versioning, communication protocol support (Modbus, Profibus, EtherNet/IP), and enclosure IP ratings (IP65 minimum for harsh environments).

What Are the Best Processing Controls Suppliers?

No supplier data available for comparative analysis.

Performance Analysis

In the absence of specific supplier profiles, buyers should focus on identifying manufacturers with demonstrated track records in industrial automation sectors aligned with their application needs—such as chemical processing, water treatment, or discrete manufacturing. Emphasis should be placed on firms offering certified quality systems, transparent production workflows, and responsive technical support. Where possible, conduct remote audits via live video tours of SMT lines and testing bays to validate claimed capabilities. Customization flexibility, particularly in I/O configuration, communication protocols, and HMI layout, serves as a key differentiator among mid-tier suppliers.

FAQs

How to verify processing controls supplier reliability?

Audit quality documentation including ISO certifications, product test certificates, and conformity declarations. Request references from existing clients in similar industries and review feedback related to system uptime, technical responsiveness, and field failure rates. Confirm traceability of critical components such as microcontrollers and power supplies.

What is the average sampling timeline?

Standard sample production takes 10–20 days, depending on complexity. Units requiring custom firmware or specialized enclosures may require 25–35 days. Air freight delivery adds 5–10 days internationally.

Can suppliers ship processing controls worldwide?

Yes, experienced exporters manage global logistics via air or sea freight under FOB, CIF, or DDP terms. Ensure proper packaging for vibration-sensitive electronics and compliance with destination-country import regulations for electrical equipment. Most suppliers support Incoterms 2020 standards.

Do manufacturers provide free samples?

Sample policies vary. Some suppliers waive fees for qualified buyers committing to volume orders (e.g., MOQ ≥50 units). Otherwise, expect to pay 50–100% of unit cost, partially or fully credited upon order placement.

How to initiate customization requests?

Submit detailed technical requirements including control architecture (centralized vs. modular), input/output types (analog/digital), communication interfaces, environmental conditions, and software interface preferences. Leading suppliers respond with schematics, BOMs, and firmware specifications within 5–7 business days.