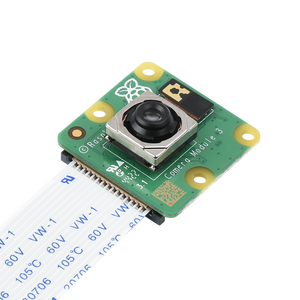

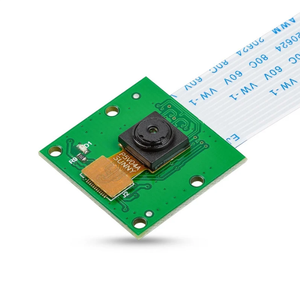

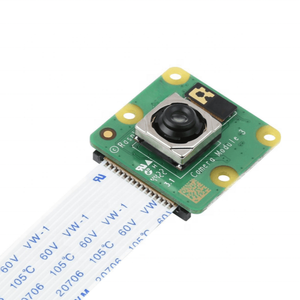

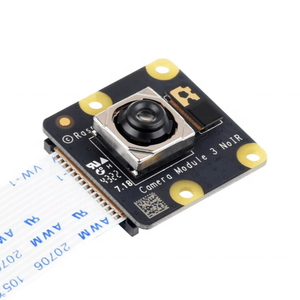

Raspberry Pi Camera Module 3

0

0

1/3

1/3

0

0

1/1

1/1

1/1

1/1

1/13

1/13

1/13

1/13

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/31

1/31

1/3

1/3

1/11

1/11

1/3

1/3

1/3

1/3

1/1

1/1

1/2

1/2

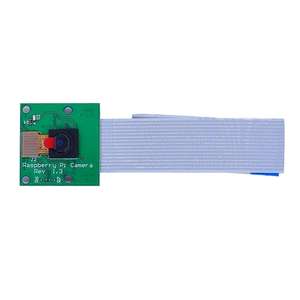

About raspberry pi camera module 3

Where to Find Raspberry Pi Camera Module 3 Suppliers?

China maintains a dominant position in the production of embedded imaging solutions, with key supplier clusters concentrated in Shanghai, Wuhan, and Shenzhen. These regions host vertically integrated electronics manufacturing ecosystems specializing in compact camera modules for single-board computing platforms. Shanghai-based suppliers leverage proximity to semiconductor packaging facilities and MIPI-CSI2 interface component inventories, enabling rapid prototyping and assembly. Wuhan and Shenzhen contribute through high-density SMT lines and automated optical inspection systems, supporting consistent yield rates above 95% for small-form-factor sensor arrays.

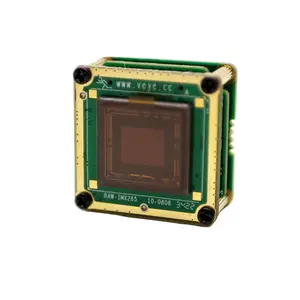

The industrial advantage lies in localized access to image sensor die (e.g., Sony IMX708), lens assemblies, and flex PCB suppliers within 50km radii. This integration reduces material lead times by 40–60% compared to offshore alternatives. Suppliers in these zones typically operate multi-line production setups capable of monthly outputs exceeding 10,000 units per model, with cycle times optimized for batch processing of autofocus, infrared, and wide-angle variants. Buyers benefit from scalable MOQs, ranging from one-off samples to bulk container shipments, supported by mature export logistics networks.

How to Choose Raspberry Pi Camera Module 3 Suppliers?

Procurement decisions should be guided by structured evaluation criteria:

Technical Compatibility Verification

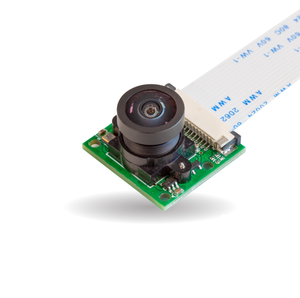

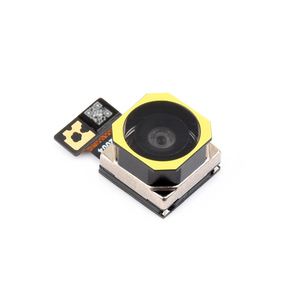

Confirm alignment with Raspberry Pi Foundation specifications, including support for 12MP resolution, IMX708 sensor integration, and MIPI CSI-2 interface compliance. For specialized applications—such as low-light vision or machine vision—verify inclusion of HDR, global shutter, or IR-cut filter features. Request test reports on signal integrity, thermal performance, and focus calibration accuracy.

Production and Quality Assurance Audit

Assess operational capacity based on the following benchmarks:

- Minimum facility size supporting dedicated SMT and testing stations

- In-house firmware flashing and functional testing protocols

- Use of automated optical inspection (AOI) and burn-in testing

Cross-reference on-time delivery performance (target ≥90%) and response time (ideally ≤3 hours) as indicators of operational efficiency.

Transaction and Risk Mitigation Protocols

Utilize secure payment mechanisms such as escrow services for initial orders. Prioritize suppliers with documented quality management practices, even if formal ISO 9001 certification is not listed. Conduct sample evaluations focusing on mechanical fit, image quality under varying lighting, and driver compatibility across Raspberry Pi OS versions. Verify labeling, packaging standards, and ESD-safe handling procedures prior to full-scale procurement.

What Are the Best Raspberry Pi Camera Module 3 Suppliers?

| Company Name | Main Products (Listings) | Online Revenue | On-Time Delivery | Response Time | Reorder Rate | Min. Order Flexibility | Price Range (USD) |

|---|---|---|---|---|---|---|---|

| Shanghai Belite Technology Co., Ltd. | Camera Modules (411) | US $50,000+ | 82% | ≤2h | <15% | 1 piece to 1 acre* | $27–138 |

| Shanghai Xuanxin Technology Co., Ltd. | Development Boards, Kits (1202) | US $30,000+ | 90% | ≤5h | 23% | 1 piece | $19.72–161.49 |

| EASENEX INTERNATIONAL LIMITED | Development Boards, Kits (104) | US $40,000+ | 96% | ≤3h | 27% | 1 piece | $3.11–17.87 |

| Wuhan Aismartlink Intelligent Technology Co., Ltd. | Development Boards, Kits (1621) | US $140,000+ | 100% | ≤4h | 19% | 2 pieces | $2.80–51.50 |

| Lixinc Electronics Co., Limited | Drones Accessories (1751) | US $70,000+ | 88% | ≤2h | 25% | 5–10 pieces | $3.50–49.88 |

Performance Analysis

Wuhan Aismartlink leads in reliability with a 100% on-time delivery rate and the highest reported online revenue, indicating strong order fulfillment scalability. EASENEX INTERNATIONAL LIMITED demonstrates high customer retention (27% reorder rate) and competitive pricing, with some listings offering units below $10. Shanghai-based firms exhibit fast response times, though Belite’s unusually high "1 acre" minimum order suggests potential data inconsistency or non-standard listing practices. Suppliers like Xuanxin and Aismartlink offer broad technical variety, including IMX708 autofocus and infrared models, suitable for both consumer and industrial applications. For prototype-stage buyers, prioritize suppliers supporting 1-piece MOQs; for volume production, assess consistency across multi-unit batches and logistics readiness.

FAQs

How to verify Raspberry Pi camera module supplier reliability?

Cross-check product specifications against official Raspberry Pi documentation. Request evidence of compatibility testing, including boot verification and image capture logs. Analyze transaction metrics such as on-time delivery rate, response speed, and reorder frequency as proxies for service consistency.

What is the typical sampling timeline?

Standard sample processing takes 3–7 days, depending on customization level. Add 5–10 days for international air shipping. Suppliers with in-house programming capability can deliver pre-flashed modules ready for immediate integration.

Can suppliers accommodate custom modifications?

Yes, many suppliers support lens type swaps (e.g., fisheye, telephoto), fixed-focus adjustments, and cable length modifications. Firmware-level changes, such as exposure tuning or HDR enablement, require technical collaboration and may involve NRE fees for development and validation.

What are common MOQ and pricing structures?

MOQ ranges from 1 piece for standard models to 10+ units for cost-sensitive configurations. Unit prices vary significantly based on sensor type: basic 5MP modules start at $3, while 12MP IMX708 autofocus variants range from $27–$50. Volume discounts are typically available beyond 100 units.

How to ensure quality in bulk orders?

Implement pre-shipment inspection protocols, including random sampling for visual defects, focus accuracy, and electrical functionality. Require AOI and burn-in test records. Use third-party inspection services for orders exceeding 1,000 units to mitigate defect risks.