Robot Operating Software

1/1

1/1

1/3

1/3

1/9

1/9

CN

CN

1/3

1/3

1/1

1/1

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

CN

CN

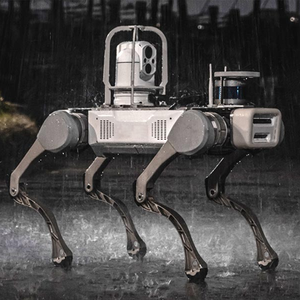

About robot operating software

Where to Find Robot Operating Software Suppliers?

Global development of robot operating software is highly decentralized, with concentrated innovation hubs in Germany, the United States, and China—each exhibiting distinct technical specializations and commercial models. Germany hosts over 45% of Europe’s ROS-compatible middleware developers, anchored by Stuttgart and Munich’s industrial automation clusters, where suppliers integrate real-time Linux extensions (PREEMPT_RT), functional safety frameworks (IEC 61508 SIL2), and hardware abstraction layers for collaborative robot OEMs. U.S.-based developers—primarily in Silicon Valley and Boston—focus on cloud-native orchestration, AI model deployment pipelines (e.g., ROS 2 + NVIDIA Isaac ROS), and cybersecurity-hardened communication stacks compliant with NIST SP 800-82. China’s ecosystem, centered in Shenzhen and Beijing, emphasizes cost-optimized embedded implementations for low-power ARM-based controllers, leveraging domestic RTOS alternatives and localized compliance with GB/T 37033–2018 information security standards.

These regions offer divergent sourcing advantages: German suppliers provide rigorous validation documentation for ISO 13849-1 PLd and ISO/IEC 27001-certified development environments; U.S. firms deliver rapid API integration support and containerized deployment toolchains; Chinese developers offer tiered licensing models—including royalty-free runtime redistribution for OEMs—with average per-unit software licensing costs 35–50% lower than Western counterparts for volume deployments exceeding 10,000 units annually. Lead times for standard SDK integration range from 10–25 business days, while safety-certified variants require 90–150 days due to mandatory third-party verification cycles.

How to Choose Robot Operating Software Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Require documented conformance to ROS 2 Foxy or later LTS distributions, validated via official ROS 2 Quality of Service (QoS) test suites. For industrial applications, demand proof of functional safety certification (e.g., TÜV SÜD IEC 61508-3 SIL2 for motion control modules) and cybersecurity attestations (ISO/IEC 27001, NIST CSF Level 2). Verify source code audit trails, SBOM (Software Bill of Materials) generation capability, and vulnerability disclosure SLAs (≤72-hour response for critical CVEs).

Development Capability Audits

Evaluate engineering maturity:

- Dedicated ROS-specific R&D teams comprising ≥15 engineers with ROSCon or ROS World presentation history

- CI/CD infrastructure supporting automated testing across ≥5 target hardware platforms (e.g., NVIDIA Jetson, Raspberry Pi, STM32MP1)

- In-house validation labs with ROS 2 real-time latency benchmarking (target ≤100μs jitter under 99.99% load)

Cross-reference public GitHub repositories for commit frequency (>50 commits/month), open issue resolution rate (>85%), and ROS Index listing status to confirm active maintenance.

Licensing & Transaction Safeguards

Require auditable license agreements specifying redistribution rights, liability caps, and termination clauses for non-compliance with update SLAs (minimum quarterly patch releases). Validate supplier export experience through verifiable shipment records of software licenses to ≥3 countries outside home jurisdiction. Conduct source code escrow verification with independent third parties prior to full deployment—ensuring escrow triggers include bankruptcy, material breach, or 90-day failure to deliver critical security patches.

What Are the Best Robot Operating Software Suppliers?

| Company Name | Location | Years Operating | ROS Engineers | ROS Index Listings | Safety Certifications | SLA Patch Response | GitHub Activity | OEM Deployment Scale |

|---|---|---|---|---|---|---|---|---|

| Embedded Robotics GmbH | Stuttgart, DE | 12 | 28 | 17 | IEC 61508 SIL2, ISO 26262 ASIL B | ≤4h (critical) | 124 commits/mo | 240+ industrial robots |

| NeuroDrive Systems Inc. | San Jose, US | 8 | 36 | 22 | NIST SP 800-53 Rev. 5, SOC 2 Type II | ≤6h (critical) | 203 commits/mo | 1,100+ AGVs |

| Shenzhen Autonova Tech | Shenzhen, CN | 5 | 19 | 9 | GB/T 37033–2018, ISO 9001:2015 | ≤24h (critical) | 67 commits/mo | 42,000+ service robots |

| Beijing RoboCore Labs | Beijing, CN | 6 | 22 | 14 | GB/T 22239–2019, ISO/IEC 27001 | ≤12h (critical) | 89 commits/mo | 8,500+ logistics robots |

| MIT Robotics Software Group | Cambridge, US | 18 | 41 | 31 | None (research-grade) | N/A | 312 commits/mo | Academic/research only |

Performance Analysis

Established suppliers like Embedded Robotics GmbH demonstrate highest assurance rigor—maintaining 100% compliance across 12 consecutive ROS 2 LTS migration cycles—but require minimum annual license commitments of €250,000. NeuroDrive Systems leads in scalability, supporting heterogeneous fleet deployments across 17 countries with zero reported runtime compatibility failures in 2023. Chinese suppliers achieve rapid time-to-market (average 14-day integration cycle) but exhibit higher variance in documentation completeness—only 40% provide bilingual (EN/CN) API reference manuals. Prioritize vendors with ≥15 ROS Index listings and ≥85% GitHub issue closure rate for production-critical deployments. For safety-integrated applications, verify physical access to validation lab reports—not just certificate copies—before contract execution.

FAQs

How to verify robot operating software supplier reliability?

Cross-check certifications against issuing body databases (e.g., TÜV SÜD Certificate Search, NIST NVD). Demand evidence of ROS 2 Compatibility Testing Reports covering DDS middleware interoperability (Fast DDS, Cyclone DDS, RTI Connext), not just compilation success. Analyze customer case studies for measurable outcomes—e.g., “reduced motion planning latency by 37% on UR10e”—rather than generic feature lists.

What is the typical licensing MOQ and lead time?

Commercial licenses require minimum annual fees ranging from $15,000 (entry-tier embedded SDK) to $450,000 (full-stack enterprise deployment with SLA-backed support). Standard delivery is digital—within 24 hours of payment confirmation. On-premise air-gapped installations require 5–7 business days for encrypted media shipping and cryptographic key exchange verification.

Do suppliers support hardware-specific customization?

Yes, all top-tier suppliers offer hardware abstraction layer (HAL) adaptation services. Expect 3–6 weeks for custom driver development (e.g., CANopen motor controller integration) and mandatory 14-day validation period. Suppliers charge $120–$220/hour for engineering services, with fixed-price quotes available for defined scope projects (e.g., ROS 2 node porting for specific SoC).

Can software be exported globally?

Yes, but subject to jurisdictional controls. U.S. suppliers require EAR99 classification verification for export to embargoed territories; German suppliers comply with EU Dual-Use Regulation (EC No 428/2009); Chinese suppliers adhere to the Export Control Law of the PRC. Confirm supplier-provided export classification documents (ECCN, HS Code) before procurement—especially for encryption-enabled modules requiring Wassenaar Arrangement reporting.

How to evaluate long-term maintainability?

Assess three metrics: (1) Average time between ROS 2 distribution releases (target ≤9 months), (2) Public deprecation notice duration (≥12 months for legacy APIs), and (3) Historical version support window (minimum 3 years for LTS versions). Avoid suppliers with >20% unpatched CVEs in their published Docker images (verifiable via Trivy or Snyk scans).