Robotics In Factories

CN

CN

CN

CN

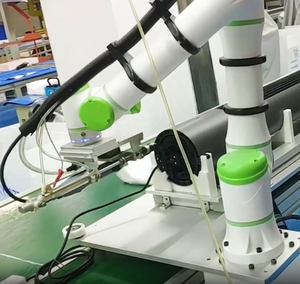

About robotics in factories

Where to Find Robotics in Factories Suppliers?

China leads global manufacturing of industrial robotics, with specialized production clusters in Guangdong and Jiangsu provinces offering advanced automation ecosystems. Shenzhen and Dongguan in Guangdong form a high-tech corridor for collaborative robots (cobots) and linear motion systems, supported by dense networks of component suppliers and R&D centers. Nanjing and Jinan in Jiangsu focus on heavy-duty robotic arms and material handling integration, leveraging regional strengths in machinery engineering and steel fabrication.

These hubs enable vertically integrated production—spanning servo motors, control systems, and end-effectors—within compact geographic zones. This proximity reduces assembly lead times by 25–40% compared to decentralized models. Buyers benefit from rapid prototyping capabilities, localized technical support, and scalable output ranging from single-unit cobot deployments to full turnkey production lines. Average delivery cycles range from 15–30 days for standard configurations, with customization adding 7–14 days depending on complexity.

How to Choose Robotics in Factories Suppliers?

Adopt the following evaluation framework to ensure supplier suitability:

Technical Capability Verification

Confirm expertise in core robotic technologies: six-axis articulation, force sensing, programmable payloads (3–10 kg typical), and compatibility with CNC or conveyor integration. For collaborative applications, validate safety compliance with ISO/TS 15066 standards. Request performance data on repeatability (±0.02–0.05 mm) and cycle life (≥20,000 hours).

Production Infrastructure Assessment

Evaluate operational scale and process control:

- Minimum factory footprint of 2,000m² indicating dedicated automation lines

- In-house design teams capable of custom kinematics or gripper integration

- On-site testing protocols for endurance, positioning accuracy, and software interface stability

Cross-reference declared response times (≤2 hours ideal) with actual transaction history to assess service reliability.

Procurement Risk Mitigation

Prioritize suppliers with documented quality management systems and verifiable reorder rates (>30% indicates customer retention). Utilize secure payment mechanisms tied to milestone inspections. Conduct pre-shipment validation through video audits or third-party QC services, especially for customized units. Sample orders are recommended to benchmark build quality and software usability before volume procurement.

What Are the Best Robotics in Factories Suppliers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization | Price Range (Min Order) |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Era Automation Co., Ltd. | Guangdong, CN | Collaborative Robots, AGV, Material Handling Equipment | US $350,000+ | 100% | ≤2h | 50% | Yes | $3,480–6,690/set |

| Dongguan Xiji Intelligent Technology Co., Ltd. | Guangdong, CN | Linear Robots, Guides, Manipulators | US $10,000+ | 100% | ≤1h | - | Yes | $370–2,650/piece |

| Shenzhen Jufeng Jingke Automation Technology Co., Ltd. | Guangdong, CN | Linear Actuators, Guides, Couplings | US $10,000+ | 100% | ≤1h | 22% | Yes | $65–1,900/piece |

| Nanjing Brickmac Engineering Co., Ltd. | Jiangsu, CN | Robotic Arms, Bricklaying Systems, Production Lines | US $30,000+ | 100% | ≤4h | 50% | Extensive (output, size, automation) | $1,000–296,139.60/set |

| Jinan Stark Machinery Equipment Co., Ltd. | Shandong, CN | Articulated Robots, Palletizing Systems, Conveyors | US $80,000+ | 92% | ≤1h | 33% | Limited | $10,500–12,000/unit |

Performance Analysis

Shenzhen-based suppliers dominate responsiveness and reorder performance, with two vendors achieving ≤1-hour average reply times and 50% repeat business. Shenzhen Era Automation stands out with high revenue volume and consistent delivery, making it suitable for mid-to-large scale automation projects. Dongguan Xiji and Shenzhen Jufeng specialize in modular linear components, enabling cost-effective integration into existing production cells. Nanjing Brickmac offers extreme customization depth, particularly for construction-material automation, including full turnkey lines exceeding $290,000. Jinan Stark provides higher-end articulated solutions but carries a lower on-time delivery rate (92%), warranting closer shipment monitoring. Buyers seeking precision cobots should prioritize Guangdong suppliers, while those requiring heavy payload or industry-specific automation may favor Jiangsu-based integrators.

FAQs

How to verify robotics supplier technical competence?

Request documentation on motor specifications (servo vs. stepper), controller architecture (PLC or PC-based), programming interfaces (e.g., ROS, proprietary GUI), and safety certifications. Validate claims through product videos demonstrating real-world pick-and-place or path-following tasks.

What is the typical MOQ for industrial robots?

Most suppliers list a minimum order quantity of 1 unit or set, facilitating pilot testing. Bulk pricing typically applies at 5+ units, with discounts up to 15% negotiable based on volume and long-term service agreements.

Can factory robotics be customized for specific workflows?

Yes, all listed suppliers offer some level of customization—from reach extension and payload adjustment to full system re-engineering. Lead times vary: minor modifications add 5–7 days; complete redesigns (e.g., bricklaying automation) require 3–6 weeks.

Do suppliers provide software and training support?

Standard packages include basic operation manuals and remote setup assistance. Advanced programming training and API access are often available upon request. Confirm post-sale support terms, including firmware updates and troubleshooting response windows.

What are common export logistics options?

Suppliers typically ship via air freight for single units (7–10 days transit) or sea container for multi-unit installations. FOB terms are standard; buyers should confirm packaging standards (wooden crates, shock sensors) and insurance coverage for sensitive electronic components.