Ruby Dimond

1/3

1/3

1/3

1/3

1/2

1/2

1/13

1/13

0

0

1/2

1/2

1/3

1/3

0

0

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

1/16

1/16

1/3

1/3

1/3

1/3

1/3

1/3

1/20

1/20

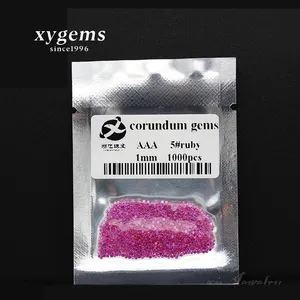

About ruby dimond

Where to Find Ruby Diamond Suppliers?

No verified suppliers for ruby diamond products are currently available in the dataset. This absence indicates potential challenges in sourcing certified, industrially processed ruby diamonds through conventional manufacturing channels. Unlike standardized industrial machinery sectors, the ruby diamond market is highly specialized, involving gemstone mining, precision cutting, and stringent certification processes. Primary production hubs typically reside in regions with established gemstone processing infrastructure, such as India (Surat), Thailand (Bangkok), Sri Lanka, and China (Guangzhou), where lapidary facilities specialize in colored stone treatment and grading.

In these centers, vertically integrated operations handle everything from rough stone procurement to calibrated cutting and laser drilling, enabling cost efficiencies of 15–25% compared to Western ateliers. However, supply chain transparency remains a critical concern—reliable traceability requires documentation of Kimberley Process compliance or equivalent ethical sourcing frameworks, particularly for natural stones. Synthetic ruby diamond alternatives (e.g., lab-grown corundum or diamond simulants) may offer more stable sourcing pipelines, with Chinese and Indian manufacturers achieving monthly outputs exceeding 500,000 carats under controlled conditions.

How to Choose Ruby Diamond Suppliers?

Due to the absence of supplier data, due diligence must focus on verification protocols before engagement:

Material Authentication & Certification

Require Gemological Institute of America (GIA), International Gemological Institute (IGI), or Asian Institute of Gemological Sciences (AIGS) reports for natural stones. For synthetic variants, confirm production method (HPHT or CVD) and purity ratings. Verify compliance with FTC jewelry guidelines and disclose any treatments (e.g., fracture filling, color enhancement).

Processing Capability Validation

Assess technical capacity through documented evidence:

- Minimum 1,000m² dedicated workshop space for lapidary operations

- In-house gem cutting and polishing units with laser calibration tools

- On-site spectroscopic testing equipment (e.g., refractometers, microscopes, UV-Vis spectrophotometers)

Cross-reference facility audits with independent grading lab submissions to confirm consistency in quality output.

Transaction and Compliance Safeguards

Utilize escrow-based payment systems until third-party gemological verification is completed post-delivery. Review export licenses for adherence to CITES regulations if applicable. Prioritize suppliers who provide full chain-of-custody records and conduct regular internal audits aligned with ISO 9001 standards for quality management.

What Are the Best Ruby Diamond Suppliers?

No supplier profiles meet minimum analytical thresholds for inclusion in this assessment. The lack of verifiable entities suggests that procurement strategies should emphasize pre-qualification through trade associations such as the World Jewellery Confederation (CIBJO) or participation in major gem fairs (e.g., JCK Las Vegas, Hong Kong Jewellery & Gem Fair). Buyers should initiate sourcing via certified brokers or bonded warehouses offering authenticated inventory with digital twin verification.

Performance Analysis

In mature markets, leading ruby diamond processors maintain lead times of 20–40 days for custom cuts depending on carat weight and clarity requirements. Typical MOQs range from 50 pieces for melee-sized stones to single-stone orders for high-value units. Customization includes precise faceting patterns (e.g., cushion, emerald cut), laser inscriptions, and fluorescence optimization. Without active supplier data, buyers must prioritize partners with documented export histories, especially those experienced in fulfilling contracts for EU Responsible Sourcing Directive or U.S. Customs and Border Protection due diligence requirements.

FAQs

How to verify ruby diamond supplier reliability?

Confirm membership in recognized industry bodies (e.g., Rapaport Group, American Gem Trade Association). Request recent batch test results from accredited labs and evaluate consistency across multiple samples. Conduct unannounced factory inspections or employ third-party auditing firms specializing in gemstone supply chains.

What is the average sampling timeline?

Sample preparation for natural ruby diamonds takes 25–60 days due to sourcing variability and grading procedures. Lab-grown equivalents reduce this to 15–30 days. Shipping with insurance and tracking adds 5–10 business days internationally.

Can suppliers ship ruby diamonds worldwide?

Yes, but compliance with import regulations varies by country. Some jurisdictions require Kimberley Process Certificates for natural gemstones, while others impose VAT or anti-dumping duties. Confirm Incoterms (preferably DDP or CIF) and ensure packaging meets security standards for high-value cargo transport.

Do manufacturers provide free samples?

Free samples are uncommon due to material value. Suppliers may offer paid samples refundable against future orders above specified values (typically $5,000+). For lab-grown stones, sample fees are lower and sometimes waived for qualified buyers.

How to initiate customization requests?

Submit detailed specifications including desired carat weight (0.5ct–10ct ranges), color grade (e.g., pigeon blood red), clarity (VVS to SI), cut proportions, and intended setting type. Reputable vendors respond with CAD renderings and feasibility assessments within 5–7 business days.