Scaffolding Material

Top sponsor listing

Top sponsor listing

0

0

1/10

1/10

1/7

1/7

1/3

1/3

1/22

1/22

1/16

1/16

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/15

1/15

1/17

1/17

0

0

1/23

1/23

1/8

1/8

1/25

1/25

CN

CN

1/7

1/7

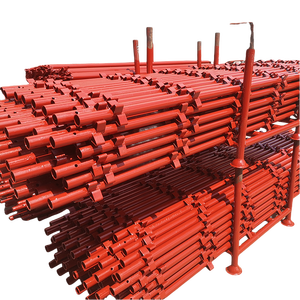

About scaffolding material

Where to Find Scaffolding Material Suppliers?

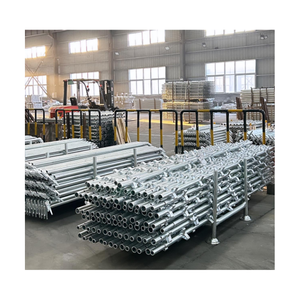

China remains the dominant global hub for scaffolding material manufacturing, with key production clusters concentrated in Hebei and Shandong provinces. These regions benefit from integrated steel supply chains, proximity to major ports like Tianjin and Qingdao, and mature industrial ecosystems specializing in construction-grade metal fabrication. Hebei alone accounts for over 40% of China’s scaffold component output, leveraging low-cost access to Q235 and Q345 structural steel, which reduces raw material expenses by 15–25% compared to international alternatives.

The region’s vertically integrated facilities support full-cycle production—from galvanization lines to precision welding and CNC cutting—enabling rapid turnaround for both standard and engineered systems. Buyers gain logistical advantages through centralized supplier networks where logistics providers, metallurgical labs, and packaging services operate within tight geographic radii. This integration translates into lead times averaging 20–35 days for containerized orders, with scalability for bulk shipments exceeding 50 tons per month. The presence of dedicated export channels ensures compliance-ready documentation for markets in Australia, the EU, and North America.

How to Choose Scaffolding Material Suppliers?

Selecting reliable suppliers requires systematic evaluation across technical, operational, and transactional dimensions:

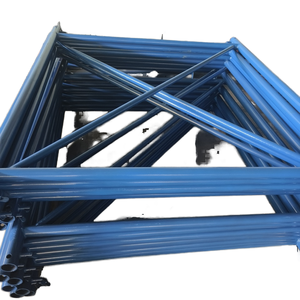

Material & Structural Compliance

Verify adherence to international standards such as BS EN 12811 (scaffold design), ASTM A123 (galvanization), and AS/NZS 1576 (Australian scaffolding systems). Confirm use of Q235 or equivalent yield-strength steel for load-bearing components. Request mill test certificates (MTCs) for raw materials and third-party inspection reports for weld integrity and coating thickness (minimum 80µm for hot-dip galvanized finishes).

Production Capacity Assessment

Evaluate core infrastructure indicators:

- Minimum factory footprint of 3,000m² to support batch processing

- In-house galvanizing, punching, and automated welding capabilities

- Dedicated quality control stations with tensile testing equipment

Cross-reference declared capacities with verified on-time delivery performance (target ≥95%) and reorder rates to assess operational stability.

Customization & Transaction Security

Prioritize suppliers offering configurable options for tube diameter (48.3mm standard), length tolerances, paint/galvanization types, and labeling. Ensure digital drawing submission (DWG/PDF) and sample prototyping are available. Utilize secure payment mechanisms with milestone-based releases tied to shipment milestones. Conduct pre-shipment inspections via third-party auditors to validate product conformity.

What Are the Best Scaffolding Material Suppliers?

| Company Name | Location | Verified Type | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options |

|---|---|---|---|---|---|---|---|---|

| Jinan Gradin Machinery Co., Ltd. | Shandong, CN | Custom Manufacturer | Lift Tables, Scissor Lifts, Boom Lifts, Material Handling Equipment | US $140,000+ | 100% | ≤2h | <15% | Color, size, logo, label, graphic |

| Hebei Derfon Building Materials Co., Ltd. | Hebei, CN | - | Scaffoldings, Ladders, Formwork, Metal Building Materials | US $210,000+ | 80% | ≤4h | 46% | - |

| Hebei Nuohua Building Materials Co., Ltd. | Hebei, CN | Multispecialty Supplier | Scaffold Planks, Props, H-Frame Systems, Peri-Formwork | US $10,000+ | 100% | ≤1h | <15% | Color, material, size, packaging, logo, graphic |

| Jet Scaffold Material Co., Ltd. | - | - | Ringlock, Frame Scaffolding, Steel Props, Galvanized Planks | US $160,000+ | 100% | ≤4h | 16% | Wheels, galvanization thickness, paint, locks, scaffold drawing, dimensions |

| Guangzhou EK Building Materials Co., Ltd | Guangdong, CN | Multispecialty Supplier | Acro Props, Couplers, Quickstage Scaffolds, Second-hand Materials | US $60,000+ | 100% | ≤2h | <15% | Size, graphic |

Performance Analysis

Suppliers like Jinan Gradin and Jet Scaffold demonstrate strong engineering integration with extensive customization capabilities and high-volume output. Hebei Derfon stands out for its higher reorder rate (46%), indicating customer satisfaction despite a lower on-time delivery score (80%). Hebei Nuohua excels in responsiveness (≤1h average reply time) and flexibility, supporting fast-turnaround requests for niche configurations. All top-tier suppliers maintain 100% on-time delivery records except Derfon, suggesting potential bottlenecks in order prioritization. Buyers seeking Australian-compliant Quickstage or NZ-spec Layher-style systems should verify compatibility through technical drawings prior to procurement.

FAQs

How to verify scaffolding material supplier reliability?

Cross-check ISO 9001 certification status and request evidence of product testing under EN or ASTM standards. Review transaction history focusing on dispute resolution outcomes and post-delivery feedback. Conduct virtual factory audits to confirm automation levels and QC checkpoints.

What is the typical MOQ and pricing range?

Minimum order quantities vary: couplers and planks start at 50 pieces ($0.12–$0.30/unit), while full scaffold sets begin at 10–20 sets ($7.50–$35/set). Larger structural components like ringlock systems may require tonnage-based orders (e.g., 27 tons at $1,150/lot). Bulk discounts apply above 5-ton shipments.

Do suppliers offer custom branding and packaging?

Yes, multiple suppliers provide OEM services including laser logo engraving, color-coded painting, labeled bundles, and branded cartons. Lead time increases by 5–7 days for customized labeling and packaging setups.

Can used or recycled scaffolding materials be sourced?

Some suppliers, such as Guangzhou EK, offer second-hand galvanized scaffolding with refurbished couplers and beams. These are typically inspected for structural integrity and sold at 40–60% below new unit prices. Suitable for short-term projects but not recommended for high-load applications without independent assessment.

What are standard lead times and shipping options?

Production lead time ranges from 20–30 days for standard orders. Sea freight remains optimal for full-container loads (20FT or 40HQ), with transit times of 12–25 days depending on destination. Air freight is viable only for urgent samples due to weight constraints and cost inefficiency.