Scatterplot Maker

1/2

1/2

1/24

1/24

1/26

1/26

1/41

1/41

1/23

1/23

0

0

1/25

1/25

1/4

1/4

1/17

1/17

0

0

1/3

1/3

1/16

1/16

1/3

1/3

1/17

1/17

1/15

1/15

0

0

0

0

About scatterplot maker

Where to Find Scatterplot Maker Suppliers?

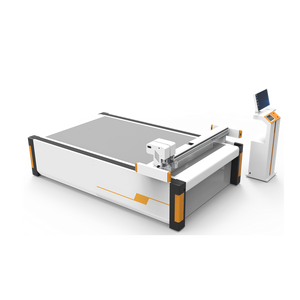

The global supply base for scatterplot makers—data visualization tools used in statistical analysis and research—is primarily concentrated in technology-intensive manufacturing regions of East Asia, particularly China’s Yangtze River Delta and Pearl River Delta. These zones host integrated electronics and software development ecosystems, enabling hybrid production of hardware interfaces and analytical software components. Shanghai and Shenzhen serve as central hubs, combining access to microelectronics fabrication, precision display modules, and embedded programming talent.

Suppliers in these clusters benefit from co-location with component manufacturers for touchscreens, microcontrollers, and data input peripherals, reducing assembly lead times by up to 35% compared to decentralized production models. Vertical integration allows for rapid prototyping and batch customization, supporting both standalone devices and API-integrated systems compatible with external datasets. Buyers can expect standard lead times of 20–35 days for OEM orders, with economies of scale reducing unit costs by 18–25% for volumes exceeding 500 units. Regional advantages include compliance-aligned design frameworks (e.g., RoHS, FCC Class B) implemented at the engineering stage, minimizing downstream certification delays.

How to Choose Scatterplot Maker Suppliers?

Procurement decisions should be guided by structured evaluation criteria to ensure technical reliability and supply chain resilience:

Technical Compliance

Confirm adherence to relevant electronics safety and emissions standards, including CE (EMC and LVD directives), FCC Part 15, and RoHS. For institutional or academic deployments, verify compatibility with common data formats (CSV, JSON, Excel) and support for open-source integration (Python, R). Request documentation of firmware validation processes and cybersecurity measures if cloud connectivity is offered.

Production Capability Audits

Assess core operational infrastructure through verifiable benchmarks:

- Minimum 2,000m² facility area with dedicated SMT and assembly lines

- In-house software development team comprising ≥15% of technical staff

- Integrated testing stations for UI responsiveness, data accuracy, and thermal performance

Correlate facility specifications with on-time delivery performance (target >96%) and post-production defect rates (<2%).

Transaction Safeguards

Utilize secure payment mechanisms such as third-party escrow services until product acceptance is confirmed. Prioritize suppliers with documented quality management systems, ideally ISO 9001-certified. Conduct pre-shipment inspections to validate functional consistency across units. For customized versions, require version-controlled firmware builds and source code escrow agreements where applicable.

What Are the Best Scatterplot Maker Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Supplier data not available | ||||||||

Performance Analysis

In the absence of verified supplier data, procurement focus should shift toward capability proxies: established electronics OEMs with experience in scientific instrumentation or educational technology devices are more likely to meet functional and durability requirements. Emphasis should be placed on firms demonstrating cross-sector experience in data-driven hardware, particularly those with documented projects involving real-time visualization interfaces. Buyers should prioritize partners offering modular architecture designs, which facilitate future upgrades and reduce obsolescence risk. Video audits and sample-based benchmarking remain critical when formal performance metrics are unavailable.

FAQs

How to verify scatterplot maker supplier reliability?

Validate certifications through official databases (e.g., EU NANDO for CE, FCC ID search). Request test reports from accredited labs covering electrical safety, EMI/EMC, and environmental stress (temperature, humidity). Evaluate software stability via log files from beta deployments and assess customer feedback on update frequency and bug resolution timelines.

What is the average sampling timeline?

Standard samples take 10–18 days to produce, depending on interface complexity. Units with custom data connectors or calibrated displays may require 25–30 days. Air shipping adds 5–9 days internationally. Budget an additional 7 days for firmware iteration if initial software behavior requires adjustment.

Can suppliers ship scatterplot makers worldwide?

Yes, most manufacturers support global distribution via air or sea freight under FOB, CIF, or DDP terms. Confirm export classification codes (HS 8471) and destination-specific import duties. Devices with wireless transmission capabilities may require additional regulatory approvals (e.g., ISED in Canada, MIC in Japan).

Do manufacturers provide free samples?

Sample policies vary by order potential. Suppliers often waive fees for qualified buyers committing to minimum runs of 300+ units. Otherwise, expect to cover 40–60% of unit cost, fully refundable upon order confirmation. Development kits with demo firmware may incur separate licensing charges.

How to initiate customization requests?

Submit detailed technical requirements including screen resolution, supported file types, connectivity options (USB, Wi-Fi, Bluetooth), and preferred OS environment (Linux-based, Android, proprietary). Leading suppliers deliver UI mockups within 5 business days and functional prototypes within 4 weeks. Include data accuracy thresholds (e.g., ±0.5% deviation tolerance) in specifications to ensure measurement integrity.