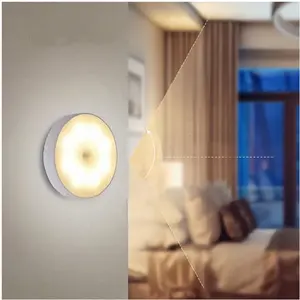

Sensor Led Producer

About sensor led producer

Where to Find Sensor LED Producers?

China remains the central hub for sensor-integrated LED manufacturing, with key production clusters in Guangdong and Shenzhen offering vertically integrated supply chains. These regions host specialized facilities combining LED optics, motion-sensing technology (PIR, infrared, touch induction), and compact circuit design under one roof. The proximity to component suppliers—particularly for IC controllers, sensors, and aluminum heat sinks—enables streamlined assembly and reduced material lead times by 10–15 days compared to offshore alternatives.

Manufacturers in these zones typically operate dedicated SMT lines and automated testing stations, supporting both high-volume OEM orders and low-MOQ custom configurations. Facilities average 2,000–5,000m², with many maintaining in-house R&D teams focused on energy efficiency, signal stability, and miniaturization. Buyers benefit from localized ecosystems where firmware programming, housing injection molding, and photometric validation occur within tightly controlled workflows, ensuring consistency across batches.

How to Choose Sensor LED Producers?

Apply the following evaluation criteria when selecting a supplier:

Technical & Quality Compliance

Verify adherence to international standards including CE, RoHS, and REACH for European markets, and FCC for North America. While not all suppliers list certifications explicitly, consistent product performance metrics—such as stable PIR detection ranges (typically 2–8 meters) and low power consumption (<1W standby)—indicate robust engineering practices. Request test reports covering lumen output, color temperature variance (±200K target), and sensor response cycles (minimum 50,000 operations).

Production Capability Assessment

Evaluate operational scale through available indicators:

- On-time delivery rates exceeding 95% reflect reliable logistics and inventory management

- Response times ≤2 hours suggest dedicated sales and technical support teams

- Monthly online transaction volumes above US $70,000 correlate with sustained production capacity

Prioritize suppliers advertising "own production line" capabilities, which reduce dependency on third-party sourcing and improve traceability.

Procurement Risk Mitigation

Leverage small-batch ordering (as low as 1–2 units) to validate product quality before scaling. Confirm return policies and defect resolution protocols upfront. Use secure payment methods with buyer protection, especially for initial transactions. For integration projects, request sample units with adjustable sensitivity or time-delay settings to assess field adaptability.

What Are the Leading Sensor LED Producers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order Flexibility |

|---|---|---|---|---|---|---|---|

| Guangzhou Sunjack Lighting Co., Ltd. | Guangzhou, CN | LED Driver, Cabinet Lights, LED Strips | US $150,000+ | 95% | ≤2h | 25% | 2 sets |

| Shenzhen Tuodi Electronics Co., Ltd. | Shenzhen, CN | Night Lights, Smart Home Lights, Inductive Switches | US $4,000+ | 100% | ≤1h | <15% | 2 pieces |

| Guangzhou Ilin-Lighting & Electrical Co., Ltd. | Guangzhou, CN | Cabinet Lights, Inductive Switches, Smart Strip Lights | US $110,000+ | 83% | ≤2h | 20% | 1 piece |

| Shenzhen Fitled Lighting Co., Ltd. | Shenzhen, CN | Cabinet Lights, Auto Interior Lighting, Desk Lamps | US $70,000+ | 96% | ≤3h | <15% | 20–50 pieces |

| Chunghop Electronics Ind Co., Ltd. | Shenzhen, CN | Night Lights, Smart Home Lights, LED Sensor Lights | US $3,000+ | 100% | ≤2h | - | 1–10 pieces |

Performance Analysis

Guangzhou- and Shenzhen-based producers demonstrate strong specialization in compact sensor LEDs for cabinetry, hospitality, and smart home applications. Guangzhou Sunjack leads in reorder volume and revenue, suggesting established export processes and consistent quality. Shenzhen Tuodi and Chunghop achieve perfect on-time delivery records, indicating disciplined order fulfillment despite smaller reported revenues. Notably, several suppliers offer MOQs as low as one piece—ideal for prototyping or niche integrations—though pricing scales inversely with volume. Customization is widely supported, particularly for voltage input (5V–24V DC), sensor type (PIR, proximity, touch), and mounting configuration.

FAQs

What is the typical lead time for sensor LED orders?

Standard orders ship within 7–15 days after confirmation. Custom designs with modified firmware or mechanical dimensions may require 20–30 days, depending on complexity. Air freight adds 5–10 days for international delivery.

Do sensor LED producers support customization?

Yes, most suppliers listed offer customization for voltage, sensing range, delay time, and physical form factor. Some provide PCB redesign or private labeling. Minimum order quantities for customized units typically start at 50–100 pieces, though sample adjustments can be tested at lower volumes.

Are samples available before bulk purchase?

Sample availability is common, often at slightly marked-up prices. Units are typically shipped within 3–7 days and can be ordered individually. This allows buyers to evaluate light output, sensor reliability, and build quality prior to full commitment.

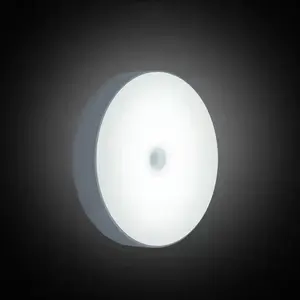

What materials are commonly used in sensor LED construction?

Housings are typically made from aluminum alloy for heat dissipation, ABS plastic for lightweight designs, or polycarbonate for impact resistance. Internal components include PIR sensors, IR receivers, and surface-mounted LEDs (SMD 2835 or 3528). Flexible printed circuits are standard in strip-style sensor lights.

How to assess long-term reliability of sensor LEDs?

Evaluate mean time between failures (MTBF) data if available, targeting >50,000 hours for LED lifespan and >30,000 cycles for sensor actuation. Conduct field tests under variable ambient temperatures (−10°C to 50°C) and humidity levels. Monitor false trigger rates in high-traffic or electromagnetically noisy environments.