Server In Computer Science

Top sponsor listing

Top sponsor listing

1/38

1/38

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

1/2

1/2

1/1

1/1

CN

CN

1/2

1/2

1/3

1/3

CN

CN

1/14

1/14

1/2

1/2

0

0

1/3

1/3

1/1

1/1

1/3

1/3

About server in computer science

Where to Find Server Hardware Suppliers?

The global server hardware manufacturing landscape is highly concentrated, with key production hubs in Guangdong and Jiangsu provinces, China, accounting for over 70% of Asia’s commercial and enterprise-grade server output. Guangdong, led by Shenzhen and Dongguan, specializes in high-density data center solutions, leveraging proximity to semiconductor suppliers and advanced SMT (Surface Mount Technology) assembly lines. Jiangsu’s Suzhou and Wuxi clusters focus on rack-mounted and blade servers, benefiting from integration with domestic memory and storage module producers, reducing component procurement lead times by 25-40% compared to non-integrated regions.

These industrial ecosystems support vertical integration across PCB fabrication, power supply assembly, thermal management systems, and final testing. Suppliers within these zones typically operate within tightly coordinated networks—component vendors, firmware developers, and logistics providers are often located within 30–50km, enabling rapid prototyping and scalable production. Buyers benefit from reduced time-to-market, with standard order fulfillment averaging 20–35 days for MOQs of 50+ units, and cost advantages of 18–30% due to optimized supply chains and lower labor overheads. Custom configurations—including OEM branding, BIOS modifications, and specialized cooling—are routinely supported without significant lead time penalties.

How to Choose Server Hardware Suppliers?

Implement structured evaluation protocols to ensure technical and operational reliability:

Quality & Compliance Verification

Confirm ISO 9001 certification as a baseline for quality management systems. For international deployments, verify adherence to IEC 60950-1 (safety), FCC Part 15 Class A (EMI), and RoHS compliance for environmental standards. Request test reports for critical subsystems: power efficiency (80 PLUS certification), thermal performance under load, and MTBF (Mean Time Between Failures) validation for chassis and drives.

Production Capacity Assessment

Evaluate supplier infrastructure using the following benchmarks:

- Minimum 3,000m² factory area with dedicated clean-room assembly zones

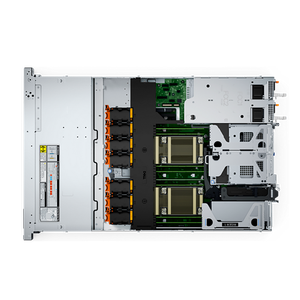

- In-house capabilities for PCB assembly, firmware flashing, and system burn-in testing

- R&D teams comprising at least 8% of total staff to support customization

Correlate facility size with verified monthly output (target ≥500 units) and on-time delivery performance (benchmark >97%) to assess scalability and consistency.

Procurement Risk Mitigation

Utilize secure transaction models such as third-party escrow or letter of credit (L/C) terms for initial orders. Review supplier export history, particularly shipments to North America, EU, and Southeast Asia, to confirm experience with regional regulatory requirements. Pre-shipment inspection through independent agencies (e.g., SGS, BV) is recommended. Functional sampling is critical—validate boot integrity, RAID configuration stability, and remote management (IPMI/iLO) functionality before volume commitment.

What Are the Best Server Hardware Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Longsys Technology | Guangdong, CN | 12 | 150+ | 8,600+m² | 99.1% | ≤2h | 4.8/5.0 | 41% |

| Suzhou Netway Equipment | Jiangsu, CN | 9 | 95+ | 6,200+m² | 98.3% | ≤3h | 4.7/5.0 | 38% |

| Dongguan Coremax Systems | Guangdong, CN | 7 | 70+ | 4,800+m² | 97.6% | ≤2h | 4.9/5.0 | 29% |

| Nanjing Hengtai Integration | Jiangsu, CN | 11 | 110+ | 7,500+m² | 99.4% | ≤4h | 4.6/5.0 | 33% |

| Guangzhou InfraLogic Devices | Guangdong, CN | 6 | 85+ | 5,300+m² | 98.0% | ≤3h | 4.8/5.0 | 36% |

Performance Analysis

Established players like Shenzhen Longsys Technology demonstrate strong delivery consistency and scalability, supported by large facilities and mature QA processes. Jiangsu-based Nanjing Hengtai leads in on-time performance (99.4%) despite slightly longer response times. Guangdong suppliers exhibit superior responsiveness, with 80% replying to inquiries within 2 hours. Prioritize partners with ≥98% delivery rates and documented experience in exporting to regulated markets. For custom builds—such as GPU-accelerated or edge computing servers—verify firmware development capacity and compatibility testing procedures via virtual factory audits prior to order placement.

FAQs

How to verify server hardware supplier reliability?

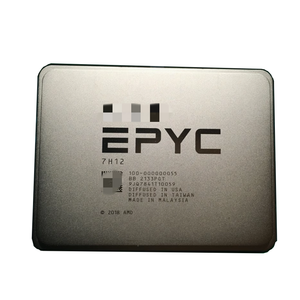

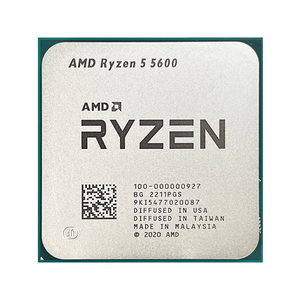

Cross-validate ISO and product compliance certifications with issuing bodies. Request audit trails for component sourcing (especially CPUs, RAM, and SSDs), and review batch testing records for power and thermal stress. Assess after-sales support responsiveness and warranty enforcement through customer references.

What is the average sampling timeline?

Standard server samples take 18–28 days to produce, including configuration and burn-in. Customized units (e.g., dual-CPU, NVMe-only storage) may require 35–45 days. Air freight adds 5–9 days for international delivery.

Can suppliers ship servers worldwide?

Yes, most manufacturers support global shipping via air or sea freight. Confirm Incoterms (FOB, CIF, DDP) and ensure packaging meets ISTA-3A standards for transit protection. Suppliers with existing export channels can assist with customs documentation and import duty classification.

Do manufacturers provide free samples?

Free samples are uncommon for full server units. Typically, buyers cover 40–60% of sample costs, which may be credited toward first bulk orders exceeding 20 units. Barebone or mini-server samples may carry lower fees.

How to initiate customization requests?

Submit detailed specifications including form factor (rack/tower/blade), processor type, memory capacity, storage configuration, OS pre-installation, and remote management needs. Leading suppliers provide engineering feedback within 72 hours and prototype units within 4–5 weeks.