Smart Metering System

Top sponsor listing

Top sponsor listing

About smart metering system

Where to Find Smart Metering System Suppliers?

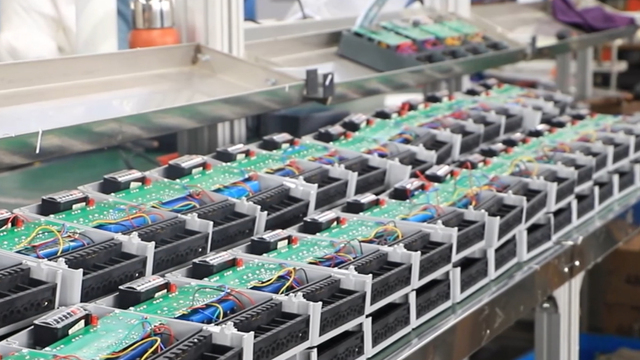

China remains a central hub for smart metering system manufacturing, with key production clusters in Zhejiang, Hunan, and Shanghai driving innovation and export capacity. The region around Ningbo in Zhejiang Province hosts integrated electrical equipment supply chains, enabling rapid prototyping and scalable production of power monitoring devices. Hunan has emerged as a specialized center for energy metering technology, supported by local government investments in smart grid infrastructure and IoT-enabled utility solutions.

These industrial ecosystems offer buyers access to vertically aligned production networks—spanning PCB assembly, sensor integration, and enclosure fabrication—within tightly coordinated geographic zones. This proximity reduces component lead times by 25–40% compared to decentralized manufacturing models. Suppliers in these regions typically maintain in-house R&D teams focused on communication protocols (e.g., Modbus, DL/T645), data security, and remote prepaid billing systems, enhancing product adaptability across international markets. Average production lead times range from 15 to 30 days for standard configurations, with bulk order scalability supported by automated testing lines and modular design architectures.

How to Choose Smart Metering System Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Compliance & Certification

Verify adherence to international standards such as IEC 62055 (prepaid meters), IEC 62053 (measurement accuracy), and MID or KEMA certification where applicable. CE, CB, and RoHS markings are essential for market access in Europe and North America. Request test reports for electromagnetic compatibility (EMC) and insulation resistance, particularly for three-phase models operating at 380V or higher.

Production and Customization Capability

Assess supplier infrastructure based on the following benchmarks:

- Minimum factory area of 3,000m² indicating established operations

- In-house capabilities in firmware development, GPRS/LTE/NB-IoT module integration, and tamper-proof housing design

- Customization support for voltage ratings (single/three-phase), current sensors (up to 250A), wire length, plug types, and branding (logo, packaging, label graphics)

Prioritize suppliers advertising response times under 2 hours and on-time delivery rates exceeding 97%, which correlate with robust internal coordination and inventory management.

Quality Assurance & Transaction Security

Confirm implementation of ISO 9001 quality management systems. Evaluate after-sales performance through reorder rates—suppliers with rates above 20% indicate customer retention driven by reliability and service. Utilize secure payment mechanisms such as trade assurance programs to mitigate risk during initial procurement cycles. Pre-shipment inspections should include functional testing of communication interfaces, load profile recording, and anti-tampering features.

What Are the Best Smart Metering System Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | Customization Options | Sample MOQ | Key Product Range |

|---|---|---|---|---|---|---|---|---|

| Hunan Stron Smart Co., Ltd. | Energy Meters, Water Meters, Gas Meters | US $300,000+ | 100% | 24% | ≤2h | Voltage, phase, display, communication module | 5–6 pieces | Single-phase ($10.65), Three-phase prepaid ($48), GPRS-enabled ($54) |

| Shanghai Royal Machinery Co., Ltd. | Energy Meters, Power Measuring Instruments | US $920,000+ | 69% | 22% | ≤11h | LCD interface, mounting type, protocol compatibility | 1 unit | ADW300 series, ADL400-compatible three-phase meters |

| Shanghai Matis Imp. & Exp. Co., Ltd. | Energy Meters, Circuit Breakers, Power Distribution Equipment | US $270,000+ | 100% | <15% | ≤5h | Current rating, IoT connectivity, housing material | 5–10 sets | Smart home meters ($39), Data center monitoring ($56), 3-phase IoT meters ($109) |

| Ningbo Yosun Electric Technology Co., Ltd. | Power Distribution Equipment, Environmental Sensors | US $50,000+ | 100% | 20% | ≤1h | Color, wire length, plug type, logo, packaging | Not specified | Multi-circuit monitoring systems, extension-based metering units |

| Jinhua Chasun Solar Technology Co., Ltd. | Solar Inverters, Energy Storage, Power Sensors | US $10,000+ | 100% | <15% | ≤1h | Current range, sensor calibration, output signal | 1 piece | DTSU666-H series smart power sensors ($70–108) |

Performance Analysis

Hunan Stron Smart stands out for competitive pricing and strong reorder metrics, offering entry-level single-phase meters from $10.65 with low MOQs ideal for pilot deployments. Despite its high revenue volume, Shanghai Royal Machinery’s 69% on-time delivery rate presents a logistical risk despite broad product coverage. Shanghai Matis demonstrates balanced performance with full delivery compliance and diverse IoT-integrated offerings suited for commercial energy management. Ningbo Yosun and Jinhua Chasun provide niche customization depth, particularly in physical specifications and solar-integrated sensing applications. Buyers prioritizing responsiveness should note that four of five suppliers respond within 5 hours, with two achieving sub-1-hour averages.

FAQs

What certifications should smart metering systems have?

Essential certifications include CE (Europe), CB Scheme (global acceptance), RoHS (hazardous substance compliance), and optionally KEMA, MID, or ANSI C12 for regulated utility markets. Firmware should support encrypted data transmission to meet cybersecurity requirements in smart grid environments.

What is the typical minimum order quantity (MOQ)?

MOQs vary widely: some suppliers offer as low as 1 unit for high-end models, while standard energy meters require 50–100 pieces. Sample orders for testing are commonly accepted at 1–5 units, often with partial cost recovery.

Can smart metering systems be customized for specific communication protocols?

Yes, leading suppliers support customization of communication interfaces including RS485, Modbus RTU, LTE-M, NB-IoT, and GPRS. Protocol adaptation for SCADA or building management system integration is frequently available upon request.

How long does production and shipping take?

Production lead time averages 15–25 days for standard orders. Air freight adds 5–10 days for international delivery; sea freight takes 25–40 days depending on destination. Expedited production (7–10 days) may be available for urgent needs at premium costs.

Do suppliers provide technical documentation and software support?

Reputable manufacturers supply datasheets, wiring diagrams, communication protocol manuals, and configuration software. Some offer API access for cloud platform integration, especially for prepaid or remote-disconnect functionalities.