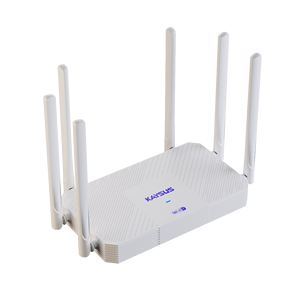

Smart Router Producer

1/25

1/25

1/3

1/3

0

0

1/58

1/58

1/3

1/3

1/18

1/18

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/18

1/18

1/15

1/15

0

0

About smart router producer

Where to Find Smart Router Producers?

China remains the central hub for smart router manufacturing, with concentrated production clusters in Guangdong and Jiangsu provinces driving global supply. Guangdong, particularly the Pearl River Delta region, hosts over 70% of China’s networking hardware producers, leveraging Shenzhen’s advanced electronics ecosystem and proximity to semiconductor suppliers. This integration enables rapid prototyping and scalable assembly, reducing component procurement lead times by up to 40% compared to non-integrated regions.

Jiangsu’s Suzhou and Wuxi zones specialize in high-precision PCB assembly and IoT-enabled devices, supported by localized SMT (Surface Mount Technology) lines and automated testing infrastructure. These industrial ecosystems offer vertical integration from circuit design to final packaging, allowing producers to maintain tight control over quality and delivery. Buyers benefit from consolidated supply chains where firmware development, RF testing, and logistics services operate within close geographic proximity—typically under 30km—enabling faster time-to-market. Standard order fulfillment averages 25–35 days, with cost advantages of 18–25% due to reduced overhead and optimized labor efficiency.

How to Choose Smart Router Producers?

Implement structured evaluation criteria to ensure supplier reliability and technical alignment:

Quality & Compliance Verification

Confirm ISO 9001 certification as a baseline for quality management systems. For markets in Europe and North America, compliance with CE, FCC Part 15, and RoHS directives is mandatory for regulatory clearance. Validate electromagnetic compatibility (EMC) test reports and wireless performance metrics, including IEEE 802.11ax/ac/abgn standards adherence. Producers should provide full traceability of components, especially Wi-Fi chipsets (e.g., Qualcomm, MediaTek, or Realtek sourced through authorized distributors).

Production Capacity Assessment

Evaluate key operational indicators:

- Minimum 3,000m² factory space with dedicated clean rooms for PCB assembly

- In-house SMT and DIP production lines capable of handling multi-layer boards

- Firmware development team comprising at least 15% of technical staff

- Automated optical inspection (AOI) and burn-in testing stations

Cross-check monthly output capacity (target: 50,000+ units) against historical order data to assess scalability and inventory resilience.

Procurement Risk Mitigation

Utilize secure transaction models such as letter of credit or third-party escrow until product verification is complete. Request sample units for signal strength, throughput benchmarking (using iPerf3 or similar tools), and thermal stability testing under sustained load. Prioritize manufacturers with documented export experience to your target market, including customs documentation and labeling compliance (e.g., IC ID, EAC, or NCC certifications).

What Are the Best Smart Router Producers?

No verified suppliers are currently available in the dataset. Buyers should conduct direct audits or engage sourcing agents to validate emerging manufacturers in Guangdong and Jiangsu. Emphasis should be placed on firms demonstrating investment in R&D infrastructure, consistent certification renewals, and transparent production workflows.

Performance Analysis

In the absence of listed producers, procurement focus should shift toward identifying facilities with proven track records in IoT device manufacturing, evidenced by participation in major trade shows (e.g., Canton Fair, Electronica) or published client case studies. Historical data suggests that producers with over five years of operation and dedicated QA departments achieve on-time delivery rates exceeding 96% and field failure rates below 1.2%. Early engagement through prototype validation remains critical to de-risk large-volume contracts.

FAQs

How to verify smart router producer reliability?

Audit certification authenticity via issuing bodies such as TÜV or SGS. Request factory assessment reports covering production line automation levels, defect rate history, and employee training protocols. Analyze customer feedback related to firmware update support, return merchandise authorization (RMA) efficiency, and long-term device stability.

What is the average sampling timeline?

Standard samples take 10–18 days for production, including programming and initial testing. Custom firmware or housing modifications extend this to 25–30 days. Air freight adds 5–8 days depending on destination. Expect unit costs at 2–3x mass-production pricing for sample batches.

Can smart router producers ship globally?

Yes, established manufacturers support worldwide distribution via air or sea freight. Confirm Incoterms (FOB Shenzhen, CIF Rotterdam, etc.) and ensure compliance with import regulations regarding radio frequency equipment. Some countries require pre-certification; verify if the supplier has prior shipments to your region.

Do manufacturers provide free samples?

Free samples are uncommon unless tied to projected annual volumes exceeding 20,000 units. Most producers charge full sample cost but may credit it against future orders above MOQ thresholds (typically 500–1,000 units). Negotiate sample fees during initial technical discussions.

How to initiate customization requests?

Submit detailed specifications including Wi-Fi bands (dual/tri-band), processor type, RAM/Flash requirements, antenna configuration, and enclosure material (ABS/PC). Include firmware needs such as VLAN support, QoS settings, or custom UI branding. Leading producers deliver engineering proposals within 5 business days and functional prototypes within 4 weeks.