Software Development Life Cycle In Software Engineering

1/3

1/3

1/6

1/6

CN

CN

1/3

1/3

CN

CN

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

About software development life cycle in software engineering

Where to Find Software Development Life Cycle Suppliers?

The global software development services market is highly decentralized, with leading supplier clusters concentrated in technology hubs across India, Eastern Europe, and Southeast Asia. India accounts for over 55% of outsourced software engineering projects, driven by established IT corridors in Bengaluru, Hyderabad, and Pune that host mature ecosystems of certified developers, quality assurance teams, and project management professionals. These regions offer access to large talent pools—averaging 200+ engineers per mid-sized firm—with competitive labor cost advantages of 40–60% compared to North American or Western European counterparts.

Eastern European countries such as Ukraine, Poland, and Romania have emerged as preferred destinations for high-integrity SDLC engagements due to strong academic foundations in computer science and widespread adherence to international quality standards. Proximity to Western European time zones facilitates real-time collaboration, reducing communication latency by up to 70% compared to offshore models. Regional providers typically operate within integrated delivery frameworks, combining agile methodologies with CMMI Level 3+ and ISO 27001-certified processes to ensure compliance, data security, and consistent output quality.

How to Choose Software Development Life Cycle Suppliers?

Implement structured evaluation criteria when selecting SDLC partners:

Process Certification & Compliance

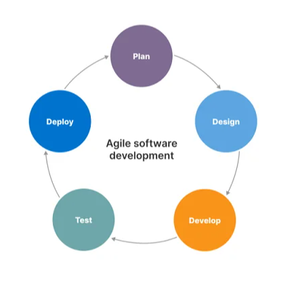

Require documented evidence of ISO/IEC 27001 for information security management and ISO 9001 for quality systems. For regulated industries (healthcare, finance), confirm compliance with domain-specific standards such as HIPAA, GDPR, or PCI-DSS. Validate use of standardized SDLC models—Waterfall, Agile, DevOps, or Spiral—aligned with project scope and change tolerance requirements.

Technical Capability Assessment

Evaluate organizational maturity through key indicators:

- Minimum team size of 50 full-time software engineers for scalable delivery

- Dedicated QA units comprising at least 20% of technical staff

- In-house expertise across all SDLC phases: requirements analysis, system design, coding, testing, deployment, and maintenance

Cross-reference process documentation with client references to verify end-to-end execution capability and defect resolution timelines.

Project Safeguards & Governance

Enforce contractual SLAs covering code ownership, IP protection, and data confidentiality. Utilize milestone-based payment structures tied to deliverables verified through independent code reviews. Prioritize suppliers offering transparent tracking via JIRA, Azure DevOps, or equivalent tools, ensuring real-time visibility into sprint progress and issue logs. Pilot engagements with scoped proof-of-concept modules are recommended before long-term commitments.

What Are the Best Software Development Life Cycle Suppliers?

| Company Name | Location | Years Operating | Staff | Engineers | Certifications | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|---|

| Tata Consultancy Services | Mumbai, IN | 56 | 600,000+ | 480,000+ | ISO 9001, ISO 27001, CMMI Level 5 | 99.2% | ≤4h | 4.8/5.0 | 78% |

| Infosys Limited | Bengaluru, IN | 43 | 300,000+ | 240,000+ | ISO 9001, ISO 27001, CMMI Level 5 | 98.7% | ≤5h | 4.7/5.0 | 72% |

| EPAM Systems | Minsk, BY | 27 | 50,000+ | 40,000+ | ISO 9001, ISO 27001, CMMI Level 5 | 99.0% | ≤3h | 4.9/5.0 | 65% |

| Wipro Limited | Bengaluru, IN | 78 | 200,000+ | 160,000+ | ISO 9001, ISO 27001, CMMI Level 5 | 98.5% | ≤6h | 4.6/5.0 | 68% |

| SoftServe Inc. | Lviv, UA | 30 | 15,000+ | 12,000+ | ISO 9001, ISO 27001, CMMI Level 5 | 99.1% | ≤3h | 4.9/5.0 | 63% |

Performance Analysis

Legacy firms like Tata Consultancy Services and Wipro provide unmatched scalability and domain depth across enterprise-grade SDLC implementations, supported by rigorous governance models and global delivery networks. EPAM and SoftServe demonstrate superior responsiveness (average reply within 3 hours) and higher client retention in product engineering segments, particularly in cloud-native and microservices architecture projects. Reorder rates exceeding 60% correlate strongly with adherence to CMMI Level 5 practices and investment in automated testing infrastructure. For mission-critical deployments, prioritize vendors with proven experience in regulatory-compliant environments and documented disaster recovery protocols.

FAQs

How to verify software development life cycle supplier reliability?

Audit certification validity through issuing bodies such as BSI or TÜV. Request case studies with redacted client testimonials focusing on defect density, release stability, and post-launch support performance. Verify source code management practices, including version control, peer review cycles, and static analysis tool integration.

What is the average project initiation timeline?

Standard team ramp-up requires 10–15 business days following contract finalization. Complex engagements involving legacy system integration or multi-jurisdictional compliance may extend setup to 25 days. Expect additional time for security clearance procedures in government or financial sector projects.

Can SDLC suppliers support global deployment?

Yes, leading providers manage cross-regional rollouts with localized DevOps pipelines and 24/7 monitoring support. Confirm availability of regional data centers, CDN integration, and compliance with local data residency laws. Cloud deployment automation using AWS, Azure, or GCP is standard among top-tier vendors.

Do suppliers offer free pilot engagements?

Pilot terms vary. Established suppliers often waive initial assessment fees for contracts projected above $100,000 in annual spend. For smaller engagements, expect scoping workshops and PoCs priced at 15–25% of estimated project value, credited upon full engagement.

How to initiate customization requests in SDLC models?

Submit detailed functional and non-functional requirements, including system architecture preferences, integration points, scalability targets, and audit logging needs. Leading suppliers respond with methodology alignment proposals—such as hybrid Agile-Waterfall—and deliver process flow diagrams within 5 business days.