Software System And Application Software

Top sponsor listing

Top sponsor listing

0

0

1/1

1/1

1/2

1/2

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

CN

CN

1/3

1/3

1/6

1/6

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

About software system and application software

Where to Find Software System and Application Software Suppliers?

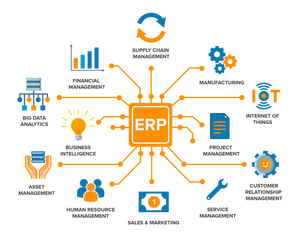

The global software systems and application software supplier landscape is highly decentralized, with development hubs concentrated in technology-intensive regions across Asia, Eastern Europe, North America, and Western Europe. India, China, and Vietnam lead in cost-efficient outsourcing, offering scalable teams and mature IT infrastructure—particularly in cities like Bangalore, Shenzhen, and Ho Chi Minh City. These regions support rapid deployment of enterprise resource planning (ERP), customer relationship management (CRM), and custom SaaS solutions through access to large pools of certified developers and agile development frameworks.

Eastern European countries—including Ukraine, Poland, and Romania—have emerged as preferred destinations for mid-to-high complexity software projects due to strong engineering education, high English proficiency, and alignment with EU data protection standards (GDPR). Meanwhile, North American and Western European suppliers specialize in regulated-sector applications (e.g., healthcare, finance) where compliance with HIPAA, SOC 2, or PSD2 is critical. This geographic diversification enables buyers to balance cost, regulatory alignment, and technical specialization when sourcing software solutions.

How to Choose Software System and Application Software Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance & Security Standards

Confirm adherence to recognized quality and security frameworks such as ISO/IEC 27001 (information security), ISO 9001 (quality management), and CMMI Level 3+ for process maturity. For cloud-based applications, verify SOC 2 Type II reports and penetration testing records. Suppliers serving regulated industries must demonstrate compliance with domain-specific requirements including HIPAA, GDPR, or PCI-DSS.

Development Capability Assessment

Evaluate technical infrastructure and team composition:

- Minimum team size of 15 full-time developers for mid-scale projects

- Dedicated QA and DevOps units comprising at least 20% of technical staff

- Proven experience with modern tech stacks (e.g., React/Angular, Node.js/.NET Core, microservices architecture)

Validate project delivery performance via case studies, code audits, or trial sprints. Target suppliers maintaining >95% sprint completion rates and documented CI/CD pipelines.

Transaction Safeguards

Implement milestone-based payment structures tied to deliverables verified through source code reviews or third-party testing. Require IP assignment clauses and NDA enforcement prior to engagement. Utilize escrow arrangements for source code release upon final acceptance. Conduct pilot engagements (2–4 weeks) to assess communication efficiency, documentation standards, and defect resolution timelines before scaling.

What Are the Best Software System and Application Software Suppliers?

No supplier data is currently available for this category.

Performance Analysis

In absence of specific supplier profiles, procurement decisions should focus on objective benchmarks: prioritize vendors with audited development processes, transparent team allocation models, and verifiable track records in similar industry verticals. Established firms typically offer structured onboarding, detailed SLAs, and post-deployment support cycles ranging from 6 to 12 months. Emerging suppliers may provide lower hourly rates but require closer oversight to ensure code quality and timeline adherence.

FAQs

How to verify software supplier reliability?

Review independent client testimonials with emphasis on project continuity, bug resolution speed, and change request handling. Request references for completed projects of comparable scope. Validate certifications through issuing bodies and examine GitHub repositories or code samples for structural integrity and commenting practices.

What is the average project timeline for custom software?

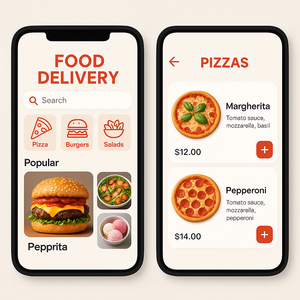

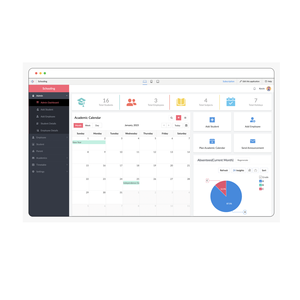

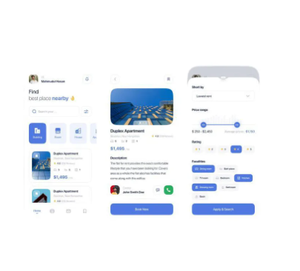

Standard business applications (e.g., inventory management, internal dashboards) require 3–6 months from requirement analysis to deployment. Complex systems involving AI integration, real-time data processing, or multi-platform synchronization may take 9–15 months. Agile methodologies typically include biweekly deliverables and user acceptance testing phases every 4–6 weeks.

Can software suppliers support ongoing maintenance?

Yes, most established suppliers offer post-launch maintenance packages covering updates, security patches, and technical support. Service level agreements commonly specify response times (<4–8 hours for critical issues), uptime guarantees (>99.5%), and annual maintenance costs ranging from 15–25% of initial development fees.

Do suppliers provide free pilot engagements?

Policies vary by region and scale. Many suppliers offer no-cost discovery phases (requirements gathering, architecture design) lasting 1–2 weeks. Full-code pilots are typically billed at reduced rates, with fees credited toward larger contracts. Expect limited free trials only for standardized SaaS products.

How to initiate customization requests?

Submit detailed functional specifications including user roles, data flow diagrams, API integrations, and UI/UX wireframes. Leading suppliers respond with technical proposals, effort estimates, and risk assessments within 5–10 business days. Prototypes or MVP builds are generally delivered within 4–6 weeks after approval.